Introduction

The Indonesian rupiah (IDR), denoted by Rp, is the currency of Indonesia. The United States dollar (USD) is the official currency of the United States and is also widely used as a global reserve currency. In 2023, the exchange rate between the two currencies was approximately Rp 15,000 to USD 1. However, this rate is constantly fluctuating due to various economic factors. This article will explore the factors that influence the rp to us dollars exchange rate and discuss the potential prospects and opportunities for the Indonesian rupiah in the coming years.

Factors Influencing the rp to us dollars Exchange Rate

Several factors influence the exchange rate between the Indonesian rupiah and the US dollar, including:

- Indonesia’s Economic Growth: A strong Indonesian economy, characterized by high GDP growth, low inflation, and a stable political environment, tends to strengthen the rupiah against the US dollar.

- Interest Rates: Changes in interest rates by the Bank of Indonesia (BI) and the US Federal Reserve (Fed) can impact the relative attractiveness of Indonesian assets to foreign investors, affecting the demand for the rupiah.

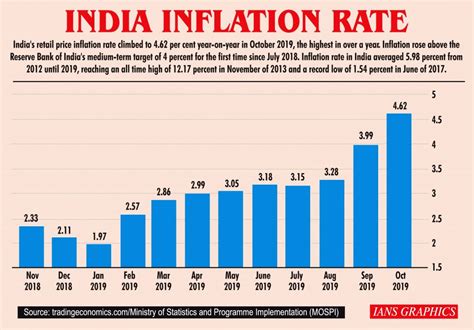

- Inflation: High inflation in Indonesia, relative to the US, can weaken the rupiah as investors may prefer to hold assets denominated in more stable currencies.

- Global Economic Conditions: The global economy, including the economic outlook of major trading partners such as China and the US, can also influence the rp to us dollars exchange rate.

- Commodity Prices: Indonesia is a major exporter of commodities such as oil, gas, and coal. Changes in global commodity prices can impact the demand for the rupiah.

Prospects for the Indonesian Rupiah

The Indonesian rupiah has faced challenges in recent years due to global economic headwinds and the COVID-19 pandemic. However, the long-term prospects for the Indonesian rupiah remain positive. Indonesia has a large and growing economy, with a young and dynamic population. The government is also implementing various reforms to improve the investment climate and boost economic growth.

According to the World Bank, Indonesia’s GDP is projected to grow by 5.1% in 2023 and 5.3% in 2024. This economic growth is expected to support the Indonesian rupiah and contribute to its appreciation against the US dollar.

Opportunities for Investors

The fluctuating rp to us dollars exchange rate presents opportunities for investors. Here are a few strategies to consider:

- Hedging Currency Risk: Investors can use currency forwards or options to hedge against currency risk and protect their investments from exchange rate fluctuations.

- Investing in Indonesian Assets: Foreign investors can take advantage of the potential appreciation of the rupiah by investing in Indonesian assets, such as stocks, bonds, or real estate.

- Exporting to Indonesia: Businesses that export goods or services to Indonesia can benefit from a weaker rupiah, as it makes their products more competitive in the Indonesian market.

Market Insights

The rp to us dollars exchange rate is closely monitored by businesses, investors, and policymakers. Several market insights can be derived from the analysis of this exchange rate:

- Indonesia’s Economic Health: The strength of the rupiah can be an indicator of Indonesia’s economic health and the confidence of investors in the country.

- Foreign Investment Flows: The exchange rate can influence the flow of foreign investment into Indonesia. A weaker rupiah can attract foreign investors seeking to acquire assets at a lower cost.

- Global Economic Outlook: The rp to us dollars exchange rate can provide insights into the global economic outlook, as it reflects the demand for the US dollar, a major global reserve currency.

Highlights

- The Indonesian rupiah has faced challenges in recent years but has long-term growth potential.

- The rp to us dollars exchange rate is influenced by several factors, including Indonesia’s economic growth, interest rates, and global economic conditions.

- Investors can leverage the fluctuating exchange rate for hedging and investment opportunities.

- The rp to us dollars exchange rate provides insights into Indonesia’s economic health, foreign investment flows, and the global economic outlook.

Conclusion

The rp to us dollars exchange rate is a complex and dynamic variable influenced by various economic factors. Despite recent challenges, the Indonesian rupiah has the potential to strengthen in the coming years, supported by Indonesia’s economic growth and reforms. Understanding the factors that influence the exchange rate and leveraging market insights can help investors and businesses make informed decisions and capitalize on opportunities presented by the fluctuating rp to us dollars rate.