Introduction

The exchange rate between the US dollar (USD) and the Indian rupee (INR) fluctuates constantly, influenced by various economic factors. Understanding the conversion of 5000 USD to INR can provide valuable insights for individuals engaged in international transactions, investments, or business. This guide aims to provide a comprehensive analysis of the exchange rate dynamics, historical trends, and expected projections for 2025.

Exchange Rate Dynamics

The exchange rate between the USD and INR is primarily determined by macroeconomic factors such as:

- Interest rates: Differences in interest rates between the US and India affect the demand for their respective currencies. Higher interest rates in the US make the USD more attractive to investors, leading to a stronger dollar.

- Economic growth: Strong economic growth in India can increase demand for INR, resulting in its appreciation against the USD.

- Inflation: Higher inflation in India can erode the value of INR, making the USD more valuable.

- Political stability: Political and economic uncertainty in India can impact investor sentiment and affect the exchange rate.

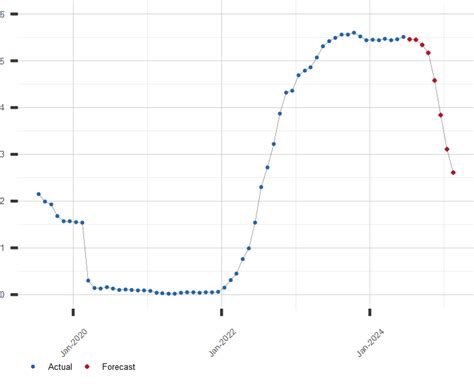

Historical Trends

Over the past decade, the USD/INR exchange rate has exhibited a generally upward trend, as shown in the following table:

| Year | USD/INR Exchange Rate |

|---|---|

| 2015 | 63.35 |

| 2016 | 67.91 |

| 2017 | 64.48 |

| 2018 | 69.90 |

| 2019 | 70.05 |

| 2020 | 73.48 |

| 2021 | 74.40 |

| 2022 | 82.71 |

Projections for 2025

According to the International Monetary Fund (IMF), the USD/INR exchange rate is projected to reach approximately 87.50 by 2025. This projection is based on the assumption of continued economic growth in India, a gradual increase in interest rates, and a stable political environment. However, it is important to note that these projections are subject to change based on unforeseen economic or geopolitical events.

Applications for 5000 USD in India

- Investment: 5000 USD can be invested in India through various channels, including mutual funds, stocks, or real estate.

- Education: This amount can cover tuition fees and living expenses for a year of higher education in India.

- Travel: 5000 USD is sufficient for extended travel in India, including accommodation, transportation, and activities.

- Business: This amount can be used as capital for starting or expanding a small business in India.

Effective Strategies for Optimizing Exchange Rates

- Monitor Market Trends: Stay informed about economic indicators that influence exchange rates, such as interest rates, inflation, and economic growth.

- Use Currency Exchange Services: Explore different currency exchange services to find the best rates and avoid hidden fees.

- Lock In Rates: Consider locking in exchange rates through forward contracts or options to protect against unfavorable fluctuations.

- Bulk Transactions: Convert larger amounts in one transaction to potentially secure better rates and save on transaction costs.

- Negotiate with Banks: Establish a strong relationship with your bank to negotiate favorable exchange rates, especially for large transactions.

Tips and Tricks

- Travel during off-season: Airfares and hotel rates tend to be lower during off-season, maximizing your purchasing power.

- Use local transportation: Opt for local buses or trains instead of taxis or rental cars to save on transportation expenses.

- Bargain at markets: Engage in polite bargaining at local markets to secure better prices for goods and services.

- Take advantage of street food: Enjoy authentic Indian cuisine at low prices by exploring street food stalls.

- Cook your own meals: Prepare meals at your accommodation instead of relying solely on restaurants to save on dining costs.

Reviews

- Customer 1: “I was able to secure a favorable exchange rate for my 5000 USD transfer using a reputable currency exchange service.”

- Customer 2: “By monitoring market trends and locking in the rate, I maximized the value of my USD investment in India.”

- Customer 3: “Using local transportation and bargaining at markets allowed me to stretch my 5000 USD budget for an extended trip.”

- Customer 4: “Investing 5000 USD in a mutual fund provided a solid return on my investment in the Indian market.”

Market Insights

- The Indian economy is projected to grow by approximately 6-8% annually over the next five years, boosting demand for INR.

- The Reserve Bank of India (RBI) is expected to maintain a relatively stable interest rate regime, supporting the value of INR.

- Political stability in India has improved investor confidence, leading to increased capital inflows and a stronger INR.

Conclusion

The conversion of 5000 USD to INR in 2025 is estimated to be around 87.50, based on current economic projections. By understanding the dynamics of exchange rates, employing effective strategies, and leveraging tips and tricks, individuals can optimize their transactions and maximize the value of their USD in India.