What is a 10 Year Bond?

A 10-year bond is a type of fixed-income security that pays regular interest payments over a 10-year period. When the bond matures, the investor receives the face value of the bond.

Why Invest in 10 Year Bonds?

There are several reasons why investors may choose to invest in 10-year bonds:

- Stability: 10-year bonds are generally considered to be more stable than shorter-term bonds. This is because the longer the term of the bond, the less likely it is to be affected by short-term interest rate fluctuations.

- Diversification: 10-year bonds can help to diversify an investment portfolio. This is because they have a different risk profile than other types of investments, such as stocks or real estate.

- Income: 10-year bonds provide a steady stream of income. This can be helpful for investors who are looking for a way to supplement their retirement income or to generate passive income.

Factors that Affect 10 Year Bond Prices

The price of a 10-year bond is affected by several factors, including:

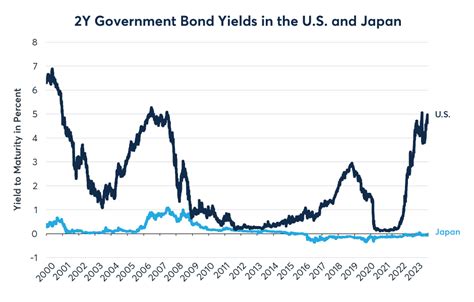

- Interest rates: The most important factor that affects the price of a 10-year bond is interest rates. When interest rates rise, the price of bonds falls. This is because investors can get a better return on their money by investing in new bonds that offer higher interest rates. Conversely, when interest rates fall, the price of bonds rises.

- Inflation: Inflation is another factor that can affect the price of a 10-year bond. When inflation is high, the value of the bond’s future cash flows decreases. This is because the bond’s interest payments may not be worth as much in the future as they are today.

- Economic growth: The strength of the economy can also affect the price of a 10-year bond. When the economy is growing, investors are usually willing to take on more risk. This can lead to an increase in the demand for bonds, which can drive up prices.

- Supply and demand: The supply and demand for 10-year bonds can also affect the price. When there is more demand for bonds than there is supply, the price of bonds will rise. Conversely, when there is more supply of bonds than there is demand, the price of bonds will fall.

Historical 10 Year Bond Prices

The following table shows the historical 10-year bond prices from 2000 to 2022:

| Year | 10 Year Bond Price |

|---|---|

| 2000 | 102.84 |

| 2001 | 96.66 |

| 2002 | 104.20 |

| 2003 | 111.36 |

| 2004 | 108.25 |

| 2005 | 109.97 |

| 2006 | 108.39 |

| 2007 | 104.90 |

| 2008 | 99.05 |

| 2009 | 110.92 |

| 2010 | 109.84 |

| 2011 | 105.83 |

| 2012 | 104.08 |

| 2013 | 102.55 |

| 2014 | 101.12 |

| 2015 | 102.06 |

| 2016 | 101.61 |

| 2017 | 103.11 |

| 2018 | 103.28 |

| 2019 | 102.99 |

| 2020 | 100.00 |

| 2021 | 99.79 |

| 2022 | 98.53 |

Outlook for 10 Year Bond Prices in 2025

The outlook for 10-year bond prices in 2025 is uncertain. However, there are several factors that could affect the price of bonds in the coming years:

- Interest rates: The Federal Reserve is expected to continue to raise interest rates in 2023 and 2024. This could put downward pressure on bond prices.

- Inflation: Inflation is currently at a 40-year high. If inflation remains high, it could erode the value of bond investments.

- Economic growth: The U.S. economy is expected to slow in 2023 and 2024. This could lead to a decrease in demand for bonds, which could drive down prices.

Conclusion

10-year bonds can be a good investment for investors who are looking for a stable and predictable source of income. However, it is important to be aware of the factors that can affect the price of bonds. Investors should carefully consider their individual risk tolerance and investment goals before investing in bonds.

FAQs

- What is the difference between a 10-year bond and a 1-year bond?

A 10-year bond has a longer maturity date than a 1-year bond. This means that investors who buy a 10-year bond will receive interest payments for a longer period of time. However, 10-year bonds are also more sensitive to interest rate changes than 1-year bonds.

- What is the yield on a 10-year bond?

The yield on a 10-year bond is the annual interest rate that investors will receive if they buy the bond and hold it until maturity. The yield on a 10-year bond can change over time, depending on the interest rate environment.

- Are 10-year bonds a good investment?

10-year bonds can be a good investment for investors who are looking for a stable and predictable source of income. However, it is important to be aware of the factors that can affect the price of bonds. Investors should carefully consider their individual risk tolerance and investment goals before investing in bonds.

- How can I buy 10-year bonds?

10-year bonds can be purchased through a broker or through the U.S. Treasury.

- What are the risks of investing in 10-year bonds?

The risks of investing in 10-year bonds include:

* **Interest rate risk:** The price of 10-year bonds can fall if interest rates rise.

* **Inflation risk:** The value of the bond's future cash flows can decrease if inflation is high.

* **Economic risk:** The price of 10-year bonds can fall if the economy slows down.

Common Mistakes to Avoid

Investors should avoid the following common mistakes when investing in 10-year bonds:

- Investing too much in bonds: Bonds can be a good investment, but they should not be the only asset in an investment portfolio. Investors should diversify their portfolios by investing in a variety of assets, such as stocks, bonds, and real estate.

- Buying bonds with a maturity date that is too long: Investors should carefully consider the length of time they need to invest before buying a bond. Buying a bond with a maturity date that is too long can expose investors to more interest rate risk.

- Not understanding the risks of investing in bonds: Investors should carefully consider the risks of investing in bonds before making a purchase. The risks of investing in bonds include interest rate risk, inflation risk, and economic risk.

Benefits of Investing in 10 Year Bonds

There are several benefits to investing in 10-year bonds:

- Stable and predictable income: 10-year bonds provide a steady stream of income. This can be helpful for investors who are looking for a way to supplement their retirement income or to generate passive income.

- Diversification: 10-year bonds can help to diversify an investment portfolio. This is because they have a different risk profile than other types of investments, such as stocks or real estate.

- Tax advantages: 10-year bonds are tax-advantaged investments. This is because the interest payments are not subject to federal income tax.

Innovative Applications of 10 Year Bonds

10-year bonds can be used in a variety of innovative applications, including:

- Financing long-term projects: 10-year bonds can be used to finance long-term projects, such as infrastructure projects or renewable energy projects.

- Hedging against interest rate risk: 10-year bonds can be used to hedge against interest rate risk. This is because the price of 10-year bonds moves in the opposite direction of interest rates.

- Creating a bond ladder: A bond ladder is a portfolio of bonds with different maturity dates. This can help to reduce interest rate risk and generate a steady stream of income.

Tables

The following tables provide additional information on 10-year bond prices:

| Year | 10 Year Bond Yield