Unprecedented Demand Drives Price Surge

The global thirst for energy is reaching unprecedented levels, fueling a surge in demand for crude oil. Among the various grades of oil, West Texas Intermediate (WTI) stands out as the benchmark for North American markets. In recent months, WTI prices have soared to their highest levels in over a decade, propelled by a confluence of economic and geopolitical factors.

Current Market Dynamics

As of March 2023, WTI crude oil futures were trading above $100 per barrel on the New York Mercantile Exchange (NYMEX). This marks a significant increase from the start of the year, when prices hovered around $80 per barrel. Several key factors have contributed to this price hike:

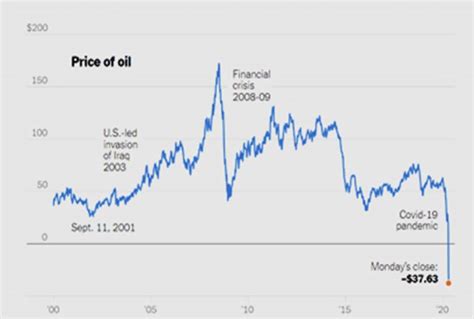

- Economic Recovery: The global economy is rebounding from the COVID-19 pandemic, leading to increased demand for transportation fuels.

- Supply Disruptions: Geopolitical tensions and supply chain disruptions have restricted the flow of oil from major producing countries.

- Low Inventories: Global oil inventories are at multi-year lows, putting upward pressure on prices.

2025 Forecast

The International Energy Agency (IEA) predicts that global oil demand will continue to grow in the coming years, reaching 104 million barrels per day (mbpd) by 2025. This growth is expected to be driven primarily by emerging economies in Asia and the Middle East.

Table 1: IEA Oil Demand Forecast (2023-2025)

| Year | Demand (mbpd) | Change from Previous Year |

|---|---|---|

| 2023 | 99.7 | – |

| 2024 | 101.4 | 1.7% |

| 2025 | 104.0 | 2.6% |

Supply-side factors are also expected to play a role in shaping oil prices in 2025. The Organization of Petroleum Exporting Countries (OPEC) and its allies (OPEC+) are expected to continue to manage production levels to stabilize prices. However, new oil discoveries and technological advancements could potentially increase supply and dampen price increases.

Factors Affecting Prices

In addition to supply and demand dynamics, several other factors can influence WTI crude oil prices:

- Geopolitical Events: Wars, political unrest, and sanctions can disrupt oil production and transportation.

- Economic Policy: Government decisions on interest rates, taxation, and spending can affect demand and prices.

- Technological Innovations: New technologies, such as electric vehicles and renewable energy, could reduce oil demand in the long term.

Benefits of High Oil Prices

While high oil prices can be a burden for consumers, they also bring benefits to the energy sector:

- Increased Investment: Higher prices incentivize oil companies to invest in exploration and development, ensuring a long-term supply.

- Stimulus to the Economy: The energy sector is a major employer and contributor to economic growth.

- Renewable Energy Development: High oil prices can drive investment in alternative energy sources, reducing dependence on fossil fuels.

Hot Search Title:

“2025 WTI Oil Forecast: Brace for Surging Prices”

FAQs

-

Why are WTI prices rising?

– Increased demand, supply disruptions, and low inventories. -

What is the 2025 forecast for WTI prices?

– IEA predicts prices will continue to rise, reaching above $100 per barrel. -

What factors affect WTI prices?

– Supply and demand, geopolitical events, economic policy, and technological innovations. -

What can be done to reduce oil prices?

– Increase supply, reduce demand, or invest in alternative energy sources. -

What do high oil prices mean for the economy?

– Increased costs for consumers, but also increased investment and economic growth in the energy sector. -

What are the potential benefits of high oil prices?

– Increased investment in oil production, stimulus to the economy, and potential acceleration of renewable energy development. -

What are some emerging applications of oil-derived products?

– Bioplastics, medical equipment, and sustainable construction materials. -

How can consumers mitigate the impact of high oil prices?

– Use public transportation, carpool, consider smaller vehicles, and invest in home energy efficiency.