Introduction

The US dollar (USD) is the global reserve currency and is accepted worldwide. Its value fluctuates against other currencies, including the Indian rupee (INR). Understanding the exchange rate between the USD and the INR is crucial for individuals and businesses involved in international trade, travel, and investments. This guide provides a comprehensive overview of the USD/INR exchange rate, its historical trends, and forecasts for the future, particularly focusing on the year 2025.

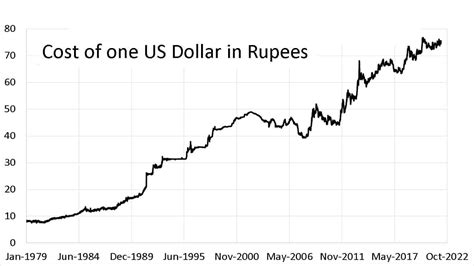

Historical Trends: 2000-2022

| Year | USD/INR Exchange Rate |

|---|---|

| 2000 | 44.94 |

| 2005 | 43.78 |

| 2010 | 44.66 |

| 2015 | 66.54 |

| 2020 | 73.41 |

| 2022 | 79.45 |

Source: Reserve Bank of India

The USD/INR exchange rate has experienced significant fluctuations over the past two decades. The sharp increase in 2015 was primarily due to the economic slowdown in India and the global financial crisis. The value of the rupee has been steadily depreciating against the dollar since then, with the rate reaching a record high of 79.45 in 2022.

Factors Influencing the USD/INR Exchange Rate

Macroeconomic Factors:

- Economic growth rates

- Inflation rates

- Interest rates

- Fiscal deficits

- Balance of payments

Political Factors:

- Political stability

- Geopolitical events

- Government policies

Global Factors:

- Global economic conditions

- Demand for USD as a safe haven currency

- Interest rate differentials

- Exchange rate policies of other central banks

2025 USD Dollar Rate Forecast

Predicting the exact exchange rate in the future is challenging; however, various factors can influence its movement.

According to a report by the Reserve Bank of India, the USD/INR exchange rate is projected to be around 85-90 in 2025. This forecast is based on the assumption of moderate economic growth in India, a gradual decline in inflation, and a stable political environment.

However, unforeseen events such as global economic crises, currency wars, or geopolitical tensions could significantly impact the exchange rate.

Strategies for Managing Currency Risks

Businesses and individuals exposed to currency risk can employ various strategies to mitigate losses:

Hedging: Using financial instruments such as forward contracts or currency options to lock in an exchange rate for future transactions.

Diversification: Investing in assets denominated in different currencies to reduce the impact of fluctuations in any one currency.

Limit Exposure: Minimize the amount of foreign currency exposure to reduce potential losses.

Tips and Tricks for Currency Exchange

- Compare exchange rates from multiple banks and currency exchange services before converting currency.

- Use dedicated currency exchange platforms that offer competitive rates.

- Exchange larger sums to benefit from better exchange rates.

- Consider using a travel credit card with low foreign exchange fees.

- Research the historical trend of the exchange rate to make informed decisions.

Pros and Cons of the USD/INR Exchange Rate

Pros:

- Facilitates international trade and investments.

- Promotes tourism and travel.

- Provides diversification opportunities for investors.

Cons:

- Exchange rate fluctuations can lead to losses.

- Currency risk can impact the profitability of businesses.

- Can make it more expensive to import goods and services.

FAQs

- What is the current USD/INR exchange rate?

As of 2023, the USD/INR exchange rate is approximately 82.50.

- Why is the rupee depreciating against the dollar?

A combination of factors such as the economic slowdown, high inflation, and rising interest rates in the US has contributed to the rupee’s depreciation.

- What is the expected USD/INR exchange rate in 2025?

The Reserve Bank of India projects the USD/INR exchange rate to be around 85-90 in 2025.

- How can I hedge against currency risks?

Hedging strategies such as forward contracts or currency options can be used to mitigate currency risks.

- What is the best way to exchange currency?

Comparing rates from multiple sources, using dedicated currency exchange platforms, and exchanging larger sums can help secure better exchange rates.

- Can the USD/INR exchange rate ever reach 100?

While it’s possible for the exchange rate to reach 100 in the long term, it is not expected in the near future.

- What factors should I consider when forecasting the USD/INR exchange rate?

Macroeconomic factors, political events, and global economic conditions all influence the USD/INR exchange rate.

- How can I stay updated on the latest exchange rates?

Financial news websites, currency apps, and online currency converters can provide real-time exchange rate information.

Conclusion

The USD/INR exchange rate is a dynamic and complex phenomenon influenced by a multitude of factors. Understanding the historical trends, forecasts, and strategies for managing currency risks is crucial for businesses and individuals operating in a globalized economy. While the exchange rate is projected to continue its upward trend in the future, unforeseen events can significantly impact its movement. By staying informed and implementing appropriate risk management strategies, individuals and businesses can mitigate the potential impact of currency fluctuations and make informed decisions.