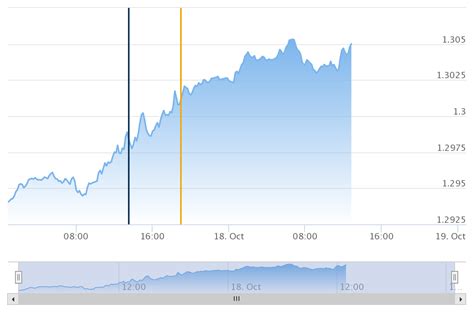

Understanding the USD/CAD Exchange Rate

The USD/CAD exchange rate is the value of the US dollar (USD) in relation to the Canadian dollar (CAD). It is expressed as the number of Canadian dollars required to purchase one US dollar. For instance, an exchange rate of 1.30 means that one US dollar can be exchanged for 1.30 Canadian dollars.

Historical and Current Trends in the USD/CAD Exchange Rate

Historical Trends

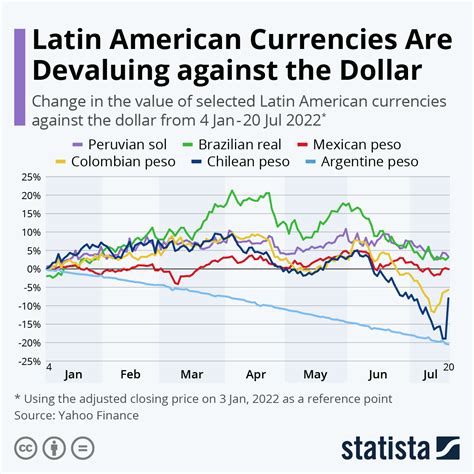

From 2015 to 2021, the USD/CAD exchange rate has experienced significant fluctuations, influenced by:

- Economic factors: Interest rate changes, economic growth, and inflation rates

- Political events: Global trade policies and geopolitical tensions

- Supply and demand: Market demand for US and Canadian dollars

Current Trends

As of July 2023, the USD/CAD exchange rate has been relatively stable, hovering around 1.25. However, analysts predict potential shifts in the coming years due to:

- Interest rate divergence: The Bank of Canada is expected to raise interest rates more aggressively than the Federal Reserve

- Commodity prices: Canada’s reliance on commodity exports may benefit from rising commodity prices

- US economic growth: A strong US economy can increase demand for the US dollar

How the USD/CAD Exchange Rate Impacts Businesses

Exporters and Importers

- Exporters: A stronger Canadian dollar makes Canadian exports more expensive for foreign buyers, potentially reducing demand.

- Importers: Conversely, a weaker Canadian dollar makes imported goods cheaper, boosting consumer spending.

Investors

- Foreign investment: A strong Canadian dollar can make Canadian assets more attractive to foreign investors.

- Cross-border investments: Fluctuations in the exchange rate can impact the value of cross-border investments.

Other Businesses

- Tourism: A weaker Canadian dollar can make Canada a more affordable destination for foreign tourists, boosting the tourism industry.

- Manufacturing: Manufacturers reliant on imported materials may face higher costs due to a stronger Canadian dollar.

Tips for Navigating the USD/CAD Exchange Rate

Hedge Against Risk

- Forward contracts: Lock in future exchange rates to protect against potential fluctuations.

- Currency swaps: Exchange future cash flows at a pre-agreed rate.

Monitor Currency Trends

- Stay informed: Use reputable sources and expert analysis to track currency movements.

- Identify trends: Analyze historical data and economic indicators to anticipate future trends.

Diversify Revenue Streams

- Multiple currencies: Accept payments in different currencies to reduce exposure to a single exchange rate.

- International expansion: Expand into markets with different currencies to minimize currency risk.

Common Mistakes to Avoid

Ignoring Currency Fluctuations

Failing to monitor and factor in currency fluctuations can lead to unexpected costs or reduced profits.

Overexposure to a Single Currency

Relying heavily on revenue from a single currency can amplify the impact of exchange rate changes.

Lack of Collaboration

Failing to involve finance and operations teams in currency management can result in misalignment and missed opportunities.

Market Insights: New Applications for Exchanging Currency

Digital Currency Exchanges

- Cryptocurrencies: Bitcoin, Ethereum, and other cryptocurrencies offer alternative ways to exchange currencies.

- Peer-to-peer platforms: Allow individuals to exchange currencies directly, bypassing traditional financial institutions.

AI-Powered Currency Management

- Machine learning: Algorithms can analyze data to identify currency trading opportunities.

- Automated hedging: AI can automatically execute hedging strategies based on pre-defined parameters.

Blockchain Technology for Cross-Border Transactions

- Faster and cheaper settlements: Eliminate intermediaries and reduce transaction fees.

- Increased transparency: Provide a secure and transparent record of all transactions.

Highlights: Standing Out in the Currency Exchange Landscape

Offer Competitive Rates

- Compare providers: Research different providers to find the best exchange rates.

- Negotiate volume discounts: Leverage higher transaction volumes to secure better rates.

Provide Excellent Customer Service

- 24/7 support: Offer quick and responsive assistance to customers.

- Tailored solutions: Understand individual customer needs and provide tailored exchange strategies.

Innovate with Digital Solutions

- Mobile apps: Make exchange services more convenient and accessible.

- APIs: Integrate currency exchange into e-commerce platforms and other applications.

Build Trust and Credibility

- Transparency and security: Ensure transparent pricing and protect customer data.

- Industry certifications: Obtain industry certifications to enhance credibility and trust.

Conclusion

The USD/CAD exchange rate is a critical factor that businesses must consider in their financial planning. By understanding historical trends, monitoring current market conditions, and implementing effective strategies, businesses can mitigate currency risk and optimize financial performance. Additionally, embracing new technologies and innovative solutions can provide a competitive advantage in the evolving currency exchange landscape.