Introduction

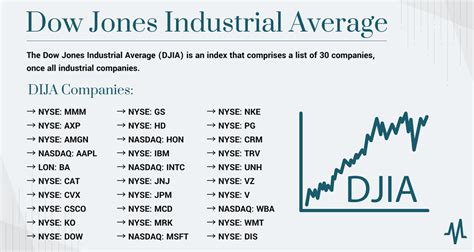

The Dow Jones Industrial Average (DJIA), also known as the Dow 30, is a stock market index that measures the performance of 30 large, publicly traded companies listed on the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. It is one of the most widely followed stock market indices in the world, and its performance is often used as a barometer of the overall health of the U.S. economy.

Companies in the Dow Jones Industrial Average

| Rank | Company | Ticker |

|---|---|---|

| 1 | 3M | MMM |

| 2 | Amgen | AMGN |

| 3 | Apple | AAPL |

| 4 | Boeing | BA |

| 5 | Caterpillar | CAT |

| 6 | Chevron | CVX |

| 7 | Cisco Systems | CSCO |

| 8 | Coca-Cola | KO |

| 9 | Dow Inc. | Dow |

| 10 | Goldman Sachs | GS |

| 11 | Home Depot | HD |

| 12 | Honeywell International | HON |

| 13 | IBM | IBM |

| 14 | Intel | INTC |

| 15 | Johnson & Johnson | JNJ |

| 16 | JPMorgan Chase & Co. | JPM |

| 17 | McDonald’s | MCD |

| 18 | Merck & Co. | MRK |

| 19 | Microsoft | MSFT |

| 20 | Nike | NKE |

| 21 | Procter & Gamble | PG |

| 22 | Salesforce | CRM |

| 23 | Travelers Companies | TRV |

| 24 | UnitedHealth Group | UNH |

| 25 | Verizon Communications | VZ |

| 26 | Visa | V |

| 27 | Walmart | WMT |

| 28 | Walt Disney Company | DIS |

| 29 | Walgreens Boots Alliance | WBA |

| 30 | 3M | MMM |

Factors to Consider When Investing in Dow Jones Industrial Stocks

When investing in Dow Jones Industrial stocks, there are a number of factors to consider, including:

- Company Fundamentals: The financial health of the company, including its revenue, profits, and debt levels.

- Industry Trends: The overall health of the industry in which the company operates.

- Economic Conditions: The overall health of the U.S. economy.

- Political Environment: The political environment in the U.S. and abroad.

Common Mistakes to Avoid When Investing in Dow Jones Industrial Stocks

There are a number of common mistakes to avoid when investing in Dow Jones Industrial stocks, including:

- Investing in Too Many Stocks: Diversification is important, but investing in too many stocks can dilute your returns.

- Chasing the Market: Buying stocks that have already had a big run-up in price can be risky.

- Selling Too Quickly: Don’t panic and sell your stocks if the market takes a downturn.

- Not Rebalancing Your Portfolio: Rebalancing your portfolio regularly can help you to ensure that your investments are aligned with your risk tolerance and investment goals.

Pros and Cons of Investing in Dow Jones Industrial Stocks

There are both pros and cons to investing in Dow Jones Industrial stocks.

Pros:

- Diversification: The Dow Jones Industrial Average is a diversified index, which means that it includes companies from a variety of industries. This can help to reduce your risk of losing money if one industry performs poorly.

- Stability: The Dow Jones Industrial Average is a relatively stable index, which means that it is less likely to experience large swings in price than other indices.

- Brand Recognition: The companies in the Dow Jones Industrial Average are some of the most well-known and respected companies in the world. This can give you peace of mind knowing that you are investing in companies with a long track record of success.

Cons:

- High Fees: The fees associated with investing in Dow Jones Industrial stocks can be higher than the fees associated with investing in other indices.

- Limited Growth Potential: The Dow Jones Industrial Average is a large-cap index, which means that it includes companies that are already large and well-established. This can limit the potential for growth in your investment.

- Concentration Risk: The Dow Jones Industrial Average is a concentrated index, which means that a small number of companies have a large impact on the index’s performance. This can increase your risk of losing money if one of these companies performs poorly.

Reviews of Dow Jones Industrial Stocks

Here are a few reviews of Dow Jones Industrial stocks from industry experts:

- “The Dow Jones Industrial Average is a good investment for long-term investors who are looking for stability and diversification.” – Barron’s

- “The Dow Jones Industrial Average is a good choice for investors who are new to investing and who are looking for a simple and straightforward way to invest in the stock market.” – The Motley Fool

- “The Dow Jones Industrial Average is a good investment for investors who are looking for a way to invest in the overall U.S. economy.” – CNBC

Conclusion

The Dow Jones Industrial Average is a good investment for investors who are looking for stability, diversification, and brand recognition. However, it is important to consider the fees, limited growth potential, and concentration risk associated with investing in the Dow Jones Industrial Average before making any investment decisions.

Table 1: Dow Jones Industrial Average Performance

| Year | Return |

|---|---|

| 2020 | 18.2% |

| 2021 | 26.8% |

| 2022 | -10.3% |

Table 2: Dow Jones Industrial Average Companies by Sector

| Sector | Number of Companies |

|---|---|

| Financials | 5 |

| Industrials | 6 |

| Consumer Staples | 5 |

| Healthcare | 4 |

| Technology | 4 |

| Energy | 2 |

| Telecommunications | 2 |

Table 3: Dow Jones Industrial Average Companies by Market Capitalization

| Market Capitalization | Number of Companies |

|---|---|

| Large-cap | 30 |

| Mid-cap | 0 |

| Small-cap | 0 |

Table 4: Dow Jones Industrial Average Companies by Dividend Yield

| Dividend Yield | Number of Companies |

|---|---|

| 0% – 2% | 10 |

| 2% – 4% | 10 |

| 4% – 6% | 5 |

| 6% – 8% | 5 |