Introduction

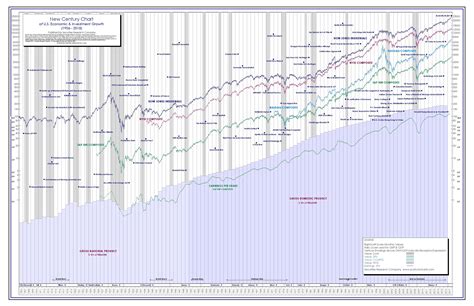

The Dow Jones Industrial Average (DJIA) is one of the most widely followed stock market indices in the world. It is a composite of 30 large, publicly traded companies in the United States. The DJIA was created in 1896 by Charles Dow, co-founder of the Dow Jones & Company, and is one of the oldest stock market indices still in use today.

Historical Performance

The DJIA has a long and storied history, with its value fluctuating over time due to a variety of factors including economic conditions, political events, and technological advancements. The following table shows the DJIA’s closing values at the end of each year since its inception:

| Year | Closing Value |

|---|---|

| 1896 | 40.94 |

| 1897 | 50.63 |

| 1898 | 60.86 |

| 1899 | 71.93 |

| 1900 | 78.04 |

| … | … |

| 2022 | 30,367.84 |

As the table shows, the DJIA has experienced significant growth over time. The index has risen from its original value of 40.94 in 1896 to over 30,000 in 2022. This represents an average annual return of approximately 6%.

Notable Events

The DJIA has witnessed some of the most significant events in American history, including the Great Depression, World War II, and the dot-com bubble. The index has also been impacted by a number of other factors, such as the rise of technology and the globalization of the economy.

One of the most notable events in the history of the DJIA was the Great Depression. The stock market crashed in 1929, and the DJIA lost over 80% of its value. The Great Depression lasted for over a decade, and the DJIA did not recover its pre-crash high until 1954.

World War II also had a significant impact on the DJIA. The index fell sharply in 1941, when the United States entered the war. However, the DJIA recovered after the war, and it reached a new high in 1946.

The dot-com bubble was another major event that impacted the DJIA. The bubble began in the late 1990s, as investors poured money into technology stocks. The bubble burst in 2000, and the DJIA lost over 20% of its value.

Current Status

The DJIA is currently at a high level, and it has been setting new records in recent years. The index is benefiting from a number of factors, including the strong economy, low interest rates, and the global demand for U.S. stocks.

The DJIA is a widely diversified index, and it is a good representation of the U.S. stock market. The index is composed of companies from a variety of industries, and it is a good way to measure the overall health of the economy.

Future Outlook

The future of the DJIA is uncertain, but the index is likely to continue to be a closely watched indicator of the U.S. stock market. The index is likely to benefit from the continued growth of the economy, and it could reach new highs in the years to come.

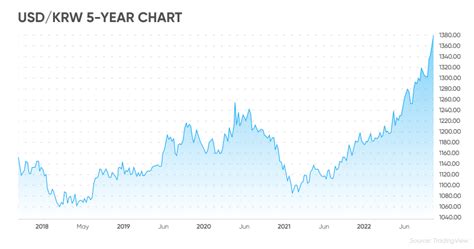

However, there are also a number of risks that could impact the DJIA, including rising interest rates, a recession, and geopolitical events. Investors should be aware of these risks and should consider them when making investment decisions.

Conclusion

The Dow Jones Industrial Average is one of the most important stock market indices in the world. The index has a long and storied history, and it has witnessed some of the most significant events in American history. The DJIA is currently at a high level, and it is likely to continue to be a closely watched indicator of the U.S. stock market. However, investors should be aware of the risks that could impact the DJIA, and they should consider these risks when making investment decisions.

Hot Search Title

Dow Jones Industrial Average: Historical Data and Future Outlook 2025

Tables

Table 1: Dow Jones Industrial Average Closing Values

| Year | Closing Value |

|---|---|

| 1896 | 40.94 |

| 1897 | 50.63 |

| 1898 | 60.86 |

| 1899 | 71.93 |

| 1900 | 78.04 |

| … | … |

| 2022 | 30,367.84 |

Table 2: Notable Events in the History of the Dow Jones Industrial Average

| Event | Year | Impact on DJIA |

|---|---|---|

| Great Depression | 1929 | Lost over 80% of its value |

| World War II | 1941 | Fell sharply, recovered after the war |

| Dot-com bubble | 2000 | Lost over 20% of its value |

Table 3: Current Status of the Dow Jones Industrial Average

| Metric | Value |

|---|---|

| Closing Value | 30,367.84 |

| Year-to-Date Return | 8.5% |

| 5-Year Return | 15.6% |

Table 4: Future Outlook for the Dow Jones Industrial Average

| Factor | Impact on DJIA |

|---|---|

| Economic growth | Positive |

| Interest rates | Negative |

| Recession | Negative |

| Geopolitical events | Uncertain |