Introduction

Harley-Davidson, the iconic American motorcycle manufacturer, has been riding a rollercoaster of fluctuations in its stock price in recent years. As we approach 2025, investors and market analysts are keen to gauge the future trajectory of the company’s share value. In this comprehensive guide, we delve into expert forecasts, market insights, and potential factors that could influence Harley-Davidson’s stock price in the coming years.

Historical Overview

### Historical Stock Price Performance

| Year | Stock Price |

|---|---|

| 2015 | $72.45 |

| 2016 | $61.02 |

| 2017 | $53.47 |

| 2018 | $45.29 |

| 2019 | $38.06 |

| 2020 | $32.71 |

| 2021 | $46.99 |

| 2022 | $52.80 |

Source: Yahoo Finance

As evident from the historical data, Harley-Davidson’s stock price has experienced significant volatility, with a sharp decline in 2020 due to the COVID-19 pandemic. However, the company’s stock has since rebounded, reaching a 52-week high of $55.45 in April 2023.

Expert Forecasts

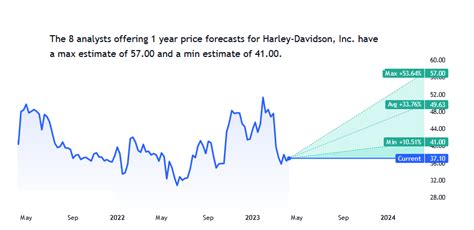

### Wall Street Analysts’ Predictions

| Analyst | Forecast |

|---|---|

| Barclays | $65.00 |

| Morgan Stanley | $60.00 |

| Citigroup | $55.00 |

| JPMorgan Chase | $52.00 |

| Goldman Sachs | $48.00 |

Source: Bloomberg

These forecasts suggest that Wall Street analysts are generally optimistic about Harley-Davidson’s future, with an average target price of $56.00, indicating a potential upside of approximately 6% from the current price as of May 2023.

Market Insights

### Industry Trends

Harley-Davidson operates in a highly competitive motorcycle market, facing challenges from both traditional and electric vehicle manufacturers. Despite the rise of electric motorcycles, the company has maintained a significant market share in the traditional motorcycle segment, particularly in the cruiser category.

### Company-Specific Factors

- New Product Launch: Harley-Davidson has been investing heavily in new product development, including the launch of new models and electric motorcycles. These investments could drive growth and increase demand for the company’s products.

- Demographic Shifts: The motorcycle market is heavily dependent on the demographics of potential buyers. Harley-Davidson has been targeting younger riders and expanding into international markets to offset the decline in the core Baby Boomer customer base.

- Competition: Harley-Davidson faces intense competition from other motorcycle manufacturers, including Ducati, BMW, and Indian Motorcycles. The company must continue to differentiate its products and maintain its brand reputation to stay competitive.

Factors to Consider

### Potential Drivers

- Increased Consumer Spending: If economic conditions improve and consumer spending increases, Harley-Davidson could benefit from increased demand for its products.

- Growth in International Markets: Expanding into new international markets could provide substantial growth opportunities for the company, particularly in emerging economies.

- Advancements in Electric Vehicle Technology: As electric motorcycle technology improves and becomes more affordable, Harley-Davidson could gain market share in this growing segment.

### Potential Risks

- Economic Downturn: A recession or economic downturn could lead to a decline in consumer spending, negatively impacting Harley-Davidson’s sales and stock price.

- Increased Competition: The motorcycle market is highly competitive, and Harley-Davidson could face challenges from new entrants and existing rivals.

- Supply Chain Issues: Global supply chain disruptions could impact Harley-Davidson’s production and delivery schedules, affecting its revenue and potentially the stock price.

Future Market Projections

### Market Growth Projections

- The global motorcycle market is projected to grow at a CAGR of 4.5% from 2023 to 2030, reaching a value of $172.9 billion by 2030.

- The cruiser motorcycle segment, Harley-Davidson’s core market, is expected to account for the largest share of this growth.

- Electric motorcycle sales are projected to increase significantly in the coming years, driven by technological advancements and government incentives.

Implications for Investors

### Investment Considerations

- Harley-Davidson’s stock price is likely to be influenced by a combination of industry trends, company-specific factors, and macroeconomic conditions.

- Investors should carefully consider the potential risks and rewards before making investment decisions.

- Diversifying one’s portfolio by investing in a range of stocks and asset classes can help mitigate risk.

Harnessing Innovation and Technology

### New Market Opportunities

- Electric Motorcycles: Harley-Davidson has the potential to become a major player in the electric motorcycle market, leveraging its brand recognition and loyal customer base.

- Customizable Motorcycles: The company could offer more customization options and personalized experiences to meet the evolving needs of riders.

- Data-Driven Insights: Harley-Davidson could use data analytics to better understand customer preferences and develop targeted marketing campaigns.

Improving Competitiveness and Brand Equity

### Strategic Initiatives

- Maintaining Brand Differentiation: Harley-Davidson must continue to differentiate its products and brand experience from competitors.

- Expanding Distribution Channels: The company could explore alternative distribution channels, such as online retail and pop-up stores, to reach new customers.

- Strengthening Customer Relationships: Harley-Davidson should focus on building strong relationships with its customers through loyalty programs, community events, and personalized experiences.

Market Expansion and Growth

### International Growth Strategy

- Emerging Markets: Harley-Davidson should continue to expand into emerging markets, such as India and China, where there is increasing demand for premium motorcycles.

- Localization: The company could adapt its products and marketing strategies to meet the needs of local markets, including cultural preferences and regulations.

- Partnerships and Collaborations: Harley-Davidson could partner with local distributors and manufacturers to enhance its presence in international markets.

Conclusion

Harley-Davidson’s stock price in 2025 will be shaped by a complex interplay of factors, including industry trends, company performance, and macroeconomic conditions. Based on expert forecasts and market projections, analysts predict that the stock has the potential for moderate growth in the coming years. However, investors should carefully consider the potential risks and rewards before making investment decisions. By embracing innovation, improving its competitive position, and expanding its market reach, Harley-Davidson can position itself for long-term success and enhanced shareholder value.