Introduction

When investing in capital assets, understanding the tax implications is crucial. Short-term capital gains, realized within a year of acquiring the asset, are subject to different tax rates than long-term gains. In this article, we will delve into the taxation of short-term capital gains, exploring its implications for investors and predicting its potential changes by 2025.

Current Tax Rates on Short-Term Capital Gains

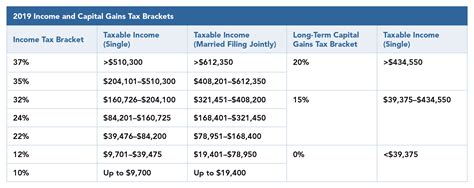

The taxation of short-term capital gains depends on the investor’s ordinary income tax bracket. For individuals, these rates range from 10% to 37%. Corporations, on the other hand, typically pay a flat rate of 21%.

Table 1: Individual Short-Term Capital Gains Tax Rates

| Marginal Tax Bracket | Short-Term Capital Gains Tax Rate |

|---|---|

| 10% | 10% |

| 12% | 12% |

| 22% | 22% |

| 24% | 24% |

| 32% | 32% |

| 35% | 35% |

| 37% | 37% |

Table 2: Corporate Short-Term Capital Gains Tax Rate

| Rate | Tax Rate |

|---|---|

| Flat Rate | 21% |

Predicting Changes in Taxation by 2025

The Biden administration has proposed a number of changes to the taxation of capital gains, including short-term gains. These proposals are still under discussion and may not ultimately become law. However, they provide insight into the potential direction of tax policy in the coming years.

Key Proposed Changes:

- Increasing the top short-term capital gains tax rate for high-income individuals to 39.6%.

- Eliminating the step-up in basis at death for assets with unrealized gains.

Implications of Proposed Changes

If implemented, these changes would have significant implications for investors. High-income individuals would face higher taxes on their short-term capital gains, while the elimination of the step-up in basis would subject gains at death to income tax. These changes could disincentivize short-term investing and encourage investors to hold assets for longer periods.

Why the Taxation of Short-Term Capital Gains Matters

The taxation of short-term capital gains plays a crucial role in shaping investment decisions. By understanding the tax implications, investors can optimize their portfolios and maximize after-tax returns.

Benefits of Tax Planning for Short-Term Capital Gains:

- Tax Deferral: Holding assets for longer periods can defer capital gains until they qualify for the lower long-term capital gains rates.

- Tax Loss Harvesting: Selling assets that have lost value can generate capital losses to offset gains, reducing overall tax liability.

- Tax-Efficient Investments: Investing in tax-advantaged accounts, such as 401(k)s and IRAs, can shelter gains from taxation until retirement.

Common Mistakes to Avoid

Many investors make mistakes when it comes to short-term capital gains. Avoid these common pitfalls to protect your hard-earned income:

- Not Accounting for State Taxes: State income taxes may apply to short-term capital gains, increasing your overall tax bill.

- Overlooking Loss Carryovers: Net capital losses can be carried over to offset future gains, reducing your tax liability.

- Ignoring the Wash Sale Rule: Selling and rebuying the same or substantially similar asset within 30 days will result in disallowed losses.

- Holding Assets Too Long: While holding assets for longer periods can defer taxes, holding them too long may miss out on potential growth opportunities.

FAQs

1. What is the holding period for short-term capital gains?

– Less than one year

2. How are short-term capital gains taxed for individuals?

– Based on ordinary income tax brackets

3. What are the proposed changes to the taxation of short-term capital gains?

– Increasing the top rate for high-income individuals and eliminating the step-up in basis at death

4. What is a common mistake investors make regarding short-term capital gains?

– Ignoring state taxes

5. What is a tax-efficient way to invest for short-term capital gains?

– Investing in tax-advantaged accounts

6. How can I reduce my tax liability on short-term capital gains?

– Tax deferral, loss harvesting, and tax-efficient investments

7. What is a “tax wash sale”?

– Selling and rebuying the same or substantially similar asset within 30 days to disallow losses

8. How do I calculate my short-term capital gains?

– Subtract the asset’s cost basis from its sale price

Conclusion

The taxation of short-term capital gains has a significant impact on investment decisions. Understanding the current tax rates and potential changes in the future can help investors optimize their portfolios and maximize their returns. By avoiding common mistakes and incorporating tax-efficient strategies, investors can minimize their tax liability and achieve their financial goals.