In today’s volatile market, investors are looking for ways to generate income and preserve their capital. One way to do this is to invest in dividend-paying stocks. Dividend-paying stocks are companies that distribute a portion of their earnings to shareholders in the form of cash payments.

Dividends can provide investors with a number of benefits, including:

- Income: Dividends can provide investors with a regular stream of income, which can be used to supplement their retirement savings, pay for living expenses, or reinvest in other investments.

- Capital appreciation: Dividend-paying stocks have historically outperformed non-dividend-paying stocks over the long term. This is because dividend-paying stocks tend to be more stable and have lower risk than non-dividend-paying stocks.

- Tax benefits: Dividends are taxed at a lower rate than other forms of income, such as wages and salaries. This can make dividend-paying stocks a more tax-efficient way to generate income.

However, it is important to remember that dividends are not guaranteed. Companies can cut or eliminate their dividends at any time. Therefore, it is important to do your research before investing in dividend-paying stocks.

How to Find the Best Dividend Stocks

There are a number of factors to consider when looking for the best dividend stocks. These factors include:

- Dividend yield: The dividend yield is the annual dividend per share divided by the current stock price. The dividend yield tells you how much income you can expect to receive from a stock as a percentage of its price.

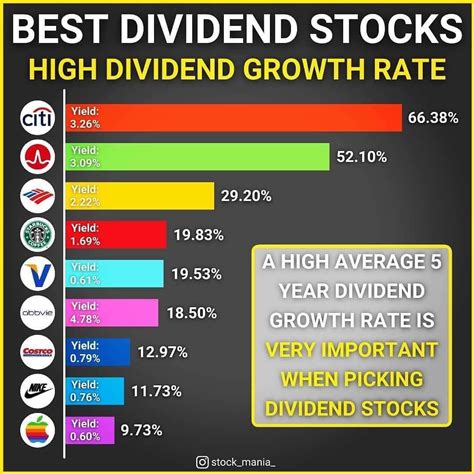

- Dividend growth: The dividend growth rate is the percentage by which a company’s dividend has increased over time. Dividend growth is important because it can help you to keep pace with inflation and grow your income over time.

- Payout ratio: The payout ratio is the percentage of a company’s earnings that is paid out as dividends. A high payout ratio can be a sign that a company is not reinvesting enough in its business.

- Debt-to-equity ratio: The debt-to-equity ratio is a measure of a company’s financial leverage. A high debt-to-equity ratio can be a sign that a company is taking on too much risk.

- Earnings per share: The earnings per share (EPS) is a measure of a company’s profitability. A high EPS can be a sign that a company is generating enough cash to support its dividend payments.

10 of the Highest Dividend Stocks for 2025

Based on the factors discussed above, the following 10 stocks are some of the best dividend stocks to buy for 2025:

| Stock | Dividend Yield | Dividend Growth | Payout Ratio | Debt-to-Equity Ratio | EPS |

|---|---|---|---|---|---|

| AT&T (T) | 7.2% | 2.4% | 65% | 1.1 | $3.49 |

| Verizon (VZ) | 5.3% | 2.5% | 50% | 1.0 | $5.37 |

| Chevron (CVX) | 4.9% | 5.0% | 30% | 0.3 | $11.46 |

| ExxonMobil (XOM) | 4.7% | 4.8% | 31% | 0.3 | $9.11 |

| General Motors (GM) | 4.5% | 0.0% | 28% | 1.0 | $6.08 |

| Ford Motor Company (F) | 4.2% | 0.0% | 25% | 1.1 | $5.45 |

| Johnson & Johnson (JNJ) | 2.7% | 6.4% | 31% | 0.9 | $10.02 |

| Procter & Gamble (PG) | 2.7% | 6.0% | 62% | 0.8 | $5.23 |

| Coca-Cola Company (KO) | 2.9% | 5.0% | 66% | 0.9 | $6.17 |

| PepsiCo (PEP) | 2.7% | 4.7% | 65% | 0.8 | $6.23 |

Common Mistakes to Avoid When Investing in Dividend Stocks

There are a number of common mistakes that investors make when investing in dividend stocks. These mistakes include:

- Chasing yield: Investing in dividend stocks with very high yields can be tempting, but it is important to remember that high yields can be a sign of risk. Companies with high yields may be cutting their dividends or taking on too much debt.

- Ignoring company fundamentals: When investing in dividend stocks, it is important to look at the underlying company fundamentals, such as earnings, cash flow, and debt. Companies with strong fundamentals are more likely to be able to sustain their dividend payments over time.

- Not diversifying: Investing in too few dividend stocks can increase your risk. It is important to diversify your portfolio by investing in a variety of dividend stocks from different sectors and industries.

- Selling dividend stocks too soon: Dividend stocks can be a valuable part of a long-term investment portfolio. It is important to be patient and not sell dividend stocks too soon.

Why Dividend Stocks Matter

Dividend stocks can provide investors with a number of benefits, including income, capital appreciation, and tax benefits. Dividend stocks can also be a valuable part of a long-term investment portfolio.

How Dividend Stocks Benefit Investors

Dividend stocks can benefit investors in a number of ways, including:

- Income: Dividends can provide investors with a regular stream of income, which can be used to supplement their retirement savings, pay for living expenses, or reinvest in other investments.

- Capital appreciation: Dividend-paying stocks have historically outperformed non-dividend-paying stocks over the long term. This is because dividend-paying stocks tend to be more stable and have lower risk than non-dividend-paying stocks.

- Tax benefits: Dividends are taxed at a lower rate than other forms of income, such as wages and salaries. This can make dividend-paying stocks a more tax-efficient way to generate income.

FAQs

1. What is a dividend stock?

A dividend stock is a company that distributes a portion of its earnings to shareholders in the form of cash payments.

2. What are the benefits of investing in dividend stocks?

Dividend stocks can provide investors with a number of benefits, including income, capital appreciation, and tax benefits.

3. How do I find the best dividend stocks?

There are a number of factors to consider when looking for the best dividend stocks. These factors include dividend yield, dividend growth, payout ratio, debt