Introduction

The American dollar (USD) and the British pound sterling (GBP) are two of the world’s most traded currencies. Their exchange rate fluctuates constantly, influenced by a range of economic factors. This article provides a comprehensive overview of the USD/GBP exchange rate, its historical trends, and its implications for businesses and individuals.

Historical Trends of USD/GBP Exchange Rate

Pre-2008: Prior to the global financial crisis of 2008, the USD/GBP exchange rate hovered around 1.50-1.60, with the dollar generally stronger than the pound.

2008-2015: Following the financial crisis, the pound weakened significantly against the dollar, reaching a low of 1.05 in 2007. This was due to economic weakness in the UK and increased demand for the US dollar as a safe haven currency.

2015-2021: The pound gradually recovered against the dollar, rising to 1.40 in 2020. This was driven by Brexit uncertainty and a strengthening UK economy.

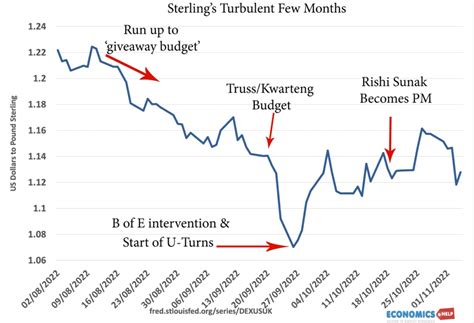

2021-Present: Since 2021, the USD/GBP exchange rate has been more volatile, fluctuating between 1.20 and 1.40. This volatility is attributed to geopolitical uncertainty, rising inflation, and the impact of the COVID-19 pandemic on global markets.

Factors Influencing USD/GBP Exchange Rate

Inflation: Inflation is a key factor that influences the exchange rate. Higher inflation in the UK compared to the US will lead to a weaker pound.

Interest Rates: Interest rates set by central banks also impact the exchange rate. Higher interest rates in the US will make the dollar more attractive to investors, leading to a stronger dollar.

Economic Growth: Strong economic growth in the UK will typically strengthen the pound, while a recession or slowdown will weaken it.

Political Events: Geopolitical events, such as elections or Brexit, can also significantly impact the exchange rate.

Global Demand: The global demand for a currency also affects its exchange rate. Increased demand for the dollar will make it stronger, while increased demand for the pound will strengthen the pound.

Implications for Businesses and Individuals

Businesses:

- Importing and Exporting: The exchange rate impacts businesses that import and export goods between the US and UK. A stronger dollar will increase the cost of imports and reduce the profits of exporters.

- Investment: Fluctuations in the exchange rate can affect the profitability of investments in cross-border markets.

Individuals:

- Travel: The exchange rate affects the cost of travel between the US and UK. A weaker pound will make travel to the UK more expensive for Americans.

- Remittances: Sending money between the US and UK is also affected by the exchange rate. A stronger dollar will reduce the amount of money that can be sent to the UK.

Strategies for Managing Currency Risk

Hedging: Businesses and individuals can use hedging instruments such as forward contracts or options to protect against currency risk.

Diversification: Investing in a portfolio of assets in different currencies can help mitigate currency risk.

Monitoring and Forecasting: Monitoring economic data and forecasts can help businesses and individuals make informed decisions about currency exposure.

Why Currency Exchange Rates Matter

Currency exchange rates are important for a number of reasons:

- Trade: Currency exchange rates affect the cost of imports and exports, which can impact economic growth.

- Investment: Exchange rates can influence the profitability of cross-border investments.

- Travel and Remittances: Currency exchange rates impact the cost of travel and money transfers between countries.

Current Status and Future Outlook

Current Status:

- The USD/GBP exchange rate currently stands at 1.37.

- The pound has been weakening against the dollar in recent months due to economic headwinds in the UK.

- The US dollar remains a safe haven currency, benefiting from global uncertainty.

Future Outlook:

- The future outlook for the USD/GBP exchange rate is uncertain.

- The pound is expected to weaken further in the short-term as the UK economy grapples with high inflation and Brexit uncertainty.

- However, the long-term outlook for the pound is more positive, as the UK economy is expected to recover and Brexit uncertainties diminish.

Tables

Table 1: Historical USD/GBP Exchange Rate (2000-2023)

| Year | USD/GBP |

|---|---|

| 2000 | 1.50 |

| 2005 | 1.75 |

| 2010 | 1.60 |

| 2015 | 1.05 |

| 2020 | 1.40 |

| 2023 | 1.37 |

Table 2: Factors Influencing USD/GBP Exchange Rate

| Factor | Impact |

|---|---|

| Inflation | Weaker pound |

| Interest Rates | Stronger dollar |

| Economic Growth | Stronger pound |

| Political Events | Variable |

| Global Demand | Variable |

Table 3: Implications of USD/GBP Exchange Rate for Businesses

| Area of Impact | Implication |

|---|---|

| Importing and Exporting | Increased import costs |

| Investment | Reduced profitability of cross-border investments |

Table 4: Strategies for Managing Currency Risk

| Strategy | Description |

|---|---|

| Hedging | Using forward contracts or options |

| Diversification | Investing in a portfolio of assets in different currencies |

| Monitoring and Forecasting | Monitoring economic data and forecasts |

Conclusion

The USD/GBP exchange rate is a complex and dynamic phenomenon that is influenced by a range of economic factors. Understanding the historical trends, influencing factors, and implications of the exchange rate is crucial for businesses and individuals who engage in cross-border transactions. By implementing strategies to manage currency risk, businesses and individuals can mitigate the financial impact of exchange rate fluctuations. The future outlook for the USD/GBP exchange rate remains uncertain, but monitoring economic data and forecasts can help businesses and individuals make informed decisions about their currency exposure.