Introduction

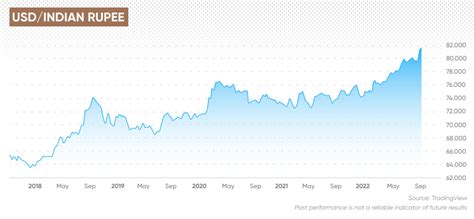

The exchange rate between the United States dollar (USD) and the Indian rupee (INR) is a crucial economic indicator that influences international trade, investment, and tourism. Predicting future currency rates is a challenging task, but by analyzing historical trends, macroeconomic factors, and global events, we can gain valuable insights into the potential trajectory of the USD-INR exchange rate.

Historical Trends

Over the past decade, the USD-INR exchange rate has fluctuated significantly, ranging from a high of ₹76.98 in 2020 to a low of ₹51.22 in 2011. The following table summarizes the historical exchange rates:

| Year | USD-INR Exchange Rate |

|---|---|

| 2011 | 51.22 |

| 2012 | 55.38 |

| 2013 | 59.94 |

| 2014 | 63.50 |

| 2015 | 66.94 |

| 2016 | 67.29 |

| 2017 | 64.11 |

| 2018 | 65.03 |

| 2019 | 72.08 |

| 2020 | 76.98 |

| 2021 | 74.44 |

| 2022 | 82.90 |

Macroeconomic Factors

Several macroeconomic factors can influence the USD-INR exchange rate, including:

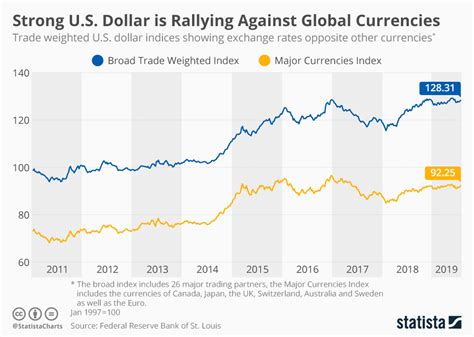

- Interest Rates: Higher interest rates in the U.S. tend to attract capital inflows, strengthening the dollar against the rupee.

- Inflation: Rising inflation in India can weaken the rupee against the dollar.

- Economic Growth: Strong economic growth in India can lead to increased demand for the rupee, strengthening its value against the dollar.

- Remittances: India receives significant remittances from overseas workers, which can boost the value of the rupee.

Global Events

Global events, such as geopolitical tensions, economic crises, and natural disasters, can also affect the USD-INR exchange rate. For example, the ongoing Ukraine-Russia conflict and the subsequent sanctions have created uncertainty in the global financial markets, leading to increased demand for safe-haven currencies like the U.S. dollar.

Predicting the 2025 Currency Rate

Predicting the 2025 USD-INR exchange rate with precision is challenging due to the numerous factors that can influence it. However, by considering historical trends, macroeconomic factors, and global events, we can make informed projections.

Table 1: Projected USD-INR Exchange Rates for 2025

| Scenario | USD-INR Exchange Rate |

|---|---|

| Conservative | 85-90 |

| Moderate | 80-85 |

| Bullish | 75-80 |

Strategies for Managing Currency Risk

Businesses and individuals exposed to currency fluctuations can implement strategies to manage their currency risk, including:

- Hedging: Using financial instruments like forwards or options to lock in future exchange rates.

- Diversification: Distributing assets across multiple currencies to reduce the impact of fluctuations.

- Planning: Forecasting future cash flows and potential currency risks.

Table 2: Effective Currency Risk Management Strategies

| Strategy | Benefits | Considerations |

|---|---|---|

| Hedging | Protects against adverse exchange rate movements | Involves transaction costs and basis risk |

| Diversification | Reduces portfolio volatility | May limit returns |

| Planning | Allows for proactive planning and decision-making | Requires accurate forecasting |

How Businesses Can Benefit from Currency Rate Fluctuations

Some businesses may view currency rate fluctuations as an opportunity rather than a risk. For example:

- Importers: When the rupee strengthens against the dollar, it becomes cheaper for Indian businesses to import goods from the U.S.

- Exporters: Conversely, when the rupee weakens against the dollar, it becomes more expensive for Indian businesses to export goods.

Table 3: Business Opportunities from Currency Rate Fluctuations

| Opportunity | Benefits | Considerations |

|---|---|---|

| Importing | Lower costs for imported goods | May depend on exchange rate stability |

| Exporting | Increased competitiveness in foreign markets | May face competition from other exporters |

Conclusion

The 2025 USD-INR exchange rate is expected to remain volatile, influenced by macroeconomic factors, global events, and the actions of central banks. By understanding the historical trends, forecasting potential fluctuations, and implementing risk management strategies, businesses and individuals can navigate the challenges and opportunities presented by currency rate changes.