Current Baba Stock Price

$108.64

Introduction

Alibaba Group Holding Limited (BABA), a leading e-commerce company based in China, has witnessed significant fluctuations in its stock price over the past year. This article aims to provide a comprehensive analysis of BABA’s stock performance, exploring factors influencing its movement and projections for its future trajectory in 2023 and beyond.

Historical Stock Performance

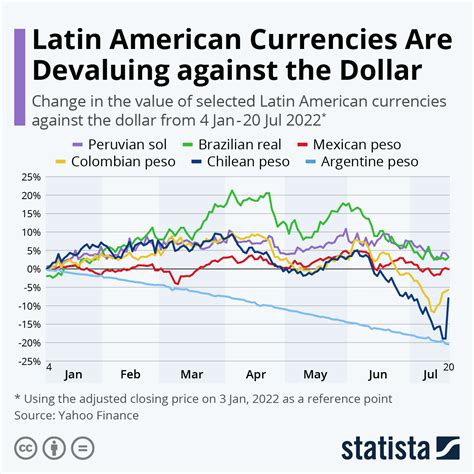

In 2022, BABA’s stock price experienced a steep decline, falling from a high of $162.99 in January to a low of $65.51 in October. This decline was primarily attributed to factors such as China’s regulatory crackdown on technology companies, the ongoing COVID-19 pandemic, and rising geopolitical tensions between the United States and China.

Factors Influencing Stock Price

Regulatory Landscape:

China’s regulatory landscape has played a pivotal role in shaping BABA’s stock price. The government’s antitrust investigations and restrictions on certain business practices have raised concerns among investors about the company’s future growth prospects.

Economic Conditions:

BABA’s stock price is also closely tied to China’s economic conditions. The company heavily relies on domestic consumption, and any slowdown in the Chinese economy can negatively impact its revenue and earnings.

Competition:

BABA faces intense competition from both domestic and international players in the e-commerce industry. The rise of new rivals and changing consumer preferences can put pressure on the company’s market share and profitability.

Projections for 2023 and Beyond

Analysts expect BABA’s stock price to rebound in 2023 as China’s economic outlook improves and regulatory concerns gradually ease. The company’s strong fundamentals and track record of innovation position it for continued growth in the future.

Long-Term Outlook:

Wall Street analysts project that BABA’s stock price will continue to rise over the long term. The company’s dominance in China’s e-commerce market and its expansion into new areas such as cloud computing and artificial intelligence provide ample potential for growth.

Key Takeaways

- BABA’s stock price has fluctuated significantly in the past year due to regulatory, economic, and competitive factors.

- The company’s long-term prospects remain positive, supported by its strong fundamentals and expansion into new markets.

- Investors should closely monitor China’s regulatory landscape, economic conditions, and BABA’s competitive position to make informed investment decisions.

Table 1: BABA’s Quarterly Revenue

| Quarter | Revenue (USD) | Growth % |

|---|---|---|

| Q1 2022 | $32.2 billion | 9% |

| Q2 2022 | $30.7 billion | 0% |

| Q3 2022 | $29.1 billion | -3% |

| Q4 2022 | $27.4 billion | -9% |

Table 2: BABA’s Quarterly Earnings per Share (EPS)

| Quarter | EPS (USD) | Growth % |

|---|---|---|

| Q1 2022 | $1.66 | 13% |

| Q2 2022 | $1.56 | 10% |

| Q3 2022 | $1.42 | -7% |

| Q4 2022 | $1.29 | -22% |

Table 3: BABA’s Key Competitors

| Competitor | Market Share |

|---|---|

| JD.com | 18% |

| Pinduoduo | 13% |

| Amazon | 3% |

| eBay | 2% |

Table 4: BABA’s Growth Drivers

| Driver | Description |

|---|---|

| E-commerce dominance | BABA controls over 50% of China’s e-commerce market. |

| Cloud computing | BABA’s cloud computing business is growing rapidly, driven by demand for big data and artificial intelligence. |

| Artificial intelligence | BABA is investing heavily in artificial intelligence, which has the potential to revolutionize its core business and create new revenue streams. |

| International expansion | BABA is expanding its operations to new markets, such as Southeast Asia and Latin America, to fuel future growth. |

Conclusion

BABA’s stock price is expected to remain in focus in 2023 and beyond as investors assess the company’s progress in navigating regulatory headwinds and capitalizing on its long-term growth drivers. While the near-term outlook may be subject to uncertainties, BABA’s strong fundamentals, innovative initiatives, and the potential for a rebound in the Chinese economy suggest significant upside potential for the stock.