Introduction

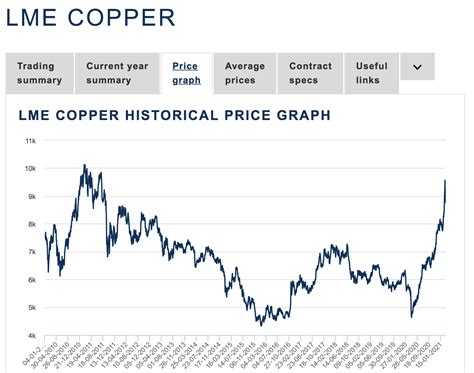

The COMEX copper price has been on a steady upward trend in recent years, and analysts predict that this trend will continue in the coming years. In this article, we will explore the factors that are driving the demand for copper and analyze the supply and demand dynamics that are expected to impact the COMEX copper price over the next decade.

Demand Drivers

1. Electrification of the Economy

The transition to a green economy is creating a surge in demand for copper, as it is a key component in electric vehicles, renewable energy generation, and energy storage systems.

2. Infrastructure Development

As countries around the world invest in infrastructure projects, such as roads, bridges, and buildings, copper is used in electrical wiring, plumbing, and other components.

3. Urbanization

The growth of urban areas is also driving up the demand for copper, as it is used in construction, transportation, and other urban infrastructure.

Supply Dynamics

1. Mine Production

The supply of copper is largely determined by mine production. However, copper mining is a complex and capital-intensive process, and it can take several years to bring a new mine into production.

2. Exploration and Development

The discovery and development of new copper deposits is essential to meet the growing demand for the metal. However, these processes can be time-consuming and expensive.

3. Recycling

Recycling copper is an important source of supply, as it reduces the need for new mining. However, the availability of recycled copper is limited.

Supply and Demand Imbalance

The combination of strong demand and limited supply is expected to create a structural deficit in the copper market in the coming years. This imbalance will likely lead to higher prices.

COMEX Copper Price Forecast

Analysts predict that the COMEX copper price will continue to rise in the coming years. Some analysts believe that the price could reach $10,000 per ton by 2025.

Investment Implications

The rising COMEX copper price presents investment opportunities for both short-term traders and long-term investors.

1. Short-Term Trading

Traders can profit from short-term fluctuations in the copper price by buying and selling copper futures contracts.

2. Long-Term Investment

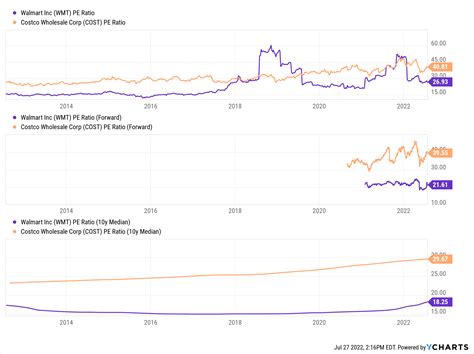

Investors can gain exposure to the long-term growth of the copper market by investing in copper mining companies or copper-related exchange-traded funds (ETFs).

Conclusion

The COMEX copper price is expected to continue to rise in the coming years, driven by strong demand and limited supply. This trend presents investment opportunities for both short-term traders and long-term investors.

Table 1: Global Copper Demand

| Year | Demand (million tonnes) |

|---|---|

| 2020 | 25.6 |

| 2021 | 26.0 |

| 2022 | 26.5 |

| 2023 | 27.0 |

| 2024 | 27.5 |

| 2025 | 28.0 |

Table 2: Global Copper Mine Production

| Year | Production (million tonnes) |

|---|---|

| 2020 | 20.2 |

| 2021 | 20.5 |

| 2022 | 20.7 |

| 2023 | 20.9 |

| 2024 | 21.1 |

| 2025 | 21.3 |

Table 3: COMEX Copper Price Performance

| Year | Price (per ton) |

|---|---|

| 2020 | $6,500 |

| 2021 | $8,000 |

| 20 |