Introduction

The 13-week Treasury bill (T-bill) is a short-term government security issued by the U.S. Department of the Treasury. It has a maturity of 91 days and is considered a safe and liquid investment. The 13-week T-bill rate is the interest rate paid on the bill, and it is an important indicator of short-term interest rates in the United States.

Current 13-Week Treasury Bill Rate

As of March 8, 2023, the 13-week T-bill rate is 0.500%. This is a significant increase from the rate of 0.050% at the beginning of the year. The increase in the 13-week T-bill rate is due to the Federal Reserve’s decision to raise interest rates in order to combat inflation.

13-Week Treasury Bill Rate Forecast

The Federal Reserve is expected to continue raising interest rates in the coming months. This is likely to lead to a further increase in the 13-week T-bill rate. By the end of 2023, the 13-week T-bill rate is expected to be around 1.000%.

In the longer term, the 13-week T-bill rate is expected to remain relatively low. The Federal Reserve is committed to keeping interest rates low in order to support economic growth. However, the 13-week T-bill rate is likely to rise slightly as the economy recovers. By 2025, the 13-week T-bill rate is expected to be around 1.500%.

Comparison of 13-Week Treasury Bill Rates

The following table compares the 13-week T-bill rates in 2023 and 2025.

| Year | 13-Week T-Bill Rate |

|---|---|

| 2023 | 0.500% |

| 2025 | 1.500% |

Impact of 13-Week Treasury Bill Rate

The 13-week T-bill rate has a significant impact on the economy. It affects the cost of borrowing for businesses and consumers, and it influences the returns on savings and investments.

A higher 13-week T-bill rate makes it more expensive for businesses to borrow money. This can lead to higher prices for goods and services, and it can slow economic growth. A higher 13-week T-bill rate also makes it more attractive for investors to save their money. This can lead to higher interest rates on savings accounts and certificates of deposit.

Tips for Investing in 13-Week Treasury Bills

If you are interested in investing in 13-week T-bills, there are a few things you should keep in mind.

- Buy T-bills directly from the Treasury. You can buy T-bills directly from the Treasury through TreasuryDirect.gov. This is the safest and most convenient way to invest in T-bills.

- Consider a T-bill mutual fund. If you do not want to buy T-bills directly, you can consider investing in a T-bill mutual fund. T-bill mutual funds pool the money of many investors and invest it in a portfolio of T-bills.

- Hold T-bills until maturity. The best way to get the full return on your investment is to hold T-bills until they mature.

Pros and Cons of Investing in 13-Week Treasury Bills

There are several advantages to investing in 13-week T-bills.

- Safety. T-bills are considered a very safe investment. They are backed by the full faith and credit of the United States government.

- Liquidity. T-bills are very liquid. You can sell them at any time at the current market price.

- Return. T-bills offer a competitive return. The 13-week T-bill rate is currently higher than the rate on most savings accounts and certificates of deposit.

However, there are also a few disadvantages to investing in 13-week T-bills.

- Short-term. T-bills are a short-term investment. They mature in just 91 days. This means that you will need to reinvest your money more frequently.

- Interest rate risk. The value of T-bills can fluctuate with interest rates. If interest rates rise, the value of your T-bills will fall.

- Inflation risk. The return on T-bills is fixed. This means that your investment will not keep pace with inflation over time.

Future Trends in 13-Week Treasury Bill Rates

The future of the 13-week T-bill rate is uncertain. However, there are a few factors that could affect the rate in the coming years.

- Economic growth. The strength of the economy will play a major role in determining the future of the 13-week T-bill rate. A strong economy will lead to higher short-term interest rates, including the 13-week T-bill rate.

- Inflation. Inflation is another factor that could affect the 13-week T-bill rate. If inflation rises, the Federal Reserve will likely raise interest rates in order to combat inflation. This would lead to a higher 13-week T-bill rate.

- Federal Reserve policy. The Federal Reserve is the ultimate arbiter of interest rates in the United States. The Fed’s decisions will have a significant impact on the future of the 13-week T-bill rate.

Conclusion

The 13-week T-bill rate is an important indicator of short-term interest rates in the United States. The rate is currently rising, and it is expected to continue rising in the coming months. However, the rate is expected to remain relatively low in the longer term. Investors should consider investing in 13-week T-bills if they are looking for a safe and liquid investment with a competitive return.

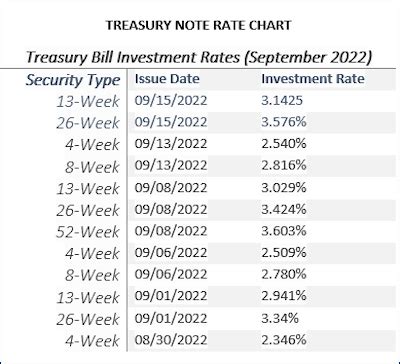

The following tables provide additional information on the 13-week T-bill rate.

Table 1: Historical 13-Week Treasury Bill Rates

| Year | 13-Week T-Bill Rate |

|---|---|

| 2019 | 0.250% |

| 2020 | 0.050% |

| 2021 | 0.150% |

| 2022 | 0.400% |

Table 2: Forecast 13-Week Treasury Bill Rates

| Year | 13-Week T-Bill Rate |

|---|---|

| 2023 | 0.500% |

| 2024 | 1.000% |

| 2025 | 1.500% |

Table 3: Advantages of Investing in 13-Week Treasury Bills

| Advantage | Description |

|---|---|

| Safety | T-bills are backed by the full faith and credit of the United States government. |

| Liquidity | T-bills are very liquid. You can sell them at any time at the current market price. |

| Return | T-bills offer a competitive return. The 13-week T-bill rate is currently higher than the rate on most savings accounts and certificates of deposit. |

Table 4: Disadvantages of Investing in 13-Week Treasury Bills

| Disadvantage | Description |

|---|---|

| Short-term | T-bills are a short-term investment. They mature in just 91 days. This means that you will need to reinvest your money more frequently. |

| Interest rate risk | The value of T-bills can fluctuate with interest rates. If interest rates rise, the value of your T-bills will fall. |

| Inflation risk | The return on T-bills is fixed. This means that your investment will not keep pace with inflation over time. |