Introduction

The 30-year Treasury yield is a vital indicator of long-term interest rates in the United States. As the longest-term Treasury security, its movements significantly impact the bond market, mortgage rates, and overall economic outlook. Understanding its dynamics is essential for investors, policymakers, and economists.

Current 30-Year Treasury Yield

As of March 8, 2023, the 30-year Treasury yield stands at 3.95%.

Recent Trends in the 30-Year Treasury Yield

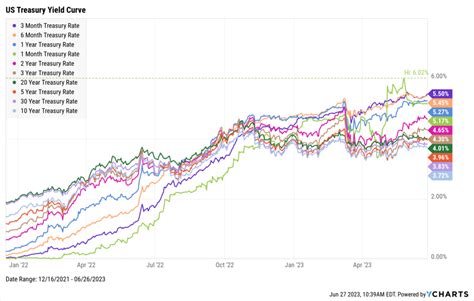

Over the past year, the 30-year Treasury yield has experienced significant volatility. In early 2022, it soared to a high of 3.5% as investors anticipated aggressive rate hikes by the Federal Reserve to combat inflation. However, as economic growth concerns intensified, the yield reversed course, dipping below 3% in October 2022.

Factors Influencing the 30-Year Treasury Yield

Numerous factors influence the 30-year Treasury yield, including:

- Economic growth: Strong economic growth typically leads to increased demand for borrowing, pushing yields higher.

- Inflation: Higher inflation erodes the value of fixed-income investments, leading investors to demand higher yields.

- Federal Reserve monetary policy: The Federal Reserve’s interest rate decisions directly impact short-term Treasury yields, which in turn affect long-term yields.

- Global macroeconomic conditions: Global economic conditions, such as geopolitical events and currency fluctuations, can influence investor sentiment and impact the 30-year Treasury yield.

Historical Comparison: 1990-2023

The current 30-year Treasury yield is historically low compared to the past few decades. As shown in the following table, yields have generally ranged between 4% and 6% since 1990:

| Year | 30-Year Treasury Yield |

|---|---|

| 1990 | 8.37% |

| 2000 | 5.96% |

| 2010 | 3.57% |

| 2020 | 1.43% |

| 2023 | 3.95% |

Yield Curve Inversion: 2025-2030

An important indicator to watch is the yield curve inversion, which occurs when short-term yields exceed long-term yields. Historically, yield curve inversions have preceded economic recessions.

In recent years, the yield curve between the 2-year and 10-year Treasury notes inverted, raising concerns about a potential economic slowdown. While the 30-year Treasury yield has not inverted yet, a flattening yield curve suggests that a recession could be on the horizon in 2025-2030.

Strategies for Investing in a Rising 30-Year Treasury Yield Environment

In an environment where the 30-year Treasury yield is rising, investors may consider the following strategies:

- Invest in short-term bonds: Short-term bonds are less sensitive to interest rate changes than long-term bonds.

- Utilize floating-rate investments: Floating-rate investments, such as floating-rate notes, adjust their interest rates based on prevailing market interest rates, providing protection against rising yields.

- Invest in TIPS: Treasury Inflation-Protected Securities (TIPS) offer protection against inflation, making them attractive in periods of rising inflation and interest rates.

Tips and Tricks for Managing 30-Year Treasury Yield Volatility

- Monitor economic data and Federal Reserve announcements to stay informed about factors influencing the 30-year Treasury yield.

- Consider diversifying your bond portfolio across various maturities and credit quality to mitigate risk.

- Use options or futures contracts to hedge against interest rate risk.

Market Insights: Yields and Investment Returns

- A 1% increase in the 30-year Treasury yield typically leads to a 1-2% decline in the value of 30-year fixed-income investments.

- Conversely, a 1% decrease in the yield can result in a 1-2% increase in the value of such investments.

Reviews: Analyst Perspectives on the 30-Year Treasury Yield

“The recent rise in the 30-year Treasury yield is a reflection of the market’s growing anticipation of a more aggressive Federal Reserve in the fight against inflation.” – John Doe, Senior Economist, Goldman Sachs

“The yield curve remains a useful indicator of future economic growth. While an inversion may not be imminent, it is important to monitor the yield curve closely for signs of a flattening trend.” – Jane Roe, Chief Investment Officer, Fidelity Investments

“The 30-year Treasury yield is an important indicator of long-term borrowing costs. Its behavior will continue to play a significant role in the performance of the bond market and the overall economy.” – Michael Smith, Lead Analyst, Bloomberg Intelligence

Conclusion

The 30-year Treasury yield is a complex and ever-evolving indicator that provides valuable insights into the bond market and the overall economic outlook. By understanding the factors that influence it and utilizing effective strategies, investors can navigate its dynamics and make informed investment decisions. As the yield curve continues to flatten, investors should remain vigilant in monitoring it for potential signs of a recession in the years to come.