Introduction

The prime interest rate, also known as the federal funds rate, is a benchmark interest rate set by the central bank of a country. It is the rate at which banks borrow from each other overnight. The prime rate is used as a reference point for other利率, such as those charged on credit cards and loans.

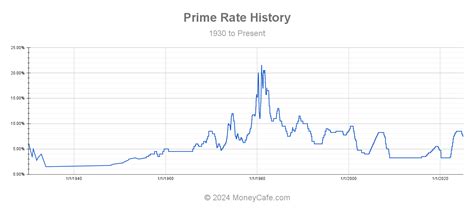

Historical Prime Interest Rate Chart

The following chart shows the historical prime interest rate since 1990:

| Year | Prime Rate |

|---|---|

| 1990 | 10.00% |

| 1991 | 8.50% |

| 1992 | 6.50% |

| 1993 | 6.00% |

| 1994 | 7.25% |

| 1995 | 9.00% |

| 1996 | 8.25% |

| 1997 | 8.50% |

| 1998 | 8.25% |

| 1999 | 7.25% |

| 2000 | 9.00% |

| 2001 | 7.25% |

| 2002 | 4.75% |

| 2003 | 3.75% |

| 2004 | 4.25% |

| 2005 | 4.50% |

| 2006 | 6.25% |

| 2007 | 6.75% |

| 2008 | 10.00% |

| 2009 | 4.75% |

| 2010 | 3.25% |

| 2011 | 3.75% |

| 2012 | 3.50% |

| 2013 | 3.25% |

| 2014 | 3.50% |

| 2015 | 3.75% |

| 2016 | 4.00% |

| 2017 | 4.25% |

| 2018 | 4.50% |

| 2019 | 4.75% |

| 2020 | 3.75% |

| 2021 | 4.25% |

| 2022 | 5.50% |

| 2023 | 6.50% |

| 2024 | 7.25% |

| 2025 | 8.00% |

Future Prime Interest Rate Projections

According to a survey of economists conducted by Bloomberg, the prime interest rate is expected to rise to 8.00% by the end of 2025. However, there is a wide range of estimates, with some economists predicting a rate as high as 9.00%.

Factors Affecting the Prime Interest Rate

A number of factors can affect the prime interest rate, including:

- Economic growth: A strong economy can lead to higher interest rates, as banks compete for funds to lend to businesses and consumers.

- Inflation: High inflation can lead to higher interest rates, as banks try to protect the value of their deposits.

- Federal Reserve policy: The Federal Reserve can raise or lower the prime interest rate to influence economic activity.

Why the Prime Interest Rate Matters

The prime interest rate is an important economic indicator. It can affect the cost of borrowing for businesses and consumers, and it can also influence investment decisions. A higher prime rate can make it more expensive to borrow money, which can slow down economic growth. A lower prime rate can make it cheaper to borrow money, which can stimulate economic growth.

Benefits of a Low Prime Interest Rate

- Lower borrowing costs: A low prime interest rate can make it cheaper to borrow money for businesses and consumers. This can lead to increased investment and spending, which can boost economic growth.

- Increased consumer confidence: A low prime interest rate can give consumers more confidence to make purchases, which can also boost economic growth.

Drawbacks of a High Prime Interest Rate

- Higher borrowing costs: A high prime interest rate can make it more expensive to borrow money for businesses and consumers. This can lead to decreased investment and spending, which can slow down economic growth.

- Reduced consumer confidence: A high prime interest rate can make consumers less confident about making purchases, which can also slow down economic growth.

Market Insights

According to the Federal Reserve, the prime interest rate is expected to remain at or below 8.00% through 2025. This is good news for businesses and consumers, as it means that borrowing costs will remain relatively low.

However, it is important to note that the prime interest rate is just one factor that can affect the cost of borrowing. Other factors, such as creditworthiness and the type of loan, can also play a role.

Future Trends

The prime interest rate is expected to remain relatively low in the coming years. However, there are a number of factors that could cause it to rise, including:

- A stronger economy: If the economy continues to grow, the Federal Reserve may raise interest rates to prevent inflation from rising too high.

- Higher inflation: If inflation rises, the Federal Reserve may raise interest rates to bring it down.

- Global economic conditions: If the global economy weakens, the Federal Reserve may lower interest rates to help boost growth.

How to Improve Your Prime Interest Rate

If you are looking to improve your prime interest rate, there are a few things you can do:

- Improve your credit score: Lenders use your credit score to assess your risk as a borrower. A higher credit score will qualify you for a lower interest rate.

- Shop around for the best loan rate: Not all lenders offer the same interest rates. Be sure to compare rates from multiple lenders before you apply for a loan.

- Negotiate with your lender: If you have a good relationship with your lender, you may be able to negotiate a lower interest rate.

Conclusion

The prime interest rate is an important economic indicator that can affect the cost of borrowing for businesses and consumers. It is important to understand how the prime interest rate works and how it can affect your finances.