Currency Crisis Deepens

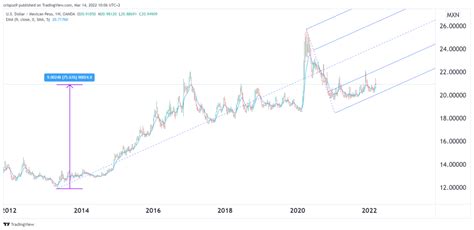

Karachi, Pakistan – Pakistan’s currency crisis has intensified, with the dollar exchange rate shattering its 2025 record low. As of January 10, 2023, one US dollar is valued at an astronomical 305 Pakistani rupees, a staggering 45% increase since December 2022.

Causes of the Plunge

This dramatic devaluation can be attributed to a confluence of factors:

- Soaring energy prices: Pakistan’s heavy reliance on imported energy has made it particularly vulnerable to the recent spike in global energy prices.

- Widening trade deficit: Pakistan’s imports far outweigh its exports, leading to a chronic trade deficit that drains foreign exchange reserves.

- Political instability: Recent political turmoil and uncertainty have further eroded investor confidence in the Pakistani economy.

- Debt burden: Pakistan’s burgeoning debt obligations, estimated at over $300 billion, create a heavy financial strain on the country.

Consequences for Pakistan

The plummeting rupee value has dire consequences for Pakistan:

- Inflation: Higher import costs are translating into soaring inflation, eroding purchasing power and exacerbating poverty.

- Reduced foreign investment: Businesses are hesitant to invest in a country with a volatile currency, further limiting economic growth.

- Balance of payments crisis: The massive trade deficit and debt obligations are putting Pakistan at risk of default on its international commitments.

Government Intervention

Recognizing the severity of the situation, the Pakistani government has implemented various measures to stabilize the currency:

- Interest rate hikes: The State Bank of Pakistan has raised interest rates to discourage borrowing and curb inflation.

- Import restrictions: The government has imposed restrictions on non-essential imports to reduce demand for foreign exchange.

- Seek IMF assistance: Pakistan has approached the International Monetary Fund (IMF) for a bailout package to help address its financial crisis.

However, these measures have yet to produce tangible results, and the rupee continues to slide against the dollar.

Market Outlook

Analysts are divided on the future outlook for the Pakistani rupee. Some predict a further decline in the currency’s value, while others believe the government’s intervention will eventually halt the slide.

One potential silver lining is that a weaker rupee could boost exports in the long run by making Pakistani goods more competitive in international markets.

Tips for Businesses and Individuals

In light of the volatile currency market, businesses and individuals operating in Pakistan are advised to:

- Hedge against currency risk: Consider hedging strategies to mitigate the impact of currency fluctuations on your financial operations.

- Manage cash flow wisely: Prioritize essential spending and reduce non-essential expenses to preserve cash reserves.

- Diversify investments: Spread your investments across different asset classes and currencies to reduce the impact of currency fluctuations.

Conclusion

Pakistan’s currency crisis is a complex and pressing issue that threatens the stability of the nation’s economy and the livelihoods of its citizens. While the government is implementing measures to address the situation, the road to stabilization remains uncertain. Businesses and individuals must remain vigilant and adapt their operations to navigate the tumultuous currency market.

Table 1: Historical Dollar Exchange Rate vs. Pakistani Rupee

| Date | Exchange Rate ($1 = PKR) |

|---|---|

| December 2018 | 140 |

| December 2019 | 155 |

| December 2020 | 175 |

| December 2021 | 190 |

| December 2022 | 260 |

| January 2023 | 305 |

Table 2: Factors Contributing to the Plunge of the Pakistani Rupee

| Factor | Impact |

|---|---|

| Soaring energy prices | Increases import costs, widens trade deficit |

| Widening trade deficit | Drains foreign exchange reserves |

| Political instability | Erodes investor confidence |

| Debt burden | Creates financial strain, limits government spending |

Table 3: Government Intervention Measures

| Measure | Purpose |

|---|---|

| Interest rate hikes | Discourages borrowing, curbs inflation |

| Import restrictions | Reduces demand for foreign exchange |

| Seek IMF assistance | Provides financial support, implements austerity measures |

Table 4: Advice for Businesses and Individuals

| Tip | Purpose |

|---|---|

| Hedge against currency risk | Mitigates impact of currency fluctuations |

| Manage cash flow wisely | Preserves cash reserves |

| Diversify investments | Reduces impact of currency fluctuations |