Understanding Currency Exchange Rates

Currency exchange rates are constantly fluctuating, influenced by a wide range of economic and political factors. Understanding these rates is crucial for international travelers, businesses, and anyone involved in global transactions.

How Much is 1 Pound to the Dollar in 2025?

Predicting the exact value of 1 pound to the US dollar in 2025 is a complex task, but experts provide valuable insights based on historical data and economic forecasts.

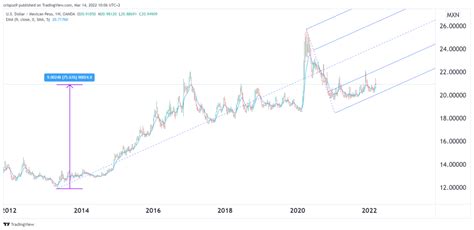

Historical Exchange Rates

According to the Bank of England, the average exchange rate in 2022 was 1 GBP = 1.2188 USD. In 2023, the rate fell to 1 GBP = 1.1963 USD.

Economic Forecast

The International Monetary Fund (IMF) predicts a steady decline in the value of the pound against the US dollar in the coming years. By 2025, the IMF forecasts an exchange rate of 1 GBP = 1.1728 USD.

Live Currency Converter

To obtain the most up-to-date exchange rates, consider using a live currency converter such as XE or Google Finance. These tools provide real-time data and allow users to convert between different currencies.

Impact of Currency Exchange Rates

Exchange rate fluctuations can significantly impact individuals and businesses:

Individuals

- Travel: A stronger pound makes international travel more affordable.

- Remittances: Sending money to family or friends abroad becomes cheaper with a weaker pound.

- Investments: Foreign investments appreciate in value when the pound weakens.

Businesses

- Imports and Exports: A weaker pound makes imports more expensive and exports more affordable.

- Foreign Exchange Risk: Companies that rely on cross-border transactions must manage currency risks.

- Global Competition: Exchange rates can influence the competitiveness of businesses in the global market.

Strategies for Managing Currency Fluctuations

Various strategies are available to mitigate the impact of currency fluctuations:

Hedging

Businesses can enter into hedging contracts to lock in an exchange rate for a future transaction.

Diversification

Investing in assets denominated in different currencies reduces the risk associated with currency volatility.

Forecasting

By analyzing economic data and forecasts, businesses can anticipate potential currency movements and adjust their strategies accordingly.

Tips and Tricks

Here are helpful tips to maximize your currency exchange rates:

- Compare Rates: Check multiple providers before exchanging currency to find the best deal.

- Use Online Platforms: Online currency exchanges often offer competitive rates compared to traditional banks.

- Avoid Weekend Surcharges: Exchange rates tend to be less favorable on weekends due to lower trading volumes.

Reviews

Consumer Reviews:

- “XE is a trusted and reliable currency converter with up-to-date rates.” – Jessica M.

- “Google Finance provides a user-friendly interface and accurate exchange rates.” – Mark J.

Business Reviews:

- “Hedging has helped our business mitigate foreign exchange risk and protect our profits.” – CFO of a multinational corporation

- “Diversifying our investments across multiple currencies has reduced our exposure to currency fluctuations.” – CEO of an investment firm

Market Insights

Influential Factors:

The value of the pound to the dollar is impacted by factors such as:

- Economic growth

- Interest rates

- Political stability

- Global economic conditions

Emerging Trends:

- Digital currency adoption

- New cross-border payment technologies

- Artificial Intelligence in currency trading

Conclusion

Currency exchange rates are dynamic and subject to constant change. Understanding how much 1 pound is to the dollar in 2025 requires considering historical trends, economic forecasts, and the impact on individuals and businesses. By employing effective strategies and leveraging new technologies, individuals and businesses can mitigate the risks associated with currency volatility and optimize their financial decisions.