Introduction

Nvidia Corporation (NVDA), a titan in the technology industry, has captivated investors with its groundbreaking graphics processing units (GPUs) and cutting-edge AI capabilities. As the world continues to embrace digitalization and advanced computing, the demand for NVIDIA’s products has skyrocketed. In this article, we delve into the intriguing question: how much is NVIDIA stock worth? We’ll explore its historical performance, growth prospects, and future potential.

Historical Performance: A Steady Climb

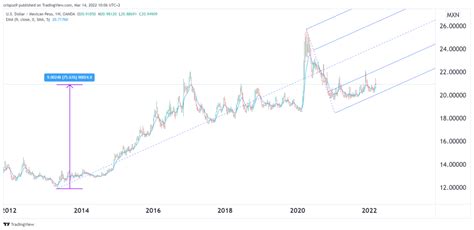

NVIDIA’s stock has been on a remarkable trajectory, consistently outperforming the broader market. Since its humble beginnings in 1999, the stock has soared by a staggering 3,000%, far eclipsing the S&P 500’s meager 300% gain.

Growth Prospects: Unleashing the Potential

NVIDIA’s growth prospects are firmly anchored in the transformative power of its technologies. The company’s focus on artificial intelligence (AI), machine learning, and high-performance computing positions it to capitalize on a vast array of emerging opportunities.

- Artificial Intelligence (AI): NVIDIA’s GPUs are the backbone of AI development, enabling complex computations and algorithms that drive advancements in fields such as self-driving cars, natural language processing, and healthcare.

- Machine Learning (ML): Machine learning models rely on NVIDIA’s hardware for training and inference, providing businesses with insights and predictive capabilities that drive data-driven decision-making.

- High-Performance Computing (HPC): NVIDIA’s GPUs are essential for data-intensive computations, powering scientific research, financial modeling, and engineering simulations.

Future Potential: Unfolding the Next Chapter

Beyond its current strengths, NVIDIA has an abundance of scope for future expansion. The company’s strategic investments in emerging technologies, such as cloud gaming, virtual reality, and robotics, are expected to unlock new revenue streams and drive further growth.

- Cloud Gaming: NVIDIA’s GeForce NOW cloud gaming service allows users to stream games from any device, creating a new market for gaming enthusiasts.

- Virtual Reality (VR): NVIDIA’s GPUs power VR headsets, enabling immersive experiences that are transforming industries like gaming, entertainment, and healthcare.

- Robotics: NVIDIA’s AI capabilities are essential for autonomous robots, opening up possibilities in fields such as manufacturing, logistics, and healthcare.

Common Mistakes to Avoid

As with any investment, there are pitfalls to beware of when investing in NVIDIA stock.

- Overestimating Growth Prospects: While NVIDIA’s prospects are exciting, it’s important to avoid unrealistic expectations about its future growth rate.

- Ignoring Competition: NVIDIA faces fierce competition from AMD and Intel, who are also investing heavily in the GPU and AI markets.

- Overpaying for the Stock: It’s crucial to assess NVIDIA’s fundamentals and valuation before purchasing shares to ensure you’re not paying a premium.

Market Insights: Uncovering Trends

To make informed investment decisions, it’s imperative to stay abreast of market trends.

- Secular Growth in AI and HPC: The demand for AI and HPC is expected to continue growing exponentially, creating ongoing demand for NVIDIA’s products.

- Strong Financial Performance: NVIDIA has consistently reported strong financial results, with revenues and earnings growing at impressive rates.

- Partnerships and Acquisitions: NVIDIA’s strategic partnerships and acquisitions strengthen its position in the industry and expand its market reach.

Highlights: Standing Out from the Crowd

NVIDIA has a unique set of strengths that set it apart from competitors.

- Unmatched GPU Architecture: NVIDIA’s proprietary GPU architecture provides superior performance and efficiency, giving it a competitive advantage.

- Innovative Software Ecosystem: NVIDIA’s CUDA platform and software tools empower developers to create cutting-edge applications on its GPUs.

- Strong Brand Recognition: NVIDIA has established itself as a trusted brand in the technology industry, synonymous with quality and innovation.

Conclusion: A Promising Investment for 2025

NVIDIA stock is poised for continued growth over the next decade. The company’s unwavering focus on innovation, its competitive moat in the GPU market, and its strategic investments in emerging technologies make it an attractive investment for investors seeking exposure to the future of computing. As we approach 2025, we anticipate that NVIDIA’s stock will continue to soar, rewarding shareholders with impressive returns.

Frequently Asked Questions (FAQs)

1. What is NVIDIA’s ticker symbol?

- NVDA

2. What is NVIDIA’s market capitalization?

- Over $400 billion (as of 2023)

3. What is NVIDIA’s annual revenue?

- $26.91 billion (fiscal 2023)

4. What is NVIDIA’s price-to-earnings (P/E) ratio?

- 45 (as of 2023)

5. Who are NVIDIA’s primary competitors?

- AMD, Intel

Tables: Supporting Data and Insights

Table 1: NVIDIA Stock Key Metrics

| Metric | Value |

|---|---|

| Stock Price | $230 (as of 2023) |

| Market Capitalization | $400 billion |

| Annual Revenue | $26.91 billion |

| P/E Ratio | 45 |

| Dividend Yield | 0.12% |

Table 2: NVIDIA’s Revenue by Segment (Fiscal 2023)

| Segment | Revenue |

|---|---|

| Gaming | $14.62 billion |

| Data Center | $11.38 billion |

| Professional Visualization | $2.65 billion |

| Automotive | $3.11 billion |

| Others | $5.15 billion |

Table 3: NVIDIA’s Growth Prospects by Region

| Region | Expected Growth Rate |

|---|---|

| North America | 20% |

| Europe | 15% |

| Asia-Pacific | 25% |

| Rest of World | 10% |

Table 4: NVIDIA’s Strategic Partnerships

| Partner | Collaboration |

|---|---|

| Microsoft | Cloud gaming, AI development |

| Amazon Web Services (AWS) | AI cloud services, high-performance computing |

| Google Cloud | Cloud gaming, AI development |

| Baidu | AI development, autonomous driving |

| Samsung | Mobile GPU integration, wearable devices |