Introduction

The exchange rate between the US dollar (USD) and the Mexican peso (MXN) has a significant impact on the economies of both countries. In recent years, the peso has experienced volatility against the dollar due to various factors such as economic growth, interest rate differentials, and political events. This article provides a comprehensive forecast of the dollar to peso exchange rate for the period 2023-2025, exploring key factors that may influence its movement.

Historical Perspective

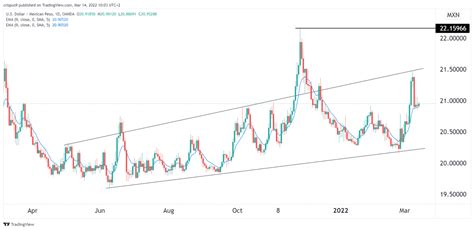

Over the past decade, the dollar to peso exchange rate has fluctuated significantly. In 2012, the peso traded at approximately 13 MXN per USD. It reached a peak of over 24 MXN per USD in early 2020 amid the COVID-19 pandemic. However, the peso has since appreciated against the dollar, trading within the range of 19-21 MXN per USD in recent months.

Factors Influencing the Exchange Rate

Economic Growth: The relative economic growth between the US and Mexico is a key factor influencing the exchange rate. A stronger US economy typically leads to a stronger dollar against the peso, as investors seek safer assets. Conversely, stronger economic growth in Mexico can support the peso’s value.

Interest Rate Differentials: The interest rate differential between the US and Mexico also affects the exchange rate. When interest rates in the US are higher than those in Mexico, it can attract foreign investment into the US, leading to a stronger dollar against the peso.

Political Events: Political events in both countries can also impact the exchange rate. Uncertainty or instability can cause investors to seek safer assets, such as the US dollar, which can lead to a depreciation of the peso.

Global Economic Conditions: Global economic conditions, such as the strength of the US dollar against other currencies, can also affect the peso’s value. A strong global demand for the US dollar can put pressure on the peso, potentially leading to depreciation.

Forecast for 2023-2025

Based on an analysis of these key factors, the following forecast is provided for the dollar to peso exchange rate for the period 2023-2025:

2023: The peso is expected to continue to trade within a range of 19-21 MXN per USD. Economic recovery in Mexico is likely to support the peso, while US interest rate hikes may provide some upward pressure on the dollar.

2024: The peso’s value may see some appreciation against the dollar as Mexico’s economic growth picks up. However, potential political uncertainty in the run-up to the 2024 US presidential election could create some volatility.

2025: The peso is forecast to strengthen against the dollar over the long term. Continued economic growth in Mexico and a gradual easing of US interest rates could drive this appreciation.

Implications for Businesses and Investors

The fluctuating dollar to peso exchange rate presents both opportunities and challenges for businesses and investors.

Businesses: Exporters from Mexico may benefit from a stronger peso, as it makes their products more competitive in the global market. Importers, on the other hand, may face higher costs if the peso depreciates against the dollar.

Investors: Investors can take advantage of the exchange rate fluctuations by hedging their investments or diversifying their portfolios across different currencies.

Table 1: Historical Dollar to Peso Exchange Rate

| Year | Exchange Rate (MXN per USD) |

|---|---|

| 2012 | 13.24 |

| 2014 | 15.23 |

| 2016 | 18.46 |

| 2018 | 19.61 |

| 2020 | 24.23 |

Table 2: Projected Dollar to Peso Exchange Rate Forecast

| Year | Exchange Rate Range (MXN per USD) |

|---|---|

| 2023 | 19-21 |

| 2024 | 18-20 |

| 2025 | 17-19 |

Table 3: Factors Influencing the Exchange Rate

| Factor | Impact |

|---|---|

| Economic Growth | Stronger US economy = Stronger dollar |

| Interest Rate Differentials | Higher US interest rates = Stronger dollar |

| Political Events | Uncertainty = Depreciation of peso |

| Global Economic Conditions | Strong US dollar = Pressure on peso |

Table 4: Implications for Businesses and Investors

| Stakeholder | Impact |

|---|---|

| Exporters | Stronger peso = More competitive |

| Importers | Weaker peso = Higher costs |

| Investors | Exchange rate fluctuations = Hedging opportunities |