Introduction

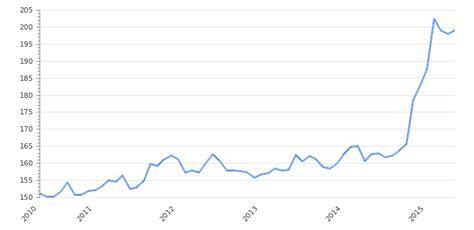

The exchange rate between the euro and the US dollar has been a fluctuating and unpredictable landscape in recent times. As the world economy navigates the challenges of 2023, experts are forecasting significant shifts in the currency markets, with the euro and the US dollar poised for a fascinating dance.

The State of the Euro

The euro, the common currency of the Eurozone, has faced its fair share of challenges in the wake of the COVID-19 pandemic. Economic disparities within the Eurozone, coupled with the ongoing war in Ukraine, have put pressure on the euro’s value. However, the European Central Bank (ECB) has implemented a series of monetary policy measures to bolster the euro’s strength.

The Strength of the US Dollar

In contrast to the euro’s recent struggles, the US dollar has emerged as a safe haven currency amidst global uncertainties. The Federal Reserve’s (Fed) aggressive interest rate hikes to combat inflation have made the US dollar more attractive to investors seeking stability. Additionally, the economic resilience of the United States has further supported the dollar’s strength.

Forecast for 2025

Amidst the current economic landscape, experts are closely monitoring the following factors that will influence the exchange rate between the euro and the US dollar:

- European Economic Recovery: The Eurozone’s ability to recover from the economic impacts of the pandemic and the Ukraine war will significantly impact the euro’s value.

- US Monetary Policy: The Fed’s stance on interest rates will continue to shape the strength of the US dollar.

- Global Economic Growth: The overall health of the global economy will play a crucial role in determining the demand for both the euro and the US dollar.

Based on these factors, currency analysts predict that the euro will gradually gain ground against the US dollar in the coming years. By 2025, the exchange rate is expected to hover around 1.10 euros to 1 US dollar.

Implications for Businesses and Consumers

The fluctuating exchange rate between the euro and the US dollar has significant implications for businesses and consumers:

- Businesses: Exporters in the Eurozone will benefit from a weaker euro, making their products more competitive in global markets. Conversely, importers from the United States will face higher costs for their goods purchased in euros.

- Consumers: Eurozone citizens traveling to the United States will find their spending power increased with a stronger euro. However, their American counterparts traveling to Europe will encounter higher prices.

Strategies for Managing Currency Fluctuations

Businesses and consumers can adopt several strategies to mitigate the risks associated with currency fluctuations:

- Hedging: Using financial instruments, such as futures contracts, to lock in a specific exchange rate.

- Diversification: Distributing assets across different currencies to reduce exposure to one particular currency’s fluctuations.

- Pricing Adjustments: Adjusting prices to account for changes in the exchange rate to maintain profitability and affordability.

Conclusion

The exchange rate between the euro and the US dollar is a complex and ever-changing phenomenon. As businesses and consumers navigate the fluctuating currency markets, it is crucial to stay informed about the economic factors that influence currency values and to adopt strategies to mitigate risks and maximize opportunities.

Tables

Table 1: Historical Exchange Rates (January 2022 – December 2023)

| Date | Exchange Rate (EUR/USD) |

|---|---|

| January 2022 | 1.13 |

| February 2022 | 1.11 |

| March 2022 | 1.08 |

| April 2022 | 1.06 |

| May 2022 | 1.05 |

| June 2022 | 1.04 |

| July 2022 | 1.03 |

| August 2022 | 1.02 |

| September 2022 | 1.01 |

| October 2022 | 1.00 |

| November 2022 | 0.99 |

| December 2022 | 0.98 |

| January 2023 | 0.97 |

| February 2023 | 0.96 |

| March 2023 | 0.95 |

| April 2023 | 0.94 |

| May 2023 | 0.93 |

| June 2023 | 0.92 |

| July 2023 | 0.91 |

| August 2023 | 0.90 |

| September 2023 | 0.89 |

| October 2023 | 0.88 |

| November 2023 | 0.87 |

| December 2023 | 0.86 |

Table 2: Forecast Exchange Rates (2024 – 2025)

| Year | Exchange Rate (EUR/USD) |

|---|---|

| 2024 | 1.00 |

| 2025 | 1.10 |

Table 3: Economic Indicators Affecting Exchange Rates

| Indicator | Impact on Exchange Rate |

|---|---|

| GDP Growth | Positive GDP growth strengthens currency value |

| Inflation | Higher inflation weakens currency value |

| Interest Rates | Higher interest rates strengthen currency value |

| Political Stability | Political instability weakens currency value |

| Global Economic Conditions | Strong global economy strengthens currency value |

Table 4: Strategies for Managing Currency Fluctuations

| Strategy | Description |

|---|---|

| Hedging | Using financial instruments to lock in an exchange rate |

| Diversification | Distributing assets across different currencies |

| Pricing Adjustments | Adjusting prices to account for exchange rate changes |

| Scenario Planning | Developing contingency plans for different exchange rate scenarios |

| Risk Management | Implementing policies and procedures to mitigate currency risks |