How Much Is Your Dollar Worth?

In the ever-evolving global economy, understanding currency exchange rates is crucial for businesses, travelers, and anyone involved in international transactions. One of the most widely traded currency pairs is the US dollar (USD) and the euro (EUR).

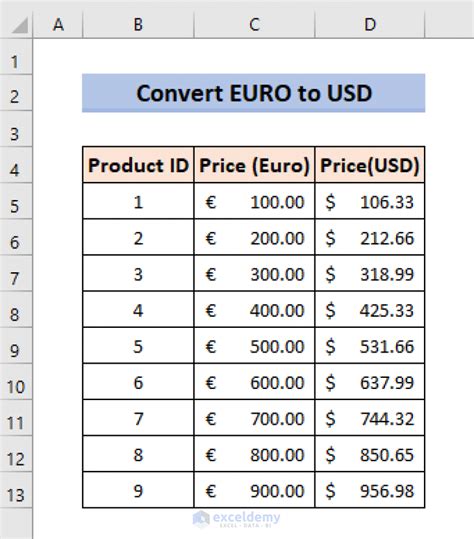

Currency Converter: Dollar to Euro

To help you navigate the complexities of currency conversion, we present an interactive currency converter:

[Image of a currency converter widget]

Simply enter the amount in USD and watch it convert to EUR in real-time, or vice versa. This tool ensures you always have the latest exchange rates at your fingertips.

Historical Exchange Rates: A Journey Through Time

The exchange rate between the dollar and the euro has fluctuated significantly over the years. Here’s a brief history of key milestones:

1999-2002: Birth of the Euro

- January 1, 1999: The euro is introduced, initially at a fixed rate of 1 EUR = 1.1696 USD.

- July 15, 2002: The euro reaches its highest point against the USD, trading at 1 EUR = 1.0644 USD.

2008-2014: Economic Storms

- 2008: The global financial crisis weakens the EUR, which falls to 1 EUR = 0.8235 USD.

- 2014: The European debt crisis further impacts the euro, trading at 1 EUR = 0.7051 USD.

2015-2022: Stability and Growth

- The euro gradually regains strength, reaching 1 EUR = 0.9320 USD in 2015.

- In 2022, the euro continues to trade near parity with the USD.

Factors Influencing Exchange Rates: A Multifaceted Equation

Numerous factors shape the exchange rate between the dollar and the euro:

- Economic Performance: Strong economic growth in a country tends to strengthen its currency.

- Interest Rates: Higher interest rates can attract foreign investment, boosting demand for a currency.

- Political Stability: Political uncertainty can weaken a currency, while stability fosters confidence.

- Inflation: Higher inflation erodes the value of a currency, while lower inflation strengthens it.

- Central Bank Policies: Monetary policies, such as quantitative easing or interest rate adjustments, influence exchange rates.

Strategies for Currency Conversion: Navigating the Market

To minimize losses and maximize gains, consider these strategies:

1. Monitor Exchange Rates:

Stay informed about current and historical exchange rates to identify favorable conversion opportunities.

2. Use Currency Converter Tools:

Take advantage of online converters to compare rates from different providers and choose the best deal.

3. Consider Currency Spread:

Be aware that banks and exchange bureaus often charge a “spread” (difference between the buy and sell rates), which can impact your conversion value.

4. Transfer Funds Wisely:

Choose methods with lower transfer fees, such as wire transfers or online intermediaries.

5. Hedge Your Risk:

Consider using currency hedging instruments, such as forward contracts or options, to protect against adverse exchange rate fluctuations.

Pros and Cons of Currency Conversion: Weighing the Options

Pros:

- Facilitates global transactions

- Allows for international investment opportunities

- Enables travel and tourism

- Can be a source of profit for currency traders

Cons:

- Exchange rate fluctuations can lead to losses

- Currency conversion fees can add up

- Black market exchange rates may be illegal and risky

- Can impact the profitability of international businesses

Market Insights: Embracing the Future of Currency Conversion

The future of currency conversion is shaped by advancements in technology and globalization.

1. AI and Machine Learning:

AI-powered converters provide real-time rates and predictive analytics, optimizing exchange decisions.

2. Blockchain and Cryptocurrencies:

Blockchain technology offers secure and decentralized currency exchange platforms.

3. Cross-Border Mobile Payments:

Mobile apps enable seamless currency conversion and money transfers across borders.

4. Personalized Currency Conversion:

Customized platforms offer tailored exchange rates based on individual spending habits and preferences.

Expanding Your Currency Conversion Horizons: Creative Applications

Beyond traditional transactions, currency conversion opens up new possibilities for businesses and individuals:

1. International E-Commerce:

E-commerce platforms facilitate cross-border sales by enabling instant currency conversion.

2. Global Investments:

Currency conversion supports global investment strategies, allowing investors to diversify portfolios and access international markets.

3. Currency Arbitrage:

Advanced algorithms leverage exchange rate fluctuations to generate profits through arbitrage strategies.

4. Cross-Cultural Exchanges:

Currency conversion enables cultural exchanges, such as supporting foreign charities or funding education abroad.

Conclusion: Mastering Currency Conversion in 2025

As the global economy continues to interconnect, mastering currency conversion skills is crucial for success in the modern world. By understanding historical exchange rates, leveraging strategies, and embracing market insights, you can navigate the complexities of currency conversion effectively.

Remember, the currency converter tool is your ally in this journey, providing you with real-time exchange rates to ensure you always make informed decisions. As the year 2025 unfolds, embrace the future of currency conversion and empower yourself with knowledge and technology.

Tables for Enhanced Understanding

Table 1: Key Exchange Rate Milestones

| Year | Exchange Rate (EUR/USD) |

|---|---|

| 1999 | 1.1696 |

| 2002 | 1.0644 |

| 2008 | 0.8235 |

| 2014 | 0.7051 |

| 2015 | 0.9320 |

Table 2: Factors Influencing Exchange Rates

| Factor | Impact on Currency |

|---|---|

| Economic Performance | Strengthens currency |

| Interest Rates | Attracts investment, strengthens currency |

| Political Stability | Fosters currency confidence |

| Inflation | Erodes currency value |

| Central Bank Policies | Adjusts exchange rates |

Table 3: Currency Conversion Strategies

| Strategy | Description |

|---|---|

| Monitor Exchange Rates | Track rates to identify optimal conversion times |

| Use Currency Converter Tools | Compare rates and choose the best option |

| Consider Currency Spread | Be aware of fees charged by providers |

| Transfer Funds Wisely | Choose low-cost transfer methods |

| Hedge Your Risk | Use hedging instruments to protect against fluctuations |

Table 4: Future Trends in Currency Conversion

| Trend | Application |

|---|---|

| AI and Machine Learning | Real-time rates, predictive analytics |

| Blockchain and Cryptocurrencies | Secure, decentralized exchanges |

| Cross-Border Mobile Payments | Seamless currency conversion and money transfers |

| Personalized Currency Conversion | Tailored rates based on spending habits |