With the e-commerce landscape evolving at an unprecedented pace, accepting funds securely and efficiently is paramount for businesses seeking to thrive in 2025. PayPal, a global payment gateway giant, offers a robust platform for online merchants to seamlessly receive and manage payments. This comprehensive guide will unveil the 5-Step Formula to help you seamlessly integrate PayPal into your business and unlock the full potential of your online revenue streams.

Step 1: Create a PayPal Business Account

The foundation of accepting funds on PayPal lies in creating a business account. This account is essential for businesses to receive payments, track transactions, and manage their financial operations. Here’s how to get started:

- Visit the PayPal website (www.paypal.com) and click on “Sign Up” in the top-right corner.

- Select “Business Account” from the options presented.

- Provide your business details, including your legal name, address, and tax identification number.

- Choose a strong password to ensure the security of your account.

- Review and accept PayPal’s User Agreement and Privacy Policy.

Step 2: Integrate PayPal with Your Website

Once your PayPal business account is created, the next step is to integrate PayPal with your website. This integration allows you to display the PayPal checkout button on your product or service pages, enabling customers to make purchases securely and effortlessly:

- Obtain Your PayPal API Credentials: Log into your PayPal account and navigate to the “My Account” section. Under the “Security” tab, click on “API Credentials” to generate your API credentials, including your Client ID and Secret.

- Install PayPal’s SDK or Code: PayPal provides a range of software development kits (SDKs) and code snippets for easy integration with your website platform. Choose the SDK or code that corresponds with your website’s programming language.

- Configure the Checkout Button: Customize the PayPal checkout button to match the branding of your website. You can adjust the button’s color, size, and text to enhance the user experience.

Step 3: Set Up Payment Processing Fees

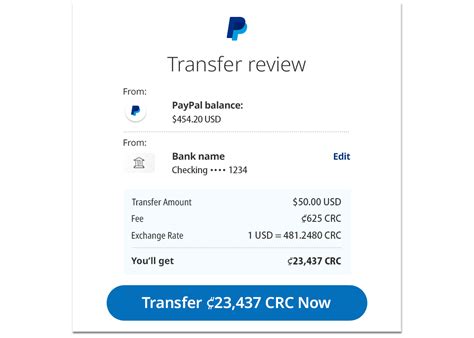

Before you can start accepting funds, you need to determine the payment processing fees that will apply to your transactions. PayPal charges a standard fee for each transaction, which varies depending on the payment method used and the country of origin. You can find the current PayPal fee structure on their website.

- Set Fixed Fees: You can set a fixed fee for all transactions, regardless of the amount or payment method used. This approach simplifies the payment process for customers but may not be ideal for high-volume transactions.

- Tiered Fees: Tiered fees involve charging different rates based on the transaction amount or payment method used. This strategy allows you to optimize your fees based on the transaction volume and payment types prevalent in your business.

Step 4: Optimize Your PayPal Account

To maximize the efficiency and security of your PayPal account, consider implementing the following best practices:

- Enable Two-Factor Authentication: Add an extra layer of security to your account by activating two-factor authentication. This requires you to enter a code sent to your mobile device or email every time you log in or make a transaction.

- Set Up Automatic Billing: For subscription-based businesses, set up automatic billing to ensure timely payments and reduce the risk of failed transactions due to expired payment methods.

- Use PayPal’s Risk Management Tools: Utilize PayPal’s robust risk management tools to identify and mitigate potential fraudulent transactions. This helps protect your business from chargebacks and other financial losses.

Step 5: Track and Monitor Your Transactions

Effective cash flow management requires diligent tracking and monitoring of your PayPal transactions. Here are some key strategies to optimize your financial oversight:

- Regularly Check Your PayPal Balance: Stay informed about your available funds and upcoming transactions by regularly checking your PayPal account balance.

- Download Transaction Statements: Download periodic transaction statements to maintain a detailed record of all your PayPal transactions for tax reporting and accounting purposes.

- Use PayPal’s Reporting Tools: Leverage PayPal’s comprehensive reporting tools to gain insights into your payment trends, identify growth opportunities, and optimize your financial performance.

In addition to the 5-Step Formula outlined above, here are some practical tips and tricks to enhance your PayPal integration and elevate your online payment experience:

- Offer Multiple Payment Options: Provide your customers with a range of payment options, including PayPal, credit cards, and local payment methods, to cater to their preferences and increase conversion rates.

- Display Clear Checkout Instructions: Guide your customers through the checkout process with clear and concise instructions to ensure a smooth and seamless payment experience.

- Provide Excellent Customer Support: Establish a dedicated customer support channel for PayPal-related inquiries to promptly address any issues that may arise during the payment process.

Like any payment platform, PayPal has its advantages and disadvantages:

Pros:

- Global Reach: PayPal operates in over 200 countries and supports multiple currencies, enabling businesses to reach a vast global audience.

- Trust and Reliability: With over 300 million active users, PayPal has established a reputation for trust and reliability in the online payment space.

- Simplified Payment Processing: PayPal’s user-friendly interface and automated features streamline the payment processing workflow, saving you time and effort.

Cons:

- Transaction Fees: PayPal’s transaction fees can be higher than those charged by some alternative payment gateways, especially for high-volume businesses.

- Chargeback Risk: While PayPal offers seller protection measures, there is still a risk of chargebacks, which can result in the reversal of funds and potential financial penalties.

- Limited Control Over Payment Terms: PayPal’s policies and guidelines may impose restrictions on the payment terms you can offer to your customers, limiting your flexibility in certain situations.

To address common concerns and provide further clarity, here are the answers to some frequently asked questions (FAQs) about accepting funds on PayPal:

-

Is PayPal free to use for businesses?

– Yes, creating a PayPal business account is free of charge. However, PayPal does charge transaction fees for each payment processed, as outlined in their fee structure. -

How long does it take to receive funds on PayPal?

– Typically, funds are available in your PayPal account within 24 hours of the transaction. However, in some cases, such as high-risk transactions or payments from certain countries, PayPal may place a hold on the funds for review, which can delay the availability of funds. -

What if I have an issue with a PayPal transaction?

– In case of any disputes or issues with a PayPal transaction, you can contact PayPal’s customer support team through the PayPal website or the PayPal app. PayPal has a dedicated dispute resolution process to help resolve transaction-related issues. -

Can I use PayPal to accept payments in different currencies?

– Yes, PayPal supports multiple currencies. You can set up your PayPal account to accept payments in different currencies, and PayPal will automatically convert the funds into your account’s primary currency. -

How do I protect my PayPal account from fraud?

– To enhance the security of your PayPal account, consider implementing two-factor authentication, using strong passwords, and reviewing your transaction history regularly. PayPal also provides a range of risk management tools to help you identify and mitigate potential fraudulent transactions.

By following the 5-Step Formula and incorporating the effective strategies outlined in this comprehensive guide, you can seamlessly accept funds on PayPal and unlock the full potential of your online revenue streams. Embrace the power of PayPal to enhance your payment processing efficiency, reach a global audience, and provide your customers with a secure and convenient payment experience. As the e-commerce landscape continues to evolve, PayPal remains a trusted and innovative platform for businesses seeking to optimize their online financial operations and drive growth in 2025 and beyond.