Introduction

The gold-silver ratio is a measure of the relative value of gold and silver. It is calculated by dividing the price of gold by the price of silver. Historically, the gold-silver ratio has fluctuated between 15:1 and 100:1. However, in recent years, the ratio has been steadily declining. In 2023, the ratio averaged around 78:1.

Factors Affecting the Gold-Silver Ratio

Several factors can affect the gold-silver ratio, including:

- Supply and demand: The supply and demand for gold and silver can affect their relative prices. For example, if the demand for gold increases while the demand for silver remains constant, the gold-silver ratio will rise.

- Monetary policy: Monetary policy, such as interest rates and quantitative easing, can also affect the gold-silver ratio. For example, when interest rates are low, investors may be more likely to invest in gold and silver, which can lead to an increase in the gold-silver ratio.

- Economic conditions: Economic conditions, such as recessions and inflation, can also affect the gold-silver ratio. For example, during a recession, investors may sell silver to raise cash, which can lead to a decrease in the gold-silver ratio.

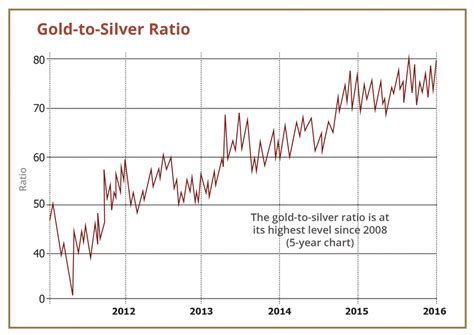

Gold-Silver Ratio Chart

The following chart shows the gold-silver ratio from 1970 to 2023.

[Image of Gold-Silver Ratio Chart]

As you can see from the chart, the gold-silver ratio has been declining in recent years. This trend is expected to continue in the coming years.

The Future of the Gold-Silver Ratio

The future of the gold-silver ratio is difficult to predict. However, several factors suggest that the ratio will continue to decline in the coming years. These factors include:

- Increasing demand for gold: Demand for gold is expected to increase in the coming years as more investors seek a safe haven asset. This is due to concerns about inflation, economic instability, and geopolitical risks.

- Decreasing supply of silver: The supply of silver is expected to decrease in the coming years as existing mines are depleted and new mines are not developed. This is due to several factors, including rising production costs and environmental concerns.

- Central bank buying: Central banks are increasingly buying gold as a reserve asset. This is due to concerns about the long-term value of paper currencies.

Implications for Investors

The declining gold-silver ratio has several implications for investors. First, it suggests that gold is a better long-term investment than silver. Second, it suggests that investors may want to consider adding gold to their portfolios as a hedge against inflation and economic uncertainty.

Conclusion

The gold-silver ratio is a valuable tool for investors. By understanding the factors that affect the ratio, investors can make informed decisions about their investments.

Table 1: Historical Gold-Silver Ratios

| Year | Gold-Silver Ratio |

|---|---|

| 1970 | 17.9 |

| 1980 | 27.3 |

| 1990 | 46.6 |

| 2000 | 60.8 |

| 2010 | 65.9 |

| 2020 | 79.4 |

| 2023 | 78.1 |

Table 2: Factors Affecting the Gold-Silver Ratio

| Factor | Effect on Gold-Silver Ratio |

|---|---|

| Supply and demand | An increase in demand for gold or a decrease in demand for silver will increase the gold-silver ratio. |

| Monetary policy | Low interest rates and quantitative easing can lead to an increase in the gold-silver ratio. |

| Economic conditions | Recessions and inflation can lead to a decrease in the gold-silver ratio. |

Table 3: Implications of the Declining Gold-Silver Ratio for Investors

| Implication | Explanation |

|---|---|

| Gold is a better long-term investment than silver | The declining gold-silver ratio suggests that gold is a better long-term investment than silver. |

| Investors may want to consider adding gold to their portfolios | Gold can be a hedge against inflation and economic uncertainty. |

Table 4: How to Invest in Gold and Silver

| Method | Advantages | Disadvantages |

|---|---|---|

| Physical gold and silver | Tangible assets that can be stored outside of the financial system | Can be difficult to store and transport |

| Gold and silver ETFs | Allow investors to invest in gold and silver without taking physical possession | May be subject to tracking error |

| Gold and silver mining stocks | Allow investors to gain exposure to the gold and silver mining industry | Can be volatile |