Introduction

The exchange rate between the United States dollar (USD) and the Philippine peso (PHP) is a crucial economic indicator that impacts trade, investment, and tourism. With the increasing globalization and interconnectedness of economies, understanding the factors that influence the USD to PHP rate has become essential for businesses, investors, and individuals alike. This comprehensive guide will delve into the complexities of the USD to PHP exchange rate, providing valuable insights into its historical trends, drivers, and potential future developments.

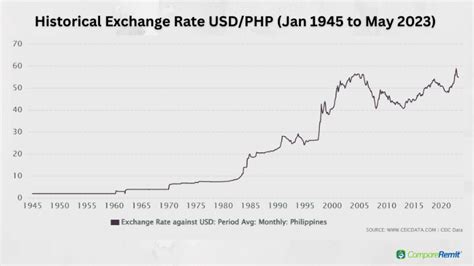

Historical Trends and Drivers

The USD to PHP exchange rate has fluctuated significantly over time, influenced by a multitude of factors. From 2010 to 2019, the peso depreciated against the dollar, primarily due to the Federal Reserve’s quantitative easing policies, which weakened the US currency. However, in 2020, the pandemic-induced economic downturn reversed this trend, leading to a strengthening of the peso.

– Monetary Policy: The central banks of the United States and the Philippines play a significant role in determining the exchange rate through their monetary policy decisions. Interest rate adjustments, quantitative easing, and other measures can influence the supply and demand for the respective currencies.

– Economic Growth: The relative economic performance of the United States and the Philippines is a major determinant of the exchange rate. Strong economic growth in the Philippines compared to the United States can lead to an appreciation of the peso against the dollar.

– Trade Balance: The balance of trade between the two countries affects the exchange rate. A trade surplus for the Philippines (exporting more than importing) can strengthen the peso, while a trade deficit can weaken it.

– Foreign Direct Investment: Foreign direct investment (FDI) in the Philippines can have a positive impact on the peso’s value. Inflows of FDI increase the demand for the peso, leading to appreciation.

– Political Stability: Political stability and policy certainty in the Philippines enhance investor confidence, leading to increased demand for the peso and potential appreciation.

– Remittances: Remittances sent home by overseas Filipino workers (OFWs) are a significant source of foreign exchange for the Philippines. A rise in remittances can increase the supply of US dollars in the market, leading to depreciation of the peso.

Predictions for 2025

Forecasting the USD to PHP exchange rate for 2025 is a challenging task due to the inherent uncertainty of economic factors. However, based on current trends and projections by various economists and financial institutions, the following predictions can be made:

– Gradual Appreciation of the Peso: The Philippine economy is projected to maintain a steady growth trajectory in the coming years, supported by strong domestic demand and government infrastructure spending. This is expected to lead to a gradual appreciation of the peso against the dollar.

– Influence of Federal Reserve Policy: The Federal Reserve’s monetary policy will continue to be a key factor influencing the USD to PHP rate. If the Fed raises interest rates more aggressively than expected, the dollar could strengthen, leading to depreciation of the peso.

– Global Economic Outlook: The global economic outlook will play a role in determining the exchange rate. A strong global economy with robust trade and investment flows will benefit the Philippine economy and support the peso’s value.

– Table 1: Historical USD to PHP Exchange Rates

| Year | Exchange Rate |

|---|---|

| 2010 | 45.75 |

| 2015 | 48.36 |

| 2020 | 55.77 |

| 2022 | 54.41 |

– Table 2: Key Drivers of USD to PHP Exchange Rate

| Driver | Impact |

|---|---|

| Monetary Policy | Interest rate adjustments can influence the supply and demand for currencies |

| Economic Growth | Strong Philippine economy leads to peso appreciation |

| Trade Balance | Trade surplus strengthens peso, deficit weakens it |

| Foreign Direct Investment | FDI inflows increase peso demand |

| Political Stability | Reduces risk perception, increases peso demand |

| Remittances | Higher remittances increase supply of US dollars |

Benefits of Understanding the USD to PHP Exchange Rate

A clear understanding of the USD to PHP exchange rate provides numerous benefits, including:

– Informed Financial Decisions: Businesses and individuals can make more informed decisions regarding currency exchanges, investments, and international trade.

– Risk Management: Identifying potential fluctuations in the exchange rate helps mitigate currency risks and plan accordingly.

– Investment Opportunities: Investors can capitalize on exchange rate movements to identify undervalued assets and maximize returns.

– Export and Import Strategy: Businesses can optimize their export and import strategies by taking advantage of favorable exchange rates.

Common Mistakes to Avoid

When dealing with the USD to PHP exchange rate, it is crucial to avoid common mistakes that can lead to financial losses or missed opportunities:

– Assuming Stability: Exchange rates are dynamic and can fluctuate significantly over time. Avoid the assumption that current rates will remain stable.

– Ignoring the Spread: Currency exchanges often involve a “spread” (difference) between the buy and sell rates. Factor in this spread when calculating costs or profits.

– Using Unreliable Sources: Rely on trusted sources for accurate and up-to-date exchange rates to avoid miscalculations and losses.

– Timing the Market: Attempting to time the market by speculating on exchange rate movements is highly risky and often unsuccessful.

– Table 3: Benefits of Understanding USD to PHP Exchange Rate

| Benefit | Impact |

|---|---|

| Informed Financial Decisions | Makes better choices regarding currency exchanges and investments |

| Risk Management | Mitigates currency risks |

| Investment Opportunities | Capitalize on exchange rate movements |

| Export and Import Strategy | Optimize international trade strategies |

Frequently Asked Questions

1. What is the current USD to PHP exchange rate?

As of January 2023, the exchange rate is approximately 54.41 PHP to 1 USD.

2. Why is the USD to PHP exchange rate important?

The exchange rate affects international trade, investment, tourism, and the prices of imported and exported goods.

3. What factors influence the USD to PHP exchange rate?

Monetary policy, economic growth, trade balance, political stability, and remittances are all key influencing factors.

4. How can I stay updated on the USD to PHP exchange rate?

Monitor financial news, subscribe to currency rate alerts, or use online currency converters.

5. What is the expected USD to PHP exchange rate in 2025?

Predictions suggest a gradual appreciation of the peso, with the exchange rate potentially reaching around 52 PHP to 1 USD.

6. How can I protect myself from exchange rate fluctuations?

Consider using currency hedging strategies, such as forward contracts or options, to minimize risks.

7. Are there any resources available to learn more about the USD to PHP exchange rate?

The Philippine Central Bank, commercial banks, and financial websites provide valuable resources and information.

8. How can I get the best exchange rate?

Compare rates from multiple sources, negotiate with currency exchange providers, and consider factors like transaction fees and hidden charges.

– Table 4: Common Mistakes to Avoid When Dealing with USD to PHP Exchange Rate

| Mistake | Impact |

|---|---|

| Assuming Stability | Can lead to financial losses if exchange rates fluctuate |

| Ignoring the Spread | Can reduce profits or increase costs |

| Using Unreliable Sources | Can result in incorrect calculations and financial harm |

| Timing the Market | Highly risky and often unsuccessful strategy |