What is ROI?

Return on Investment (ROI) is a powerful metric that measures the profitability of an investment. It quantifies how much gain or loss an entity has incurred relative to its initial investment.

Calculating ROI

ROI is calculated as follows:

ROI = (Gain - Cost) / Cost

Where:

- Gain is the difference between the final value and the initial cost of the investment.

- Cost is the initial investment.

Example:

If you invest $10,000 in a project and it generates a revenue of $15,000, your ROI would be:

ROI = (15,000 - 10,000) / 10,000

= 50%

This means that for every dollar invested, you gained 50 cents.

Why ROI Matters

ROI is a crucial metric for several reasons:

- Decision-making: It provides valuable insights into the performance of investments, allowing organizations to make informed decisions about resource allocation.

- Performance evaluation: It serves as a benchmark for evaluating the effectiveness of projects and determining which initiatives to continue or discontinue.

- Financial planning: It helps businesses assess the profitability of future investments and plan their financial strategies accordingly.

Benefits of ROI

Understanding and maximizing ROI offers numerous benefits, including:

- Improved financial performance: By focusing on investments with high ROIs, organizations can increase their profitability and create long-term value.

- Reduced risk: Carefully evaluating ROIs helps minimize the potential for financial losses and protect investments.

- Increased stakeholder confidence: Demonstrating a track record of strong ROIs can boost investor and stakeholder confidence.

- Enhanced decision-making: ROI analysis provides a data-driven approach to decision-making, ensuring that resources are used wisely.

How to Enhance ROI

There are several strategies to maximize ROI, including:

- Research and due diligence: Conduct thorough research and due diligence before making investment decisions.

- Set clear goals and objectives: Define specific goals and objectives for your investments and track progress regularly.

- Use data analytics: Leverage data analytics to understand customer behavior, identify trends, and optimize marketing campaigns.

- Optimize customer experience: Prioritize customer satisfaction and provide exceptional experiences to drive repeat business and customer loyalty.

- Innovate and adapt: Seek new opportunities, experiment with innovative ideas, and adapt to changing market dynamics.

Creative New Word: “ROIspiration”

“ROIspiration” refers to the process of generating ideas and developing innovative applications to maximize ROI. This involves leveraging creative thinking, data analysis, and customer insights.

Tables

Table 1: Key Performance Indicators for ROI

| KPI | Description |

|---|---|

| Net income | Total revenue minus total expenses |

| Profit margin | Net income divided by total revenue |

| Operating profit | Gross profit minus operating expenses |

| Gross profit | Total revenue minus cost of goods sold |

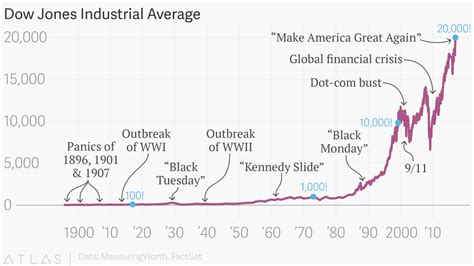

Table 2: ROI by Industry

| Industry | Average ROI |

|---|---|

| Technology | 15-25% |

| Healthcare | 10-15% |

| Manufacturing | 5-10% |

| Retail | 3-5% |

Table 3: Benefits of ROI

| Benefit | Description |

|---|---|

| Improved financial performance | Increased profitability and long-term value |

| Reduced risk | Minimized potential for financial losses |

| Increased stakeholder confidence | Boosted investor and stakeholder confidence |

| Enhanced decision-making | Data-driven approach to decision-making |

Table 4: Strategies to Maximize ROI

| Strategy | Description |

|---|---|

| Research and due diligence | Thorough research and due diligence before investments |

| Set clear goals and objectives | Define specific goals and track progress |

| Use data analytics | Leverage data analytics to understand customers and optimize campaigns |

| Optimize customer experience | Prioritize customer satisfaction and exceptional experiences |

| Innovate and adapt | Seek new opportunities and adapt to changing market dynamics |

FAQs

1. What is a good ROI?

A good ROI depends on the industry and investment risk. Generally, an ROI of 10% or more is considered positive.

2. How can I calculate ROI for non-financial investments?

For non-financial investments, you can use qualitative measures such as customer satisfaction, brand reputation, or employee engagement.

3. Why is ROI important for small businesses?

ROI helps small businesses make the most of their limited resources, ensuring that investments yield positive returns.

4. What is the relationship between ROI and cash flow?

While ROI measures profitability, cash flow measures the inflow and outflow of cash. A healthy ROI does not necessarily indicate positive cash flow.

5. What are some common mistakes to avoid with ROI?

Common mistakes include relying solely on past performance, overlooking hidden costs, and not considering the long-term impact of investments.

6. How can I use ROI to improve my marketing efforts?

By tracking the ROI of marketing campaigns, you can identify which channels and initiatives generate the highest returns.

7. What is the role of technology in ROI optimization?

Technology can enhance data collection, analysis, and decision-making, leading to improved ROI optimization.

8. How does ROI impact employee motivation?

Recognizing and rewarding employees for their contributions to ROI can boost motivation and enhance productivity.