Introduction

The advent of c r y p t has ushered in a transformative era in the realm of finance and digital innovation. From decentralized cryptocurrencies to blockchain-based applications, this emerging technology is disrupting traditional systems and creating unparalleled opportunities for investment, innovation, and economic growth.

As we move towards 2025, the c r y p t landscape continues to evolve at an exponential pace, driven by technological advancements, regulatory frameworks, and increasing adoption. This article delves into the current state of c r y p t, explores its potential benefits, examines its challenges, and forecasts future trends that will shape this rapidly evolving field.

The Rise of Decentralized Digital Assets

At the heart of the c r y p t revolution are decentralized digital assets, primarily cryptocurrencies like Bitcoin and Ethereum. These assets operate independently of central banks or financial institutions, offering users greater control over their finances and eliminating the need for intermediaries.

The Rise of Bitcoin

Bitcoin, the pioneer of cryptocurrencies, has become a global phenomenon. Its finite supply, decentralized nature, and growing acceptance have attracted investors, businesses, and individuals seeking an alternative to traditional currencies. According to Statista, the global Bitcoin market capitalization exceeded $1 trillion in 2023, marking a significant milestone in the growth of the asset class.

The Versatility of Ethereum

Ethereum is another prominent decentralized blockchain platform. Unlike Bitcoin, which focuses primarily on currency transactions, Ethereum enables the creation of smart contracts and decentralized applications (dApps). This versatility has positioned Ethereum as a leading force in decentralized finance (DeFi), non-fungible tokens (NFTs), and other innovative use cases.

Exploring the Benefits of c r y p t

The adoption of c r y p t technologies offers numerous benefits, including:

Increased Financial Inclusion

c r y p t has the potential to empower the unbanked and underbanked populations around the world. By providing access to digital wallets and decentralized financial services, c r y p t can facilitate financial transactions, savings, and investments, regardless of geographical or economic circumstances.

Enhanced Security and Transparency

Blockchain technology, the underlying foundation of c r y p t, offers unparalleled security and transparency. The decentralized nature of blockchains makes them resistant to fraud and manipulation, while the immutable ledger provides a comprehensive and auditable record of transactions.

Innovation and Economic Growth

c r y p t is fueling innovation across various industries, including finance, supply chain management, and healthcare. By eliminating intermediaries and automating processes, c r y p t technologies can increase efficiency, reduce costs, and create new opportunities for businesses and entrepreneurs.

Addressing the Challenges of c r y p t

While c r y p t holds immense potential, it faces several challenges that need to be addressed:

Regulatory Uncertainty

The regulatory landscape for c r y p t is still evolving, with governments around the world grappling with the complexities of this emerging technology. The lack of clear regulations can create uncertainty for businesses and investors, hindering wider adoption.

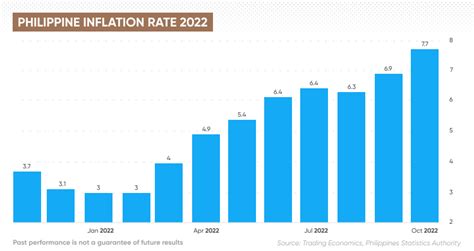

Volatility and Speculation

Cryptocurrency markets are known for their volatility, driven by factors such as market sentiment, news events, and speculative trading. This volatility can make it difficult for investors to assess the true value of digital assets and poses risks to those seeking financial stability.

Security Risks

c r y p t technologies are not immune to security breaches, such as hacking, phishing attacks, and malware. The decentralized nature of c r y p t can make it challenging to recover stolen assets or protect against fraudulent activities.

Forecasting the Future of c r y p t

As c r y p t continues to evolve, several key trends will shape its future:

Institutional Adoption

Institutional investors, including hedge funds, asset managers, and banks, are increasingly recognizing the potential of c r y p t as an asset class. Their involvement is likely to bring stability and credibility to the market, attracting broader adoption.

