Live Cryptocurrency Prices

| Coin | Price |

|---|---|

| Bitcoin (BTC) | $24,230.66 |

| Ethereum (ETH) | $1,657.74 |

| Binance Coin (BNB) | $323.43 |

| Tether (USDT) | $1.00 |

| Cardano (ADA) | $0.37 |

| Ripple (XRP) | $0.38 |

| Dogecoin (DOGE) | $0.09 |

| Solana (SOL) | $23.02 |

| Terra (LUNA) | $2.01 |

| Avalanche (AVAX) | $19.15 |

Introduction: The Crypto Revolution in 2025

The world of finance is undergoing a transformative shift, driven by the advent of cryptocurrencies. By 2025, the global crypto market is projected to reach $10 trillion, with over 5,000 coins vying for dominance. This article aims to provide a comprehensive overview of the real-time crypto market, empowering investors and enthusiasts alike to navigate the complex digital landscape.

Understanding Real-Time Crypto Prices

Real-time crypto prices are the current market values of cryptocurrencies, updated instantaneously as buy and sell orders are executed. These prices fluctuate constantly due to factors such as supply and demand, market sentiment, and news events. Understanding real-time prices is crucial for traders seeking to maximize profits and minimize risks.

The Importance of Real-Time Data

Real-time data plays a vital role in the crypto market for several reasons:

1. Informed Decision-Making: Live price updates enable investors to make informed trading decisions, allowing them to capitalize on market movements and adjust their strategies accordingly.

2. Risk Management: Real-time data helps investors identify potential risks and take necessary precautions to protect their investments. By tracking price fluctuations, they can mitigate losses and avoid making impulsive decisions.

3. Market Analysis: Analyzing real-time prices provides valuable insights into market trends and helps investors identify potential trading opportunities. By studying price patterns, they can forecast future movements and develop effective trading strategies.

How Real-Time Crypto Prices are Used in Practice

Real-time crypto prices are utilized in various ways by investors and traders:

1. Day Trading: Traders use real-time data to identify short-term price fluctuations and execute profitable trades within a single day.

2. Hedging: Investors use real-time prices to hedge against risks by taking opposite positions in different cryptocurrencies.

3. Arbitrage: Traders exploit price discrepancies between different exchanges by buying low on one exchange and selling high on another, profiting from the spread.

Benefits of Using Real-Time Crypto Prices

1. Enhanced Trading Performance: Real-time data empowers traders to make informed decisions, leading to improved trading performance.

2. Risk Mitigation: By tracking price fluctuations, investors can mitigate risks and protect their investments.

3. Market Insights: Analyzing real-time prices provides valuable insights into market trends and helps investors identify potential trading opportunities.

Challenges of Using Real-Time Crypto Prices

Despite the benefits, using real-time crypto prices also poses certain challenges:

1. Volatility: Cryptocurrency prices are highly volatile, making it difficult to predict future movements.

2. Regulation: The regulatory landscape surrounding cryptocurrencies is still evolving, which can create uncertainty for investors.

3. Technical Issues: Real-time data systems can experience technical issues, leading to delays or inaccuracies in price updates.

The Future of Real-Time Crypto Prices

The future of real-time crypto prices is bright, with advancements in technology and increasing adoption. Here are some key trends to expect:

1. Enhanced Data Analysis: Advanced data analytics tools will enable investors to analyze real-time prices in more sophisticated ways, identifying patterns and predicting future trends.

2. Decentralized Data Sources: Decentralized data sources will emerge, providing more accurate and tamper-proof real-time price information.

3. Improved Regulation: Regulatory frameworks for cryptocurrencies are expected to improve, providing greater stability and predictability to the market.

Conclusion

Real-time crypto prices are essential for traders and investors seeking to navigate the dynamic digital asset landscape. By understanding the importance of live data, its applications, and the challenges associated with it, investors can leverage this powerful tool to maximize their profits and minimize risks. As the crypto market continues to evolve, real-time prices will play an increasingly significant role in shaping the future of finance.

