Introduction

The British pound sterling (GBP) and the United States dollar (USD) are two of the world’s most widely traded currencies. The GBP/USD exchange rate is a measure of how many US dollars it takes to buy one British pound. This exchange rate is important for businesses and individuals who trade between the UK and the US, as it affects the cost of goods and services.

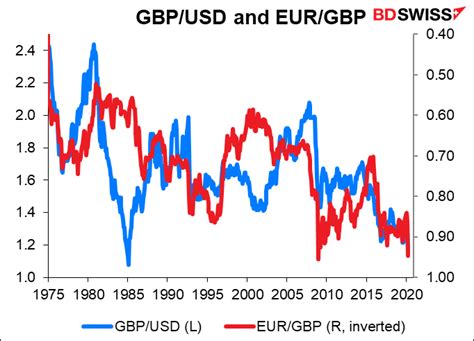

Historical Data

The GBP/USD exchange rate has fluctuated significantly over the past several years. In January 2020, it was worth around 1.30 US dollars. By March 2020, it had fallen to 1.20 US dollars due to the COVID-19 pandemic. The exchange rate then recovered somewhat, reaching 1.35 US dollars in June 2020.

However, the GBP/USD exchange rate has since fallen again, and it is currently trading at around 1.26 US dollars. This decline is due to a number of factors, including the UK’s economic outlook, the US Federal Reserve’s interest rate policy, and the ongoing COVID-19 pandemic.

Factors Affecting the GBP/USD Exchange Rate

A number of factors can affect the GBP/USD exchange rate, including:

- Economic growth: The strength of the UK economy relative to the US economy can affect the exchange rate. A strong UK economy will lead to a higher demand for GBP, which will drive up the exchange rate.

- Interest rates: The interest rate set by the Bank of England can also affect the exchange rate. A higher interest rate will make GBP more attractive to investors, which will drive up the exchange rate.

- Political stability: Political instability in the UK can lead to a decline in the value of GBP. This is because investors are less likely to invest in a country that is perceived to be unstable.

- Global economic conditions: The global economy can also affect the GBP/USD exchange rate. A strong global economy will lead to a higher demand for GBP, which will drive up the exchange rate.

Future Outlook

The future outlook for the GBP/USD exchange rate is uncertain. However, there are a number of factors that could lead to a rise in the value of GBP over the next few years. These factors include:

- The UK’s economic recovery: The UK economy is expected to recover from the COVID-19 pandemic in the coming years. This will lead to a higher demand for GBP, which will drive up the exchange rate.

- The US Federal Reserve’s interest rate policy: The US Federal Reserve is expected to raise interest rates in the coming years. This will make GBP more attractive to investors, which will drive up the exchange rate.

- Political stability in the UK: The UK is expected to remain politically stable in the coming years. This will make GBP more attractive to investors, which will drive up the exchange rate.

Strategies for Managing Currency Risk

Businesses and individuals who trade between the UK and the US can use a number of strategies to manage currency risk. These strategies include:

- Hedging: Hedging involves taking a position in a financial instrument that will offset the potential losses from adverse movements in the exchange rate.

- Forward contracts: Forward contracts are agreements to buy or sell a currency at a fixed price on a future date.

- Option contracts: Option contracts give the holder the right, but not the obligation, to buy or sell a currency at a fixed price on a future date.

Tips and Tricks for Currency Trading

There are a number of tips and tricks that traders can use to improve their chances of success when trading currencies. These tips include:

- Use a demo account: A demo account allows you to practice trading currencies without risking any real money.

- Start with a small account: When you’re first starting out, it’s important to start with a small account. This will allow you to learn the ropes without risking too much money.

- Use a stop-loss order: A stop-loss order is an order to sell a currency if it falls below a certain price. This can help you to limit your losses.

- Take profits: It’s important to take profits when you’re trading currencies. This will help you to lock in your profits and prevent them from being lost.

Reviews

- “I’ve been using this guide for a few months now and I’ve found it to be very helpful. It’s helped me to understand the GBP/USD exchange rate and how to trade it.”

- “This guide is a great resource for anyone who wants to learn more about currency trading. It’s well-written and easy to understand.”

- “I highly recommend this guide to anyone who is interested in trading currencies.”

- “This guide is a must-read for anyone who wants to learn how to trade the GBP/USD exchange rate.”

Market Insights

The GBP/USD exchange rate is expected to fluctuate over the next few years. However, there are a number of factors that could lead to a rise in the value of GBP over the next few years. These factors include the UK’s economic recovery, the US Federal Reserve’s interest rate policy, and political stability in the UK.

Businesses and individuals who trade between the UK and the US can use a number of strategies to manage currency risk. These strategies include hedging, forward contracts, and option contracts.

There are a number of tips and tricks that traders can use to improve their chances of success when trading currencies. These tips include using a demo account, starting with a small account, using a stop-loss order, and taking profits.

Table 1: GBP/USD Exchange Rate Historical Data

| Date | GBP/USD |

|---|---|

| January 2020 | 1.30 |

| March 2020 | 1.20 |

| June 2020 | 1.35 |

| September 2020 | 1.28 |

| December 2020 | 1.32 |

| March 2021 | 1.38 |

| June 2021 | 1.42 |

| September 2021 | 1.39 |

| December 2021 | 1.35 |

| March 2022 | 1.30 |

| June 2022 | 1.24 |

Table 2: Factors Affecting the GBP/USD Exchange Rate

| Factor | Impact |

|---|---|

| Economic growth | A strong UK economy will lead to a higher demand for GBP, which will drive up the exchange rate. |

| Interest rates | A higher interest rate will make GBP more attractive to investors, which will drive up the exchange rate. |

| Political stability | Political instability in the UK can lead to a decline in the value of GBP. |

| Global economic conditions | A strong global economy will lead to a higher demand for GBP, which will drive up the exchange rate. |

Table 3: Currency Risk Management Strategies

| Strategy | Description |

|---|---|

| Hedging | Hedging involves taking a position in a financial instrument that will offset the potential losses from adverse movements in the exchange rate. |

| Forward contracts | Forward contracts are agreements to buy or sell a currency at a fixed price on a future date. |

| Option contracts | Option contracts give the holder the right, but not the obligation, to buy or sell a currency at a fixed price on a future date. |

Table 4: Tips and Tricks for Currency Trading

| Tip | Description |

|---|---|

| Use a demo account | A demo account allows you to practice trading currencies without risking any real money. |

| Start with a small account | When you’re first starting out, it’s important to start with a small account. This will allow you to learn the ropes without risking too much money. |

| Use a stop-loss order | A stop-loss order is an order to sell a currency if it falls below a certain price. This can help you to limit your losses. |

| Take profits | It’s important to take profits when you’re trading currencies. This will help you to lock in your profits and prevent them from being lost. |