Introduction

In today’s uncertain economic climate, investors are looking for ways to protect their portfolios from inflation. One way to do this is to invest in dividend-paying stocks. Dividends are payments made by companies to their shareholders, typically on a quarterly or annual basis. Dividend-paying stocks can provide a steady stream of income, which can help to offset the effects of inflation.

Here are 7 of the best dividend-paying stocks to buy in 2025:

- Johnson & Johnson (JNJ)

- Procter & Gamble (PG)

- Coca-Cola (KO)

- PepsiCo (PEP)

- ExxonMobil (XOM)

- Chevron (CVX)

- Realty Income (O)

These companies have a long history of paying dividends, and they are all expected to continue to pay dividends in the future.

Why Invest in Dividend-Paying Stocks?

There are a number of reasons why investors should consider investing in dividend-paying stocks. First, dividends can provide a steady stream of income. This income can be used to supplement your retirement income, or it can be reinvested to grow your portfolio.

Second, dividend-paying stocks tend to be more stable than non-dividend-paying stocks. This is because companies that pay dividends are typically more mature and financially stable. As a result, dividend-paying stocks are less likely to experience large price swings.

Third, dividend-paying stocks can help you to beat inflation. When inflation rises, the value of your investments can decline. However, dividends can help to offset the effects of inflation by providing you with a steady stream of income.

How to Choose Dividend-Paying Stocks

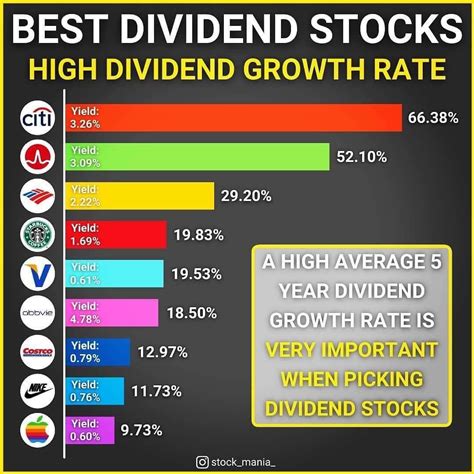

When choosing dividend-paying stocks, there are a few factors to consider. First, you should look for companies with a long history of paying dividends. This indicates that the company is committed to returning money to shareholders.

Second, you should consider the company’s dividend yield. The dividend yield is the percentage of the stock price that is paid out as dividends. A higher dividend yield means that you will receive more income from your investment.

Third, you should consider the company’s financial health. You want to invest in companies that are financially stable and have a strong track record of profitability.

Conclusion

Dividend-paying stocks can be a valuable addition to any investment portfolio. They can provide a steady stream of income, help to beat inflation, and reduce portfolio volatility. When choosing dividend-paying stocks, it is important to consider the company’s dividend history, dividend yield, and financial health.

Tips for Investing in Dividend-Paying Stocks

Here are a few tips for investing in dividend-paying stocks:

- Start by investing in a diversified portfolio of dividend-paying stocks. This will help to reduce your risk.

- Reinvest your dividends to grow your portfolio. Over time, this can significantly increase your returns.

- Consider investing in dividend-paying stocks through a dividend reinvestment plan (DRIP). This will allow you to automatically reinvest your dividends in more shares of the stock.

How to Step-by-Step Invest in Dividend-Paying Stocks

- Open a brokerage account.

- Research dividend-paying stocks.

- Consider your investment goals and risk tolerance.

- Choose a diversified portfolio of dividend-paying stocks.

- Invest in dividend-paying stocks through a DRIP.

- Monitor your investments regularly.

Pros and Cons of Investing in Dividend-Paying Stocks

Pros:

- Provide a steady stream of income

- Help to beat inflation

- Reduce portfolio volatility

Cons:

- May not provide as much growth potential as non-dividend-paying stocks

- Dividend income is taxable

Future Trending

The future of dividend-paying stocks is bright. As more investors seek to protect their portfolios from inflation, dividend-paying stocks are likely to become more popular. In addition, companies are increasingly recognizing the importance of returning money to shareholders. As a result, we can expect to see more companies paying dividends in the future.

How to Improve

There are a few things that investors can do to improve their returns on dividend-paying stocks. First, they can invest in a diversified portfolio of dividend-paying stocks. This will help to reduce their risk. Second, they can reinvest their dividends to grow their portfolio. Over time, this can significantly increase their returns. Third, they can consider investing in dividend-paying stocks through a dividend reinvestment plan (DRIP). This will allow them to automatically reinvest their dividends in more shares of the stock.

Conclusion

Dividend-paying stocks can be a valuable addition to any investment portfolio. They can provide a steady stream of income, help to beat inflation, and reduce portfolio volatility. When choosing dividend-paying stocks, it is important to consider the company’s dividend history, dividend yield, and financial health.