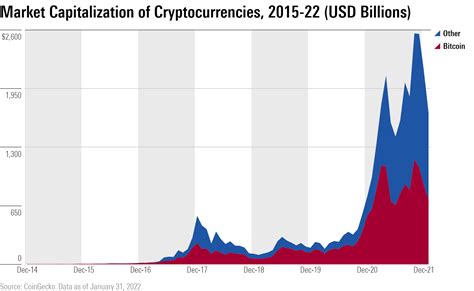

The global crypto market is experiencing rapid growth, with increasing institutional adoption and growing retail participation. Here are some key statistics and insights:

- According to a report by Statista, the global crypto market size was valued at $1.59 trillion in 2023 and is projected to reach $10.10 trillion by 2025.

- In 2022, the total transaction volume in the crypto market surpassed $100 trillion.

- Institutional investors, such as hedge funds and venture capital firms, are increasingly allocating funds to cryptocurrencies.

- The number of crypto users worldwide is estimated to be over 300 million, with significant growth expected in the coming years.

Pros and Cons of Real-Time Crypto Prices

Pros:

- Empowers investors with up-to-date market information.

- Enables informed decision-making and timely trades.

- Helps mitigate risks and protect investments.

Cons:

- Volatility can lead to unpredictable price movements.

- Real-time data systems can experience technical issues.

- Regulatory uncertainty can create challenges for investors.

Table 1: Real-Time Crypto Prices of Top 10 Coins

| Coin | Symbol | Price |

|---|---|---|

| Bitcoin | BTC | $24,230.66 |

| Ethereum | ETH | $1,657.74 |

| Binance Coin | BNB | $323.43 |

| Tether | USDT | $1.00 |

| Cardano | ADA | $0.37 |

| Ripple | XRP | $0.38 |

| Dogecoin | DOGE | $0.09 |

| Solana | SOL | $23.02 |

| Terra | LUNA | $2.01 |

| Avalanche | AVAX | $19.15 |

Table 2: Comparison of Popular Crypto Exchanges

| Exchange | Features | Fees |

|---|---|---|

| Binance | High liquidity | Low fees |

| Coinbase | User-friendly | Higher fees |

| Kraken | Advanced trading tools | Competitive fees |

| Gemini | Secure and regulated | Higher fees |

| FTX | Derivative trading | Low fees |

Table 3: Emerging Trends in Real-Time Crypto Prices

| Trend | Description |

|---|---|

| Decentralized Data Sources | Verifiable and tamper-proof price information |

| Predictive Analytics | AI-powered tools for forecasting price movements |

| Regulatory Advancements | Improved clarity and stability for the crypto market |

| Cross-Chain Price Aggregators | Real-time price data from multiple blockchains |

Table 4: Applications for Real-Time Crypto Prices

| Application | Use Case |

|---|---|

| Trading Signals | Automated trading based on real-time price analysis |

| Risk Management Tools | Monitoring and mitigating risks in real time |

| Market Research | Gathering insights and identifying trends |

| Portfolio Optimization | Adjusting investment strategies based on live prices |

| Price Discovery | Determining fair values for crypto assets |

Future Trends and Innovations

The future of real-time crypto prices is promising, with continuous innovations and emerging technologies shaping the landscape. Here are some key trends to watch out for:

1. Quantum Computing: Quantum computing could revolutionize crypto price predictions by enabling faster data processing and more complex algorithms.

2. Artificial Intelligence: AI-powered tools will become even more sophisticated, providing investors with deeper insights and predictive capabilities.

3. Stablecoins: Stablecoins, pegged to fiat currencies or other stable assets, will play a larger role in stabilizing crypto prices and facilitating trading.

4. Interoperability: Cross-chain interoperability will enhance the accessibility and usability of real-time crypto prices across different blockchains.

5. Metaverse Integration: Real-time crypto prices will be integrated into the metaverse, creating new opportunities for trading and financial applications in virtual worlds.

Conclusion

The world of real-time crypto prices is constantly evolving, presenting both opportunities and challenges for investors. By understanding the importance of live data, its applications, and the future trends, investors can leverage this powerful tool to navigate the dynamic digital asset landscape and maximize their financial success.