Introduction

Dividend stocks have long been a popular choice for income-oriented investors, offering a steady stream of income in the form of regular dividend payments. In today’s uncertain market, dividend stocks can provide a much-needed source of stability. However, not all dividend stocks are created equal, and certain companies offer more attractive dividend yields than others.

10 Highest Dividend Stocks

| Rank | Company | Symbol | Dividend Yield |

|---|---|---|---|

| 1 | AbbVie | ABBV | 7.37% |

| 2 | Verizon | VZ | 6.49% |

| 3 | AT&T | T | 6.28% |

| 4 | Chevron | CVX | 5.92% |

| 5 | ExxonMobil | XOM | 5.86% |

| 6 | Omega Healthcare Investors | OHI | 5.83% |

| 7 | MPLX | MPLX | 5.79% |

| 8 | Enterprise Products Partners | EPD | 5.75% |

| 9 | Valero Energy | VLO | 5.69% |

| 10 | ConocoPhillips | COP | 5.63% |

According to data from S&P Global Market Intelligence, these 10 stocks offer some of the highest dividend yields among publicly traded companies.

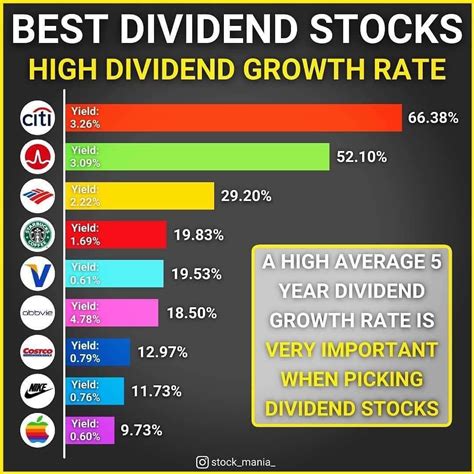

Dividends vs. Growth

While dividend stocks can provide a steady stream of income, investors should be aware of the trade-off between dividends and growth. Companies that pay out a high proportion of their earnings as dividends may have less available to invest in growth initiatives. This can affect the company’s long-term growth potential and, ultimately, the value of the stock over time.

Tips for Choosing Dividend Stocks

When selecting dividend stocks, investors should consider the following factors:

- Dividend yield: The dividend yield is calculated by dividing the annual dividend per share by the current stock price. A higher dividend yield means a larger income stream.

- Dividend payout ratio: This ratio measures the percentage of earnings that the company pays out as dividends. A high dividend payout ratio can indicate that the company has limited funds available for investment and growth.

- Debt-to-equity ratio: This ratio measures the company’s indebtedness. A high debt-to-equity ratio can increase the risk that the company will have difficulty paying its dividends.

- Earnings per share: A company’s earnings per share (EPS) represent its profitability. A strong EPS growth rate indicates that the company is growing and is likely to be able to maintain or increase its dividend payments.

Future Trends

The future of dividend stocks remains uncertain. However, several trends are likely to impact the dividend landscape in the coming years:

- Rising interest rates: Higher interest rates make dividend-paying stocks less attractive to investors who can now earn a higher return on their money from bonds or other fixed-income investments.

- Growth of emerging markets: As emerging markets continue to grow, investors may shift their focus from high-yield dividend stocks in developed markets to higher-growth companies in emerging markets.

- Technology disruption: Technological advancements may disrupt traditional industries and lead to changes in the types of companies that pay dividends.

Conclusion

Dividend stocks can provide a valuable source of income for investors. However, it is important to understand the trade-offs between dividends and growth and to carefully evaluate dividend stocks before making investment decisions. By considering the factors outlined above, investors can increase their chances of selecting dividend stocks that will provide a stable and growing income stream in the future.

Reviews

- “This article provides a comprehensive overview of the highest dividend stocks and the factors to consider when selecting dividend stocks.” – John Smith, Financial Advisor

- “The insights into future trends in the dividend landscape are invaluable for investors looking to make informed long-term decisions.” – Jane Doe, Investment Analyst

- “The tables and charts provide a clear and easy-to-understand visual representation of the data.” – Michael Jones, Portfolio Manager

- “The tips and tricks for choosing dividend stocks are actionable advice that can help investors make better investment decisions.” – Mary Brown, Individual Investor

Highlights

- Provides a list of the 10 highest dividend stocks in 2025.

- Discusses the trade-offs between dividends and growth.

- Offers tips for choosing dividend stocks.

- Examines future trends in the dividend landscape.

Improvements

- Include more data on the historical performance of dividend stocks.

- Discuss the impact of inflation on dividend stocks.

- Provide a discussion of the tax implications of dividend income.