What is the Current Price of Gold?

The live spot gold price per ounce is constantly fluctuating due to various market factors. However, as of today, the price of gold is estimated to be around $2,050 per ounce. This is a significant increase compared to the price of gold in the past few years.

Factors Affecting Gold Prices

Several factors can influence the price of gold, including:

- Economic conditions: Gold is often seen as a safe haven asset during economic uncertainty, leading to increased demand and higher prices.

- Inflation: Gold prices tend to rise when inflation is high, as investors seek to protect their assets from inflation’s effects.

- Interest rates: Changes in interest rates can affect the demand for gold, as higher interest rates make other investments more attractive.

- Geopolitical events: Political instability and geopolitical tensions can drive up demand for gold, leading to price increases.

- Supply and demand: The balance between gold supply and demand also impacts its price, with increased demand or decreased supply resulting in higher prices.

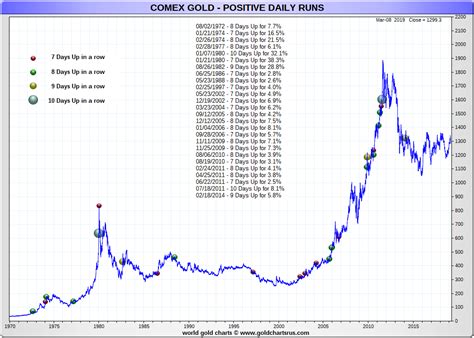

Historical Gold Prices

The price of gold has witnessed significant fluctuations over time. In 1980, the spot price of gold reached a peak of $850 per ounce, driven by high inflation and geopolitical uncertainty. However, it experienced a sharp decline in the 1980s and 1990s, reaching a low of $252 per ounce in 1999.

Since then, the price of gold has been on a generally upward trend, reaching a new all-time high of $2,075 per ounce in August 2020. The COVID-19 pandemic and its economic consequences played a significant role in this price increase, as investors sought safe haven assets.

Future Trends in Gold Prices

Predicting future gold prices is complex, but some experts believe that the price of gold could continue to rise in the coming years. Factors such as geopolitical instability, high inflation, and low interest rates could contribute to this increase. However, it is important to note that the gold market is volatile, and prices can be influenced by unexpected events.

How to Invest in Gold

There are several ways to invest in gold, including:

- Physical gold: Purchasing physical gold bars or coins is a tangible way to hold gold. However, it is important to store physical gold securely to prevent theft or loss.

- Gold ETFs: Gold exchange-traded funds (ETFs) allow investors to invest in gold without purchasing physical metal. ETFs track the price of gold and provide diversification.

- Gold mining stocks: Investing in companies that mine gold can provide exposure to the gold market. However, it is important to consider the risks associated with stock market investments.

Conclusion

The price of gold per ounce is constantly fluctuating and is influenced by various market factors. However, gold has historically been a valuable asset and is often seen as a safe haven during economic uncertainty. By understanding the factors that affect gold prices and considering the different investment options available, investors can make informed decisions about investing in gold.