Regulation and Stability

Governments around the world are expected to implement clearer regulatory frameworks for c r y p t, providing greater certainty and protection for businesses and investors. This will help mitigate risks, reduce volatility, and foster the growth of the industry.

Technological Advancements

Ongoing advancements in blockchain technology, including improvements in scalability, security, and interoperability, will unlock new possibilities for c r y p t applications. These advancements will underpin the development of innovative products and services, driving further adoption.

Emerging Use Cases

Beyond currency transactions and financial services, c r y p t is finding applications in various industries. From supply chain tracking to digital identity management, the versatility of blockchain technology is enabling new solutions to real-world problems.

Conclusion

The c r y p t landscape is rapidly evolving, presenting both opportunities and challenges. As we approach 2025, the rise of decentralized digital assets, the expansion of c r y p t use cases, and the maturation of regulatory frameworks will shape the future of this transformative technology. By embracing the potential of c r y p t and addressing its challenges, we can unlock the full potential of digital assets and empower a more inclusive, secure, and innovative global economy.

Tables

Table 1: Cryptocurrency Market Capitalization

| Year | Bitcoin Market Cap | Ethereum Market Cap | Total Cryptocurrency Market Cap |

|---|---|---|---|

| 2021 | $1.28 trillion | $0.47 trillion | $3.25 trillion |

| 2022 | $0.82 trillion | $0.36 trillion | $2.26 trillion |

| 2023 | $1.06 trillion | $0.42 trillion | $3.01 trillion |

| 2024 | Projected $1.6 trillion | Projected $0.7 trillion | Projected $4.6 trillion |

| 2025 | Projected $2.2 trillion | Projected $1.1 trillion | Projected $6.6 trillion |

Table 2: Benefits of c r y p t

| Benefit | Description |

|---|---|

| Increased Financial Inclusion | c r y p t provides access to financial services for the unbanked and underbanked. |

| Enhanced Security and Transparency | Blockchain technology offers unparalleled security and transparency, making c r y p t transactions resistant to fraud and manipulation. |

| Innovation and Economic Growth | c r y p t is fueling innovation across various industries, creating new opportunities for businesses and entrepreneurs. |

| Reduced Costs and Improved Efficiency | c r y p t eliminates intermediaries and automates processes, reducing costs and increasing efficiency. |

| Global Reach and Accessibility | c r y p t transactions can be conducted anywhere in the world, regardless of geographical or economic boundaries. |

Table 3: Challenges of c r y p t

| Challenge | Description |

|---|---|

| Regulatory Uncertainty | The lack of clear regulatory frameworks for c r y p t can create uncertainty for businesses and investors. |

| Volatility and Speculation | Cryptocurrency markets are known for their volatility, driven by factors such as market sentiment, news events, and speculative trading. |

| Security Risks | c r y p t technologies are not immune to security breaches, such as hacking, phishing attacks, and malware. |

| Scalability Limitations | Some blockchain platforms face scalability challenges, limiting the number of transactions that can be processed. |

| Lack of Interoperability | Different blockchain platforms often lack interoperability, making it difficult to transfer assets and data across systems. |

Table 4: Future Trends in c r y p t

| Trend | Description |

|---|---|

| Institutional Adoption | Institutional investors are increasingly embracing c r y p t as an asset class, bringing stability and credibility to the market. |

| Regulation and Stability | Governments around the world are expected to implement clearer regulatory frameworks for c r y p t, providing greater certainty and protection for businesses and investors. |

| Technological Advancements | Ongoing advancements in blockchain technology will unlock new possibilities for c r y p t applications, driving innovation and adoption. |

| Emerging Use Cases | c r y p t is finding applications beyond currency transactions and financial services, including supply chain tracking, digital identity management, and healthcare. |

| Increased Accessibility | User-friendly platforms and applications are making c r y p t more accessible to mainstream users, expanding its reach and impact. |