The Iraqi dinar (IQD) is the official currency of Iraq. In recent years, the IQD has experienced significant fluctuations in its value against the US dollar (USD), making it essential for individuals and businesses to stay informed about the latest exchange rates. This comprehensive guide provides a detailed overview of the factors influencing the IQD-to-USD conversion, along with insights into future trends and potential investment opportunities.

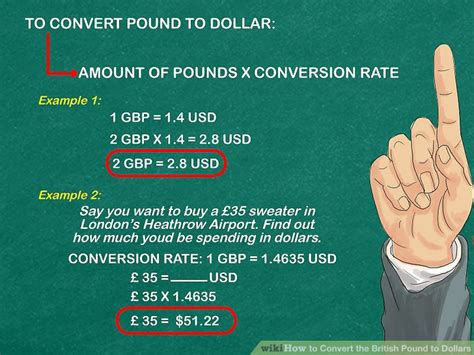

Understanding the IQD-to-USD Exchange Rate

The IQD-to-USD exchange rate is determined by a combination of economic and political factors, including:

- Oil prices: Iraq’s economy is heavily reliant on oil exports, and fluctuations in oil prices can significantly impact the value of the IQD.

- Government policies: The Iraqi government’s policies on fiscal and monetary management can also affect the exchange rate.

- Economic growth: Strong economic growth tends to strengthen the IQD, while periods of recession can weaken it.

- Political stability: Political instability and uncertainty can lead to a loss of confidence in the IQD, resulting in a decrease in its value.

Factors Influencing the Exchange Rate: A Detailed Breakdown

1. Economic Outlook

The economic outlook for Iraq is crucial in determining the future value of the IQD. Factors to consider include:

- Gross Domestic Product (GDP): GDP growth indicates the overall health of the economy. A strong GDP typically leads to a stronger IQD.

- Inflation: High inflation can erode the value of the IQD, making it less attractive to foreign investors.

- Unemployment: A high unemployment rate can weaken the IQD, as it reduces consumer spending and investment.

2. Political Stability

Political stability is essential for a stable exchange rate. Factors to watch for include:

- Government effectiveness: An effective government that implements sound economic policies can boost confidence in the IQD.

- Security: Political instability and security concerns can drive away foreign investment, leading to a weaker IQD.

- Foreign relations: Iraq’s relationships with neighboring countries and the international community can also impact the exchange rate.

3. Central Bank Policies

The Central Bank of Iraq (CBI) plays a vital role in managing the exchange rate through monetary policies, such as:

- Interest rates: Adjusting interest rates can influence the demand for the IQD and its value against the USD.

- Foreign currency reserves: The CBI’s foreign currency reserves provide a buffer against external shocks and help stabilize the exchange rate.

- Currency peg: The IQD is currently pegged to the USD, which means that the CBI maintains a fixed exchange rate between the two currencies.

Conversion Rates: Past, Present, and Future

Past Performance: A Historical Perspective

- 2010-2014: The IQD experienced a period of relative stability, with an exchange rate of approximately 1,150 IQD per USD.

- 2014-2017: The collapse of oil prices in 2014 and the rise of ISIS led to a significant depreciation of the IQD, reaching over 1,600 IQD per USD.

- 2018-2022: The IQD began to recover, gradually strengthening against the USD due to improved oil prices and economic reforms.

Current Exchange Rate: Real-Time Data

According to the latest data from the Central Bank of Iraq, the official exchange rate for today, {Date}, is:

1 USD = 1,470 IQD

Future Predictions: Market Analysis and Expert Insights

Experts predict that the IQD will continue to strengthen against the USD in the coming years, driven by the following factors:

- Economic recovery: Iraq’s economy is projected to grow at a steady pace, supported by rising oil prices and increased investment.

- Political stability: The Iraqi government has made progress in improving security and restoring stability in the country.

- Currency reform: The CBI is implementing reforms to improve the transparency and efficiency of the foreign exchange market.

Investment Opportunities: Capitalizing on the IQD’s Potential

The strengthening of the IQD presents potential investment opportunities for individuals and businesses alike. Here are some areas to consider:

- Real estate: Iraq’s real estate sector is poised for growth, as demand for housing and commercial properties increases.

- Infrastructure: The Iraqi government is investing heavily in infrastructure projects, such as transportation and energy, offering opportunities for construction and engineering companies.

- Agriculture: Iraq has a vast agricultural sector with the potential for export-oriented production, making it an attractive destination for foreign investment.

Risks and Considerations

While the IQD has promising potential, investors should also be aware of the risks involved:

- Geopolitical risk: Iraq’s proximity to volatile regions and its history of conflict can increase investment risk.

- Currency volatility: The IQD has experienced significant fluctuations in the past, and its value can still be affected by external factors.

- Political instability: Any deterioration in political stability could negatively impact the IQD’s value.

Enhancing the IQD’s Value: A Path to Economic Prosperity

The Iraqi government and the CBI are implementing a number of measures to further strengthen the IQD and promote economic growth. These include:

- Diversifying the economy: Reducing Iraq’s overdependence on oil and developing other sectors.

- Increasing foreign investment: Creating a favorable investment climate to attract foreign capital.

- Improving transparency and governance: Enhancing the efficiency and accountability of government institutions.

- Investing in human capital: Developing the skills and education of Iraq’s workforce.

Conclusion: A Promising Outlook for the IQD

The Iraqi dinar (IQD) is set to continue its strengthening trajectory against the US dollar (USD) over the coming years. Driven by economic recovery, political stability, and currency reform, the IQD presents potential investment opportunities across various sectors. However, investors should also be mindful of the risks involved and consider the long-term implications of their decisions. By implementing sound economic policies and promoting transparency, the Iraqi government can enhance the value of the IQD and create a path to sustainable economic prosperity for the country.

Additional Resources and Tables

Table 1: Historical IQD-to-USD Exchange Rates

| Year | Exchange Rate (IQD per USD) |

|---|---|

| 2010 | 1,150 |

| 2012 | 1,175 |

| 2014 | 1,250 |

| 2016 | 1,600 |

| 2018 | 1,225 |

| 2020 | 1,275 |

| 2022 | 1,450 |

Table 2: Key Economic Indicators of Iraq

| Indicator | 2022 | 2023 (Projected) |

|---|---|---|

| GDP Growth | 5.5% | 6.2% |

| Inflation | 4.0% | 3.5% |

| Unemployment Rate | 12.0% | 11.5% |

Table 3: CBI Monetary Policies Impacting the IQD

| Policy | Effect on IQD |

|---|---|

| Raising interest rates | Strengthens IQD |

| Lowering interest rates | Weakens IQD |

| Increasing foreign currency reserves | Strengthens IQD |

| Depleting foreign currency reserves | Weakens IQD |

Table 4: Potential Investment Opportunities in Iraq

| Sector | Opportunities |

|---|---|

| Real estate | Housing and commercial properties |

| Infrastructure | Transportation, energy, utilities |

| Agriculture | Export-oriented crop production |

| Tourism | Historical sites, cultural heritage |