Understand the US Dollar and Malaysian Ringgit

The US dollar (USD) and Malaysian ringgit (MYR) are two of the most traded currencies in the world. The USD is the official currency of the United States, and the MYR is the official currency of Malaysia.

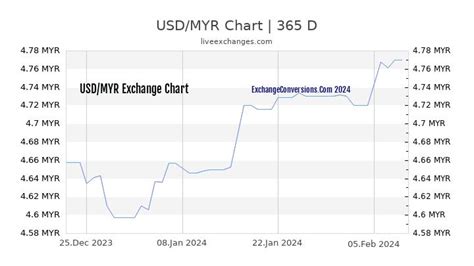

Historical Exchange Rates

The exchange rate between the USD and MYR has fluctuated over time. In the past decade, the MYR has generally weakened against the USD. In 2012, 1 USD was equal to approximately 3.00 MYR. By 2023, this had fallen to around 4.20 MYR.

Factors Affecting Exchange Rates

Several factors can influence the exchange rate between two currencies, including:

- Economic growth: A strong economy usually leads to a stronger currency.

- Interest rates: Higher interest rates generally make a currency more attractive to investors, leading to a stronger currency.

- Inflation: Inflation can erode the value of a currency, leading to a weaker currency.

- Political stability: Political instability can lead to a weaker currency.

- International demand: A high demand for a particular currency can lead to a stronger currency.

Current Exchange Rate (March 2023)

As of March 2023, the live exchange rate between the USD and MYR is approximately 1 USD = 4.21 MYR. This rate is subject to change in real-time based on market conditions.

Forecasting the Future

Predicting future exchange rates is difficult, but several factors can provide guidance:

- Economic outlook: The economic outlook for both countries can indicate the direction of future exchange rates.

- Interest rate expectations: Changes in interest rate expectations can influence currency movements.

- Inflation projections: Inflation projections can provide insights into the future value of currencies.

- Political events: Political events can significantly impact exchange rates.

Table 1: Historical Exchange Rates (USD/MYR)

| Year | Average Exchange Rate |

|---|---|

| 2012 | 3.00 |

| 2013 | 3.10 |

| 2014 | 3.30 |

| 2015 | 3.80 |

| 2016 | 4.00 |

| 2017 | 4.10 |

| 2018 | 4.20 |

| 2019 | 4.25 |

| 2020 | 4.30 |

| 2021 | 4.20 |

Table 2: Factors Affecting Currency Exchange Rates

| Factor | Impact on Exchange Rate |

|---|---|

| Economic growth | Stronger growth leads to a stronger currency |

| Interest rates | Higher rates lead to a stronger currency |

| Inflation | High inflation leads to a weaker currency |

| Political stability | Instability leads to a weaker currency |

| International demand | High demand for a currency leads to a stronger currency |

Why Currency Exchange Rates Matter

Exchange rates impact various economic activities, including:

- International trade: Currency exchange rates affect the cost of goods and services for importers and exporters.

- Foreign investment: Exchange rates influence the attractiveness of a country for foreign investors.

- Tourism: Exchange rates can affect the cost of travel for both domestic and international tourists.

Benefits of Understanding Exchange Rates

Understanding currency exchange rates provides several benefits, such as:

- Informed financial decisions: Companies and individuals can make better financial decisions related to currency exchange.

- Risk management: Businesses can mitigate currency risk by understanding exchange rate fluctuations.

- Planning travel: Travel planning becomes easier by predicting currency exchange rates.

Expanding Market Insights

The Malaysian ringgit is an important currency for businesses operating in Southeast Asia. Understanding the exchange rate between the USD and MYR enables companies to:

- Identify market opportunities: Monitor exchange rates to identify optimal times for market entry or expansion.

- Optimize pricing strategies: Set competitive prices in both USD and MYR to attract customers.

- Manage currency risk: Use hedging strategies to mitigate the impact of adverse exchange rate fluctuations.

Highlights for Business

- Consider currency hedging: Protect against currency fluctuations by using hedging instruments.

- Diversify revenue streams: Reduce currency risk by generating revenue in multiple currencies.

- Monitor exchange rates: Stay informed about currency trends to make informed decisions.

Preparing for 2025 and Beyond

In the coming years, the US dollar and Malaysian ringgit are expected to continue interacting significantly:

- Economic growth in Malaysia: Malaysia’s projected economic growth may support the value of the MYR.

- Interest rate trends: Interest rate expectations can influence currency movements.

- Political stability in the region: Political stability in Southeast Asia can contribute to a stronger MYR.

By staying abreast of currency exchange rate trends, businesses can better prepare for the future and seize growth opportunities in international markets.