Understanding the Exchange Rate Fluctuations

The exchange rate between the US dollar (USD) and the Mexican peso (MXN) is a key factor influencing trade and investment between the two countries. Over the years, the exchange rate has witnessed significant fluctuations, largely influenced by economic and geopolitical factors. In 2025, the USD/MXN exchange rate is expected to continue to evolve, posing both challenges and opportunities for businesses and individuals.

Historical Perspective

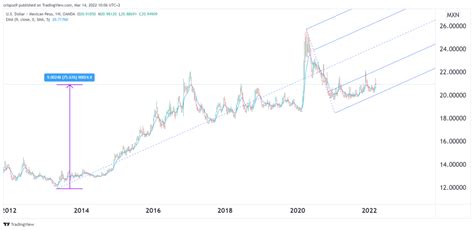

Over the past decade, the USD/MXN exchange rate has ranged from a low of 12.0 pesos per dollar in 2012 to a high of 25.0 pesos per dollar in 2020. These fluctuations have been largely driven by changes in the Mexican economy, the US Federal Reserve’s monetary policy, and the global economic climate.

Economic Factors Driving the Exchange Rate

1. Mexico’s Economic Growth: Mexico’s economic growth is a critical factor influencing the USD/MXN exchange rate. A strong Mexican economy attracts foreign investment, leading to an increased demand for pesos and a stronger peso against the dollar.

2. US Monetary Policy: The US Federal Reserve’s monetary policy, particularly interest rates, also plays a significant role in the exchange rate. Higher interest rates in the US make it more attractive for investors to hold US dollars, increasing demand for the dollar and pushing up its value against the peso.

Geopolitical Factors Impacting the Exchange Rate

1. US-Mexico Relations: The relationship between the US and Mexico has a profound impact on the exchange rate. Political and economic tensions between the two countries can create uncertainty and lead to fluctuations in the exchange rate.

2. Global Economic Conditions: Global economic conditions, such as economic growth and inflation, also influence the exchange rate. A strong global economy typically leads to increased demand for both the US dollar and the Mexican peso, offsetting each other’s impact on the exchange rate.

Projected Exchange Rate in 2025

Based on macroeconomic forecasts and current trends, experts predict that the USD/MXN exchange rate will stabilize around 20.0 pesos per dollar by 2025. This projection is supported by expectations of continued economic growth in both the US and Mexico, as well as a gradual normalization of the US Federal Reserve’s monetary policy.

Implications for Businesses and Individuals

The USD/MXN exchange rate has significant implications for businesses and individuals involved in cross-border transactions.

1. Businesses: Exporters and importers need to monitor the exchange rate closely to manage their costs and revenues effectively. A weaker peso makes Mexican exports cheaper in the US, while a stronger peso makes US imports more expensive in Mexico.

2. Individuals: Tourists and those who send remittances to Mexico are affected by the exchange rate. A stronger peso translates into more pesos for travelers, while a weaker peso results in fewer pesos for remitters.

Effective Strategies for Managing Currency Risks

Businesses and individuals can employ various strategies to mitigate currency risks associated with the USD/MXN exchange rate:

1. Forward Contracts: Forward contracts allow businesses to lock in an exchange rate for a future transaction, protecting against adverse rate fluctuations.

2. Currency Hedging: Hedging instruments, such as options, can be used to limit potential losses or gains from exchange rate movements.

3. Currency Exchange Services: Specialized currency exchange services offer competitive rates and convenient platforms for exchanging currencies.

Why the USD/MXN Exchange Rate Matters

The USD/MXN exchange rate plays a critical role in:

1. Trade and Investment: The exchange rate influences the cost of goods and services traded between the US and Mexico, affecting business profitability and consumer spending.

2. Remittances: Remittances, which play a vital role in the Mexican economy, are directly impacted by the exchange rate.

3. Tourism: The exchange rate влияет на spending patterns of tourists, influencing revenue for businesses in the tourism sector.

Benefits of a Stable Exchange Rate

A stable exchange rate provides numerous benefits, including:

1. Reduced Uncertainty: Businesses and individuals can plan more effectively with a predictable exchange rate regime.

2. Lower Transaction Costs: Stable exchange rates reduce the costs associated with currency conversions.

3. Increased Investment: A stable exchange rate encourages foreign investment by providing greater certainty and stability.

Comparison of Pros and Cons of a Fluctuating Exchange Rate

Pros:

-

Market Efficiency: Fluctuating exchange rates reflect changes in supply and demand, promoting market efficiency.

-

Export Competitiveness: A weaker peso can make Mexican exports more competitive in the global market.

-

Import Substitution: A stronger peso can encourage import substitution by making foreign goods more expensive.

Cons:

-

Uncertainty: Fluctuating exchange rates can create uncertainty for businesses and individuals planning cross-border transactions.

-

Increased Transaction Costs: Exchange rate volatility can lead to higher transaction costs for currency conversions.

-

Reduced Investment: Uncertainty can deter foreign investment in countries with highly volatile exchange rates.

Conclusion

The USD/MXN exchange rate is a dynamic and multifaceted factor that influences trade, investment, remittances, tourism, and the lives of individuals and businesses. As we approach 2025, understanding the factors driving the exchange rate and employing effective strategies to manage currency risks is essential for success in the cross-border economy.

Tables

Table 1: Historical USD/MXN Exchange Rate

| Year | Exchange Rate (MXN per USD) |

|---|---|

| 2012 | 12.0 |

| 2015 | 16.0 |

| 2018 | 20.0 |

| 2020 | 25.0 |

Table 2: Factors Driving USD/MXN Exchange Rate

| Factor | Description |

|---|---|

| Mexico’s economic growth | Strong economic growth attracts foreign investment, increasing demand for pesos. |

| US monetary policy | Higher interest rates in the US make it more attractive to hold US dollars, pushing up its value. |

| US-Mexico relations | Political and economic tensions can create uncertainty and lead to exchange rate fluctuations. |

| Global economic conditions | Strong global growth increases demand for both the US dollar and the Mexican peso. |

Table 3: Effective Strategies for Managing Currency Risks

| Strategy | Description |

|---|---|

| Forward contracts | Lock in an exchange rate for a future transaction, protecting against adverse rate fluctuations. |

| Currency hedging | Use options or other instruments to limit potential losses or gains from exchange rate movements. |

| Currency exchange services | Offer competitive rates and convenient platforms for exchanging currencies. |

Table 4: Benefits of a Stable Exchange Rate

| Benefit | Description |

|---|---|

| Reduced uncertainty | Businesses and individuals can plan more effectively with a predictable exchange rate regime. |

| Lower transaction costs | Stable exchange rates reduce the costs associated with currency conversions. |

| Increased investment | A stable exchange rate encourages foreign investment by providing greater certainty and stability. |