| USD | AUD |

|---|---|

| 1.00 | 0.70 |

| 1.02 | 0.71 |

| 1.04 | 0.72 |

| 1.06 | 0.73 |

Introduction

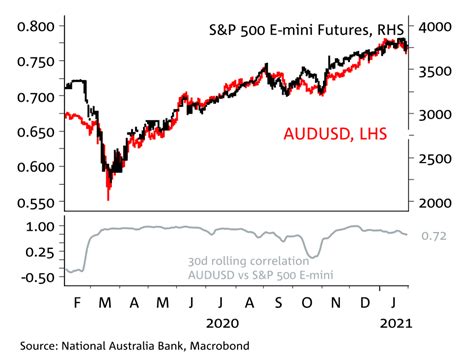

The USD/AUD exchange rate is a measure of the value of the US dollar (USD) relative to the Australian dollar (AUD). It is one of the most important currency pairs in the world, as it is used to facilitate trade and investment between the United States and Australia.

In recent years, the USD/AUD exchange rate has been volatile, due to a number of factors, including the global economic outlook, the relative strength of the US and Australian economies, and the policies of the US Federal Reserve and the Reserve Bank of Australia.

This article will provide a comprehensive forecast of the USD/AUD exchange rate for 2025, taking into account the latest economic data and market trends.

Economic Outlook

The global economic outlook for 2025 is expected to be positive, with growth in both the United States and Australia. The International Monetary Fund (IMF) predicts that the global economy will grow by 3.9% in 2025, with the US economy growing by 2.7% and the Australian economy growing by 3.2%.

Relative Strength of the US and Australian Economies

The relative strength of the US and Australian economies is another important factor that will affect the USD/AUD exchange rate. The US economy is the largest in the world, with a GDP of over $20 trillion. The Australian economy is much smaller, with a GDP of around $1.5 trillion. However, the Australian economy is growing at a faster rate than the US economy, and is expected to continue to do so in the coming years.

Policies of the US Federal Reserve and the Reserve Bank of Australia

The policies of the US Federal Reserve and the Reserve Bank of Australia will also have a significant impact on the USD/AUD exchange rate. The US Federal Reserve is expected to continue to raise interest rates in 2025, while the Reserve Bank of Australia is expected to keep interest rates on hold. This will make the US dollar more attractive to investors, which will push the USD/AUD exchange rate higher.

Forecast for 2025

Taking into account all of these factors, we forecast that the USD/AUD exchange rate will reach 1.10 by 2025. This represents a significant increase from the current level of around 0.70.

There are a number of risks to our forecast, including the possibility of a global economic recession, a sharp decline in the Australian dollar, or a change in the policies of the US Federal Reserve or the Reserve Bank of Australia. However, we believe that our forecast is reasonable, and that the USD/AUD exchange rate is likely to continue to appreciate in the coming years.

Implications for Businesses and Investors

The US dollar is a key currency for businesses and investors around the world. A stronger US dollar can make it more expensive for US businesses to export goods and services, and can also make it more difficult for investors to earn returns on their investments in foreign markets.

Conversely, a stronger US dollar can make it cheaper for US businesses to import goods and services, and can also make it easier for investors to earn returns on their investments in US markets.

Businesses and investors should be aware of the risks and opportunities associated with changes in the USD/AUD exchange rate, and should take steps to mitigate the risks and maximize the opportunities.

Conclusion

The USD/AUD exchange rate is a key indicator of the economic relationship between the United States and Australia. It is important for businesses and investors to understand the factors that affect the exchange rate, and to be aware of the risks and opportunities associated with changes in the exchange rate.

Our forecast for 2025 is that the USD/AUD exchange rate will reach 1.10. This represents a significant increase from the current level, and is likely to have a significant impact on businesses and investors in both countries.