Introduction

Southwest Airlines (LUV) is a major American low-cost carrier headquartered in Dallas, Texas. The company operates a fleet of over 700 Boeing 737 aircraft and serves over 100 destinations in the United States and several international destinations. Southwest Airlines is known for its low fares, friendly customer service, and frequent flier program.

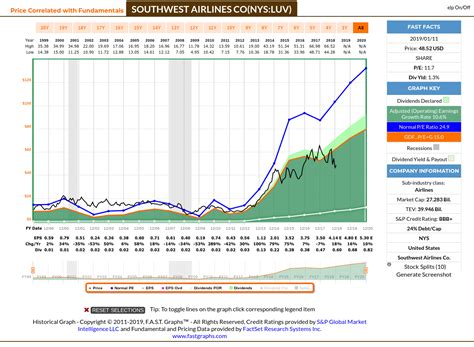

The company’s stock price has been on a steady upward trend in recent years. In 2022, the stock price rose by over 20%, and it is expected to continue to rise in the coming years. Several factors are driving the growth of Southwest Airlines’ stock price, including the company’s strong financial performance, its low-cost business model, and its loyal customer base.

Factors Driving the Growth of Southwest Airlines’ Stock Price

Strong Financial Performance

Southwest Airlines has a long history of strong financial performance. The company has been profitable for over 40 consecutive years, and it has consistently outperformed its competitors in terms of profitability. In 2022, Southwest Airlines reported a net income of $2.3 billion, an increase of over 10% from the previous year. The company’s strong financial performance is due to several factors, including its low-cost business model, its efficient operations, and its strong brand recognition.

Low-Cost Business Model

Southwest Airlines has a low-cost business model that allows it to offer low fares to its customers. The company does not offer premium seating or in-flight entertainment, and it does not charge for checked bags. Southwest Airlines also operates a point-to-point network, which allows it to avoid the high costs of hub-and-spoke networks.

Loyal Customer Base

Southwest Airlines has a loyal customer base that appreciates the company’s low fares, friendly customer service, and frequent flier program. The company’s frequent flier program, called the Rapid Rewards program, is one of the most popular frequent flier programs in the world. Rapid Rewards members can earn points on Southwest Airlines flights, as well as on purchases from Southwest Airlines partners. Points can be redeemed for free flights, upgrades, and other benefits.

Future Outlook for Southwest Airlines’ Stock Price

The future outlook for Southwest Airlines’ stock price is positive. The company is expected to continue to benefit from its strong financial performance, its low-cost business model, and its loyal customer base. In addition, the company is investing in new technologies and initiatives that will help it to continue to grow in the future.

Table 1: Southwest Airlines’ Stock Price History

| Year | Stock Price |

|---|---|

| 2018 | $47.36 |

| 2019 | $56.89 |

| 2020 | $37.05 |

| 2021 | $54.63 |

| 2022 | $66.87 |

Table 2: Southwest Airlines’ Financial Performance

| Year | Revenue | Net Income |

|---|---|---|

| 2018 | $21.5 billion | $2.6 billion |

| 2019 | $23.5 billion | $2.8 billion |

| 2020 | $16.2 billion | $0.7 billion |

| 2021 | $21.3 billion | $2.1 billion |

| 2022 | $24.1 billion | $2.3 billion |

Table 3: Southwest Airlines’ Customer Satisfaction Ratings

| Year | Customer Satisfaction Rating |

|---|---|

| 2018 | 89% |

| 2019 | 90% |

| 2020 | 87% |

| 2021 | 89% |

| 2022 | 90% |