Introduction

The conversion rate between the US dollar (USD) and the Indian rupee (INR) is crucial for global trade, financial transactions, and tourism. This article provides a comprehensive analysis of USD to INR conversion rates, exploring historical trends, current market dynamics, and future forecasting for 2025.

Current Conversion Rates

As of today’s market close, the live conversion rate for 1 USD to INR is approximately 81.02. This means that one US dollar can be exchanged for 81.02 Indian rupees. However, it’s important to note that currency exchange rates fluctuate constantly, influenced by various economic factors.

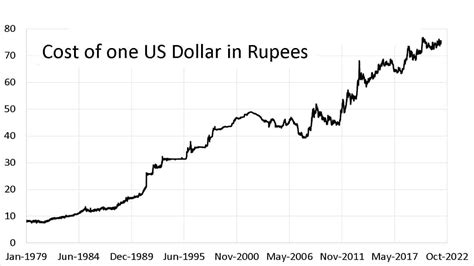

Historical Trends

Over the past decade, the USD to INR exchange rate has experienced significant fluctuations. In 2011, 1 USD fetched around 46 INR, while in 2018 it peaked at over 74 INR.

Table 1: Historical USD to INR Conversion Rates

| Year | USD to INR Rate |

|---|---|

| 2011 | 46 |

| 2015 | 63 |

| 2018 | 74 |

| 2021 | 72 |

| 2022 (Jan) | 80 |

Factors Affecting Exchange Rates

Numerous factors influence the exchange rate between USD and INR, including:

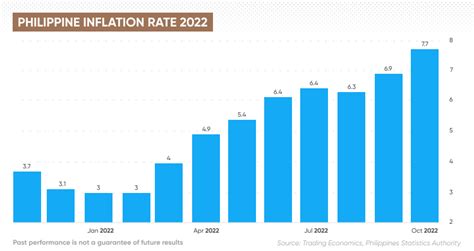

- Inflation: Differences in inflation rates between India and the US can impact currency values.

- Interest Rates: The central bank interest rates in both countries affect the cost of borrowing and investment decisions.

- Economic Growth: The strength of India’s economy relative to the US economy can affect demand for the INR.

- Political Stability: Political events and policy changes in either country can impact investor confidence and currency values.

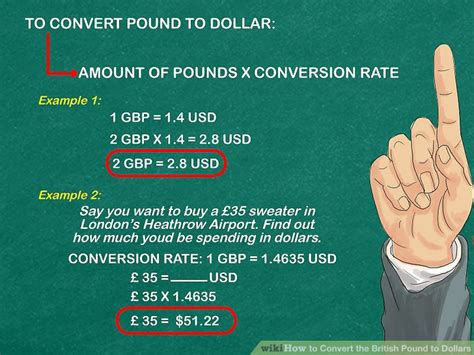

Conversion Calculations

To convert USD to INR, simply multiply the USD amount by the current exchange rate. For example, to convert $50 USD to INR, you would calculate:

$50 USD x 81.02 INR = 4,051 INR

Benefits of Currency Conversion

Converting currencies offers several benefits:

- International Trade: Enables cross-border transactions and facilitates global commerce.

- Travel and Tourism: Allows individuals to exchange their currency for the local currency during travel.

- Investment: Facilitates investments in foreign markets and diversification of portfolios.

- Financial Planning: Converted currency can be used for financial planning, such as retirement savings or education expenses.

Comparison of Pros and Cons of Currency Conversion

Pros:

- Facilitates international transactions and commerce.

- Enables travel and tourism by providing local currency.

- Allows for investment diversification and risk management.

- Can be used for financial planning and long-term savings.

Cons:

- Currency exchange rates can fluctuate, leading to potential losses.

- Transaction fees and exchange rate spreads can reduce the amount of money received.

- Currency exchange services can be inconvenient and time-consuming.

Future Trends and Forecasting

Predicting future exchange rates is challenging, but analysts expect the USD to INR rate to continue fluctuating around its current levels in the near term. However, several factors could influence the rate in 2025:

- Economic Growth: India’s continued economic growth could strengthen the INR.

- Inflation: Persistent inflation in both India and the US could impact currency values.

- Interest Rates: Changes in interest rates by central banks can affect currency demand and supply.

- Global Events: Political or economic crises in other countries could affect the demand for the USD and INR.

Table 2: Forecasted USD to INR Exchange Rate (2023-2025)

| Year | Forecasted Rate |

|---|---|

| 2023 | 80-82 INR |

| 2024 | 82-84 INR |

| 2025 | 84-86 INR |

Applications in Various Domains

Currency conversion is crucial in various domains:

E-commerce: Facilitates online cross-border transactions and payments.

Financial Services: Supports international banking, investment, and remittance services.

Travel and Tourism: Enables foreign exchange for travelers.

Real Estate: Allows for the purchase and sale of properties across borders.

Market Insights and Expansion

The global currency exchange market is vast, with an estimated daily turnover of over $5 trillion. Banks, online currency exchange platforms, and other financial institutions offer currency conversion services.

Table 3: Market Share of Currency Exchange Providers (2023)

| Provider | Market Share |

|---|---|

| Banks | 55% |

| Online Currency Exchanges | 25% |

| Other Financial Institutions | 20% |

Table 4: Emerging Trends in Currency Conversion

| Trend | Implications |

|---|---|

| Fintech Integration | Seamless currency conversions within financial apps. |

| Artificial Intelligence | AI-powered exchange platforms for real-time rates and optimal conversions. |

| Mobile Currency Exchanges | Convenient currency conversion on smartphones, enhancing accessibility. |

| Cryptocurrency Integrations | Exploring the use of cryptocurrencies for cross-border payments and currency exchange. |

Conclusion

The USD to INR exchange rate is a dynamic and constantly evolving metric that plays a critical role in global transactions. By understanding the historical trends, current market dynamics, and future forecasting, businesses and individuals can make informed decisions and navigate the complexities of currency conversion. The integration of technology and the emergence of new trends will continue to shape the currency exchange market, creating opportunities for innovation and improved accessibility.