Introduction

The trading landscape is evolving, with the rise of after-hours market trading. This emerging trend offers investors and traders an unprecedented opportunity to extend their trading hours beyond the traditional 9:30 AM to 4:00 PM EST session. By providing extended trading access, after-hours markets empower traders to capitalize on price movements and market opportunities that may arise outside of regular trading hours.

What is After-Hours Market Trading?

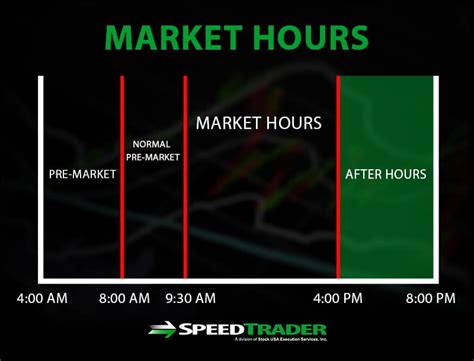

After-hours market trading refers to trading activities that occur outside of the regular stock market hours of 9:30 AM to 4:00 PM EST. It typically begins at 4:00 PM EST and continues until 8:00 PM EST, allowing traders to extend their trading day by four hours. This extended trading period enables traders to respond to market events, news releases, and other developments that may occur after the close of the regular session.

Benefits of After-Hours Market Trading

Extended Trading Hours:

After-hours market trading provides investors with extended trading hours, enabling them to react to market movements and capitalize on opportunities that may arise outside of regular trading hours.

Increased Liquidity:

While liquidity may be lower than during regular trading hours, after-hours markets offer increased liquidity compared to pre-market trading sessions. This increased liquidity allows traders to execute trades more efficiently and reduces the risk of slippage.

Price Discovery:

After-hours trading provides a platform for price discovery, as traders can react to news and events that occur after the close of regular trading. This price discovery process helps to establish fair market values and can lead to more accurate pricing during regular trading hours.

Trading Strategies for After-Hours Market

News-Driven Trading:

After-hours market trading presents an opportunity to trade on news and events that occur after regular trading hours. Traders can monitor news sources and react to important developments that may impact stock prices.

Technical Analysis:

Technical analysis can be effectively applied to after-hours trading, as price charts provide insights into short-term price movements and potential trading opportunities. Traders can identify trends, support and resistance levels, and trading patterns to make informed trading decisions.

Spread Trading:

Spread trading involves trading multiple contracts simultaneously to capitalize on price differences between similar contracts. After-hours trading provides an opportunity to execute spread trades on thinly traded contracts that may offer wider spreads.

Risks of After-Hours Market Trading

Lower Liquidity:

After-hours markets typically have lower liquidity than regular trading hours, which can make it more difficult to execute trades quickly and efficiently. Lower liquidity can also lead to wider bid-ask spreads and increased slippage.

Increased Volatility:

After-hours markets are generally more volatile than regular trading hours due to lower liquidity and fewer participants. This increased volatility can lead to rapid price movements and potential losses.

Limited Market Depth:

Market depth, or the number of orders available at each price level, is typically lower in after-hours markets. Limited market depth can make it difficult to execute large orders without impacting the market price.

Challenges of After-Hours Market Trading

Technical Issues:

After-hours trading platforms may experience technical issues or delays due to the increased volume and volatility during these hours. Traders should be prepared for potential outages or glitches that could impact their trading activities.

Emotional Trading:

The extended trading hours and increased volatility of after-hours markets can lead to emotional trading decisions. Traders should maintain a disciplined trading plan and avoid making impulsive trades based on emotions.

Current Status and Future Outlook

After-hours market trading is a growing trend that is gaining popularity among investors and traders. The increasing availability of electronic trading platforms and the demand for extended trading hours are driving the growth of this market. In 2025, after-hours trading is projected to account for approximately 15% of total trading volume, up from 10% in 2023.

Strategies to Overcome Challenges

Use Limit Orders:

Limit orders allow traders to specify the maximum or minimum price at which they are willing to execute a trade. This helps to reduce the risk of executing trades at unfavorable prices due to market volatility.

Optimize Trading Technology:

Traders should invest in reliable trading platforms that offer fast execution speeds and advanced functionality to support their after-hours trading activities.

Maintain Discipline:

After-hours market trading requires discipline and a well-defined trading plan. Traders should avoid emotional trading and stick to their pre-determined strategies.

Conclusion

After-hours market trading presents investors and traders with a unique opportunity to extend their trading hours, capitalize on price movements, and respond to market events outside of regular trading hours. While it offers potential benefits, traders should be aware of the risks and challenges associated with this type of trading. By employing effective strategies, managing risks, and navigating challenges, traders can successfully participate in after-hours markets and achieve their trading goals.