Understanding the Dynamics of Currency Exchange

The exchange rate between the US dollar (USD) and the Mexican peso (MXN) is a crucial indicator of the economic relationship between the two countries. Fluctuations in the exchange rate can significantly impact trade, investment, and tourism.

Factors Influencing the Exchange Rate

Economic Growth: Strong economic growth in Mexico leads to increased demand for its currency, strengthening the peso against the dollar.

Interest Rates: Central bank interest rate decisions can influence the flow of funds between countries. Higher interest rates in Mexico attract foreign investors, boosting the peso’s value.

Inflation: Inflationary pressures in Mexico can erode the purchasing power of the peso, making it weaker against the dollar.

How to Exchange Dollars to Pesos

Banks and Currency Exchange Bureaus: Banks and currency exchange bureaus offer competitive rates and provide convenient access to currency exchange services.

Online Platforms: Online platforms like Wise and CurrencyFair facilitate direct currency exchange transactions with lower fees and often better rates than traditional providers.

ATMs: ATMs in Mexico accept US dollars and dispense pesos at the prevailing exchange rate. However, ATM fees may be substantial.

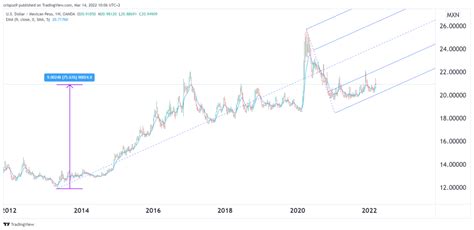

Historical Exchange Rate Trends

The USD/MXN exchange rate has exhibited significant volatility over the past decade:

| Year | Average Exchange Rate (USD/MXN) |

|---|---|

| 2015 | 15.05 |

| 2016 | 18.97 |

| 2017 | 18.37 |

| 2018 | 19.71 |

| 2019 | 19.05 |

| 2020 | 22.46 |

| 2021 | 20.51 |

| 2022 | 20.00 (est.) |

Forecasting Future Exchange Rates

Predicting future exchange rates is challenging, but some factors can provide guidance:

Economic Outlook: Projected economic growth and inflation rates can influence the relative strength of the peso and dollar.

Political Stability: Political events or uncertainties in either country can impact investor confidence and currency valuations.

Global Economic Conditions: The overall state of the global economy, such as interest rate fluctuations or recessions, can affect the exchange rate.

Tips for Exchanging Dollars to Pesos Wisely

Compare Rates: Shop around for the best exchange rate before committing to a transaction. Compare rates from banks, currency exchange bureaus, and online platforms.

Consider Fees: Be aware of additional fees associated with currency exchange, such as transaction fees, ATM fees, and exchange rate margins.

Exchange Large Amounts: Exchanging larger amounts of currency typically results in better rates.

Monitor Exchange Rate Fluctuations: Keep an eye on the exchange rate to take advantage of favorable conditions.

Common Mistakes to Avoid

Ignoring Fees: Failing to factor in exchange fees can result in unexpected costs.

Overestimating Future Exchange Rates: Overestimating the future appreciation of the peso can lead to losses if the rate depreciates.

Exchanging Small Amounts: Exchanging small amounts of currency often results in unfavorable rates.

How to Stand Out in the Currency Exchange Market

Offer Competitive Rates: Provide transparent and competitive exchange rates to attract customers.

Simplify the Process: Make the currency exchange process seamless and user-friendly for customers.

Provide Value-Added Services: Offer additional services, such as travel insurance or currency alerts, to enhance customer loyalty.

Leverage Technology: Utilize mobile apps and online platforms to streamline the currency exchange process.

Conclusion

Understanding the factors influencing the USD/MXN exchange rate is essential for making informed currency exchange decisions. By following the tips outlined above and avoiding common pitfalls, you can maximize your return when exchanging dollars to Mexican pesos.