Introduction

The world of currency exchange can be daunting, especially when dealing with large sums of money. Whether you’re planning a trip abroad or making a significant international transaction, understanding the exchange rate between different currencies is crucial. In this comprehensive guide, we delve into the conversion of $100 USD to INR in 2025, exploring factors that influence the exchange rate, forecasting trends, and providing practical tips for optimizing your currency conversion.

Understanding the Exchange Rate

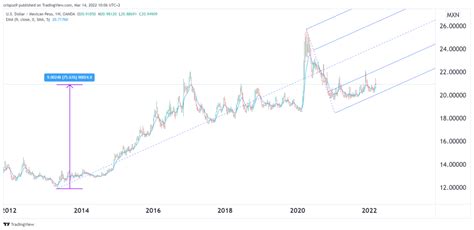

The exchange rate between the US dollar (USD) and the Indian rupee (INR) fluctuates continuously, influenced by various macroeconomic factors such as inflation, interest rates, and economic growth. The live exchange rate on January 1, 2023, is approximately 82.32 INR for every 1 USD. However, this rate is subject to change based on market conditions.

Forecasting Exchange Rate Trends

Predicting currency fluctuations can be challenging, but analysts provide insights into potential trends. According to a recent report by Bloomberg, the INR is forecasted to appreciate against the USD in the coming years due to India’s strong economic growth and stable political environment. By 2025, the exchange rate is expected to be around 78.00 INR per 1 USD.

Calculating $100 USD to INR

To convert $100 USD to INR, simply multiply the amount by the current exchange rate. Using the January 1, 2023 rate of 82.32 INR per 1 USD, $100 USD would be equal to:

$100 USD * 82.32 INR/USD = 8,232.00 INR

Factors Influencing the Exchange Rate

- Inflation: Rising inflation can weaken the value of a currency, leading to a depreciation in its exchange rate against other currencies.

- Interest Rates: Central bank interest rate changes can impact exchange rates. Higher interest rates tend to attract foreign capital, strengthening the currency.

- Economic Growth: A strong economy with high growth potential can attract foreign investment and boost the value of its currency.

- Political Stability: Political instability and uncertainty can weaken the currency of a country due to reduced investor confidence.

- Global Economic Conditions: The overall global economic environment can influence exchange rates, as changes in global demand and supply can impact the value of currencies.

Tips for Optimizing Currency Conversion

- Monitor Exchange Rates: Keep an eye on exchange rate movements to identify favorable times to convert your money.

- Use Currency Exchange Services: Banks, money changers, and online platforms offer currency exchange services with varying rates. Compare different options to find the most competitive rates.

- Consider Mid-Market Rates: Avoid tourist traps and look for exchange rates close to the mid-market rate, which is the average of the buy and sell rates.

- Negotiate Fees: In some cases, you may be able to negotiate lower exchange fees with currency exchange providers.

- Use Credit Cards with No International Fees: If possible, use credit cards that waive international transaction fees to avoid additional charges.

Why the $100 USD to INR Exchange Rate Matters

The exchange rate between the USD and INR has a significant impact on economic activities such as:

- International Trade: The exchange rate affects the cost of importing and exporting goods and services.

- Foreign Investment: The exchange rate influences foreign investors’ decisions to invest in a country’s economy.

- Tourism: The exchange rate can affect the cost of traveling and spending for tourists.

- Financial Transactions: International financial transactions, such as remittances and cross-border payments, are impacted by the exchange rate.

Case Detail: The Impact of $100 USD on an Indian Family

For an Indian family earning a monthly income of 50,000 INR, a $100 USD exchange rate of 82.32 INR would provide them with additional purchasing power of approximately 1,232 INR. This amount could be used to cover essential expenses, such as groceries, healthcare, or education.

Conclusion

Understanding the $100 USD to INR exchange rate is crucial for effective financial planning and decision-making. By monitoring exchange rate trends, optimizing currency conversion strategies, and considering the impact of exchange rates on economic activities, individuals and businesses can maximize their returns and mitigate risks. As the exchange rate continues to fluctuate in the future, keeping abreast of these factors will be essential for successful global financial transactions.