Introduction

In today’s fast-paced digital world, the ability to transfer funds quickly and securely is essential. Bank of America offers a variety of wire transfer options to meet your needs, whether you’re sending money domestically or internationally.

Types of Wire Transfers

Domestic Wire Transfers

- Standard Wire Transfer: Typically processed within one business day.

- Same-Day Wire Transfer: Processed on the same day as initiated for an additional fee.

International Wire Transfers

- Standard International Wire Transfer: Processed within 1-3 business days.

- Express International Wire Transfer: Processed within 24 hours for an additional fee.

Fees

Fees for wire transfers vary depending on the type of transfer and the amount being sent.

| Transfer Type | Domestic Fee | International Fee |

|---|---|---|

| Standard Wire Transfer | $25 | $45 |

| Same-Day Wire Transfer | $35 | $55 |

| Express International Wire Transfer | $45 | $65 |

Limits

The maximum amount that can be sent via wire transfer is $100,000 per day for domestic transfers and $250,000 per day for international transfers.

How to Initiate a Wire Transfer

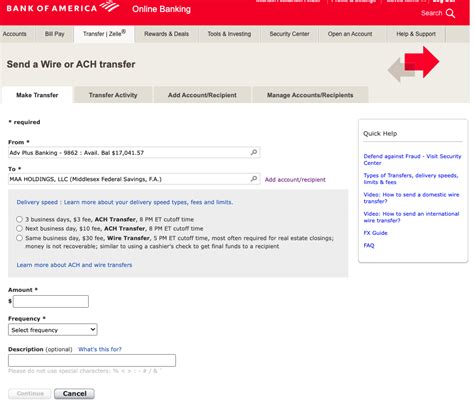

To initiate a wire transfer, you can:

- Online Banking: Log into your online banking account and select the “Wire Transfers” tab.

- Mobile Banking: Download the Bank of America mobile banking app and select the “Transfers” menu.

- Phone Banking: Call 1-800-432-1000 and follow the prompts.

- In-Branch: Visit a Bank of America branch and speak with a teller.

Benefits of Using Wire Transfers

- Speed: Wire transfers are processed quickly, making them ideal for urgent payments.

- Security: Wire transfers are secure and encrypted to protect your funds.

- Convenience: You can initiate wire transfers from anywhere with an internet connection.

- Global Reach: Bank of America offers international wire transfers to over 200 countries.

Why Wire Transfers Matter

Wire transfers are an essential tool for businesses and individuals alike. They enable you to:

- Pay bills on time: Avoid late fees by sending payments electronically.

- Send money to loved ones: Support family and friends overseas quickly and securely.

- Invest in stocks and bonds: Transfer funds to your brokerage account for investments.

- Purchase real estate: Secure financing for your dream home or investment property.

Market Insights

According to the Federal Reserve, the value of wire transfers in the United States exceeded $12 trillion in 2022. This number is expected to grow to over $15 trillion by 2025.

Future Trends

- Increased use of mobile banking: Mobile apps will continue to make it easier to initiate wire transfers on the go.

- Expansion of international capabilities: Bank of America will continue to expand its offerings for international wire transfers.

- Integration with digital wallets: Wire transfers will become more seamlessly integrated with digital wallets like Apple Pay and Google Pay.

Tips for Improving Wire Transfers

- Compare fees: Shop around to find the best rates on wire transfers.

- Use online banking: Online banking offers the most convenient and cost-effective way to initiate wire transfers.

- Verify recipient information carefully: Ensure that the recipient’s name and account number are correct to avoid errors.

- Consider using a wire transfer service: Wire transfer services can help you save money on larger transfers.

Conclusion

Bank of America offers a reliable and secure wire transfer service to meet your needs. By understanding the different types, fees, and benefits of wire transfers, you can make the best decision for your situation. As the digital banking landscape continues to evolve, wire transfers will remain an essential tool for moving funds quickly and securely.