Introduction

The global economy is an ever-evolving tapestry woven together by intricate threads of currency exchange. Amidst the myriad of currencies, the US dollar reigns supreme, serving as a benchmark against which other currencies are often measured. In this article, we delve into a comparative analysis of the US dollar (1$) and the Indian rupee (₹), examining their relative strengths, weaknesses, and the implications for the Indian economy in 2025.

Comparative Value and Purchasing Power

As of 2023, 1$ is approximately equal to ₹82.50. This means that for every dollar earned in the United States, an Indian would need to earn around ₹82.50 to have the same purchasing power.

However, the purchasing power of each currency varies significantly across different goods and services. For instance, while 1$ can purchase a gallon of milk in the United States, it would only fetch you around half a liter of milk in India. This disparity in purchasing power is evident in various other sectors, such as healthcare, education, and entertainment.

Factors Influencing Currency Value

Several factors contribute to the relative value of currencies. These include:

Economic Growth:

Robust economic growth leads to increased demand for a nation’s currency, appreciating its value. India’s GDP is projected to grow at an impressive 7.5% in 2025, which could potentially bolster the value of the rupee.

Inflation:

High inflation erodes the purchasing power of a currency, depreciating its value. The Reserve Bank of India (RBI) has set an inflation target of 4% for 2025, which could contribute to a stable exchange rate.

Interest Rates:

Higher interest rates attract foreign investments, increasing demand for a currency and boosting its value. The Federal Reserve (Fed) is expected to maintain higher interest rates in 2025, which may sustain the relative strength of the US dollar.

Fiscal Policy:

Government spending and taxation policies can influence the value of a currency. For example, if India increases its fiscal deficit, it could lead to depreciation of the rupee.

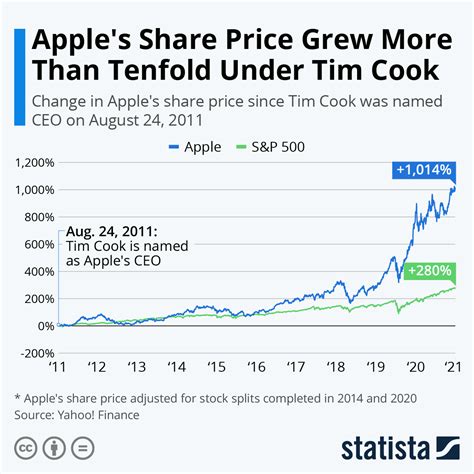

Historical Performance

The value of the Indian rupee against the US dollar has fluctuated over the years, influenced by various macroeconomic factors. From 2010 to 2023, the rupee depreciated from around ₹45 to ₹82.50 per dollar.

However, India’s economic growth has outpaced that of the United States in recent years, contributing to a narrowing of the gap between the two currencies. In 2023, the rupee touched a record high of ₹71.50 against the dollar.

Implications for India in 2025

The relative strength of the US dollar and Indian rupee in 2025 will have significant implications for the Indian economy:

Trade:

A weaker rupee makes Indian exports more competitive in the global market, while a stronger dollar makes imports more expensive.

Investment:

A stronger rupee may attract foreign investments, leading to job creation and economic growth. However, a weaker rupee can deter foreign investors and increase the cost of servicing foreign debt.

Tourism:

A weaker rupee can make India a more attractive destination for foreign tourists, while a stronger dollar may encourage Indians to travel abroad.

Monetary Policy:

The RBI may need to intervene in the foreign exchange market to manage the value of the rupee and maintain macroeconomic stability.

Effective Strategies for Managing the Rupee’s Value

The Indian government and RBI have implemented several strategies to manage the value of the rupee and mitigate its volatility:

Sterilization:

When the RBI buys dollars in the foreign exchange market to prevent the rupee from appreciating, it issues sterilization bonds to withdraw an equivalent amount of rupees from the system.

Forward Contracts:

The RBI enters into forward contracts with market participants to hedge against fluctuations in the exchange rate.

Interest Rate Differentials:

The RBI can raise or lower interest rates to influence the flow of foreign capital and manage the exchange rate.

Capital Controls:

In extreme cases, the government may impose capital controls to restrict the flow of money in and out of the country.

Tips and Tricks for Investors

Investors can adopt various strategies to mitigate the risks associated with currency fluctuations:

Diversification:

To reduce the impact of currency volatility, investors should diversify their portfolio across different currencies.

Currency ETFs:

Investors can invest in currency ETFs (exchange-traded funds) that track the performance of a specific currency or basket of currencies.

Currency Options:

Currency options allow investors to hedge against the risk of adverse currency movements.

Foreign Exchange Brokers:

Investors can use the services of foreign exchange brokers to execute currency transactions and benefit from competitive exchange rates.

Common Mistakes to Avoid

Investors should be aware of common pitfalls when dealing with currency exchange:

Ignoring Transaction Costs:

Banks and brokers charge fees for currency exchange transactions. Investors should consider these costs when determining the profitability of their trades.

Timing the Market:

Predicting the future direction of exchange rates is notoriously difficult. Trying to time the market can lead to losses.

Over-Leveraging:

Investors should avoid borrowing excessive amounts of money to finance currency trades.

Lack of Research:

Before investing in any currency, it is crucial to conduct thorough research and understand the factors that influence its value.

Future Trends and Innovations

The future of currency exchange is characterized by rapid technological advancements and innovative solutions:

Blockchain Technology:

Blockchain technology offers the potential to revolutionize currency exchange by creating decentralized, secure, and transparent platforms for cross-border payments.

Artificial Intelligence (AI):

AI algorithms can analyze vast amounts of data to predict currency movements and optimize trading strategies.

Mobile Payment Apps:

The rise of mobile payment apps is making it easier and more convenient to conduct currency exchanges from anywhere in the world.

Conclusion

The relationship between the US dollar and Indian rupee is a complex and dynamic one. In 2025, the relative strengths of these currencies will continue to shape the Indian economy, impacting trade, investment, tourism, and monetary policy. By understanding the factors influencing currency value, implementing effective strategies, and avoiding common mistakes, investors can navigate the complexities of currency exchange and harness the opportunities it presents. As technology continues to transform the financial landscape, we can anticipate further innovations that will revolutionize the way we think about and use currency in the years to come.

Appendix: Tables

Table 1: Historical Currency Exchange Rates

| Year | US Dollar (1$) to Indian Rupee (₹) |

|---|---|

| 2010 | 45.10 |

| 2015 | 63.50 |

| 2020 | 74.50 |

| 2023 | 82.50 |

Table 2: Factors Influencing Currency Value

| Factor | Effect on Currency Value |

|---|---|

| Economic Growth | Strengthens currency value |

| Inflation | Weakens currency value |

| Interest Rates | Strengthens currency value (higher rates) |

| Fiscal Policy | Weakens currency value (higher deficit) |

Table 3: Effective Strategies for Managing Currency Value

| Strategy | Description |

|---|---|

| Sterilization | RBI buys dollars and issues bonds to neutralize the effect on money supply |

| Forward Contracts | RBI hedges against exchange rate fluctuations |

| Interest Rate Differentials | RBI adjusts interest rates to influence capital flows |

Table 4: Tips and Tricks for Investors

| Tip | Description |

|---|---|

| Diversify Investment Portfolio | Spread investments across different currencies to reduce volatility risk |

| Use Currency ETFs | Track the performance of specific currencies or currency baskets |

| Employ Currency Options | Hedge against adverse currency movements |