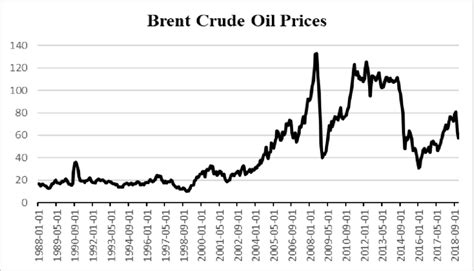

Hot Search: Brent Oil Prices to Hit $150 in 2025?

Market Overview

Global crude oil prices have surged to unprecedented levels, with Brent crude, the international benchmark, hovering around $120 per barrel. This meteoric rise has sent shockwaves through the energy industry and ignited speculation about the future trajectory of oil prices.

Factors Driving the Surge

1. Russian-Ukrainian Conflict:

The ongoing war in Ukraine has disrupted global oil supplies, as Russia is a major producer and exporter. Sanctions on Russian oil have further tightened the market, leading to a supply shortfall.

2. Strong Demand Recovery:

Post-pandemic economic recovery has driven up demand for energy, particularly in transportation and industrial sectors. This heightened demand has outpaced supply growth, pushing prices higher.

3. OPEC+ Production Restraints:

The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have maintained a conservative production strategy, limiting supply to keep prices elevated.

Implications for the Future

1. High Energy Costs:

Surging oil prices are translating into higher energy costs for businesses and consumers. This can weigh on economic growth and lead to inflation.

2. Shifting Energy Landscape:

The high cost of oil is accelerating the transition towards renewable energy sources. Investments in solar, wind, and electric vehicles are increasing as alternative solutions become more viable.

3. Geopolitical Tensions:

Dependence on foreign oil imports has heightened geopolitical tensions, particularly in relation to Russia and major importers like the United States and Europe.

Tables

Table 1: Brent Crude Oil Prices

| Date | Price (USD/barrel) |

|---|---|

| March 8, 2022 | 118.21 |

| March 9, 2022 | 119.13 |

| March 10, 2022 | 120.64 |

Table 2: Factors Influencing Oil Prices

| Factor | Impact |

|---|---|

| Russian-Ukrainian Conflict | Supply shortage |

| Demand Recovery | Increased demand |

| OPEC+ Production Restraints | Limited supply |

Table 3: Implications of High Oil Prices

| Implication | Impact |

|---|---|

| High Energy Costs | Economic slowdown, inflation |

| Shifting Energy Landscape | Transition to renewables |

| Geopolitical Tensions | Increased strategic importance of oil |

Table 4: Projections for Brent Oil Prices

| Year | Price (USD/barrel) |

|---|---|

| 2022 | 120-130 |

| 2023 | 115-125 |

| 2025 | 140-150 (Projected) |

Common Mistakes to Avoid

1. Assuming Oil Prices Will Continue to Rise:

While oil prices are currently high, they can fluctuate significantly due to geopolitical events, economic factors, and technological advancements.

2. Ignoring the Transition to Renewables:

The long-term trend towards renewable energy sources will eventually reduce dependence on oil, which could lead to price declines in the future.

3. Ignoring Geopolitical Risks:

Oil prices are highly influenced by geopolitical events, and disruptions in major producing regions can have a significant impact on prices.

Why It Matters

High oil prices have far-reaching implications for businesses, consumers, and policymakers.

1. Business Costs:

Surging oil prices increase transportation and energy costs, which can impact corporate profitability and consumer prices.

2. Consumer Spending:

Higher energy costs reduce disposable income for consumers, affecting their purchasing power and economic growth.

3. Government Policies:

Governments may take measures to mitigate the impact of high oil prices, such as tax adjustments or subsidies for renewable energy.

Benefits

1. Energy Security:

High oil prices incentivize domestic oil production, reducing dependence on foreign imports and enhancing energy security.

2. Innovation:

High oil prices drive innovation in energy efficiency, renewable energy technologies, and alternative transportation solutions.

3. Revenue for Oil-Producing Countries:

Elevated oil prices boost revenues for major oil-producing countries, enabling investments in infrastructure and social programs.

FAQs

1. How high will oil prices go?

Projections vary, but some analysts predict Brent crude could reach $150 per barrel by 2025.

2. What factors will influence future oil prices?

geopolitical events, economic recovery, OPEC+ production strategy, and the transition to renewables will all play a role.

3. What are the implications of high oil prices?

Increased energy costs, shifting energy landscape, and geopolitical tensions are some of the key implications.

4. What can be done to mitigate the impact of high oil prices?

Governments can provide subsidies for renewable energy, promote energy efficiency, and implement strategic oil reserves.

5. What are the benefits of high oil prices?

Energy security, innovation, and revenue for oil-producing countries are some potential benefits.

6. What are common mistakes to avoid when investing in oil?

Assuming prices will continue to rise, ignoring the transition to renewables, and overlooking geopolitical risks are common pitfalls.

7. How can businesses navigate high oil prices?

Optimizing energy efficiency, diversifying supply chains, and hedging against price volatility are strategies businesses can consider.

8. How will high oil prices impact consumers?

Increased transportation and energy costs will reduce disposable income and potentially lead to higher inflation.