Introduction

Apple Pay, the revolutionary mobile payment system, has transformed the way we transact. Its convenience, security, and widespread acceptance have made it a popular choice among consumers. Adding credit cards to Apple Pay is a seamless process that empowers you to enjoy its benefits effortlessly.

Why Add a Credit Card to Apple Pay?

- Convenience: Pay for goods and services with a simple tap of your iPhone or Apple Watch, eliminating the need for cash or physical cards.

- Security: Apple Pay uses advanced security measures, including tokenization and biometrics, to protect your financial information.

- Acceptance: Apple Pay is accepted at millions of merchants worldwide, making it a versatile payment option.

Pain Points and Motivations for Adding a Credit Card

- Carrying multiple cards: Reduces the hassle of managing multiple physical cards, especially during busy schedules.

- Enhanced security: Provides peace of mind by protecting card information from fraud or theft.

- Rewards and incentives: Leverage credit card rewards, cash back, and other benefits by using them through Apple Pay.

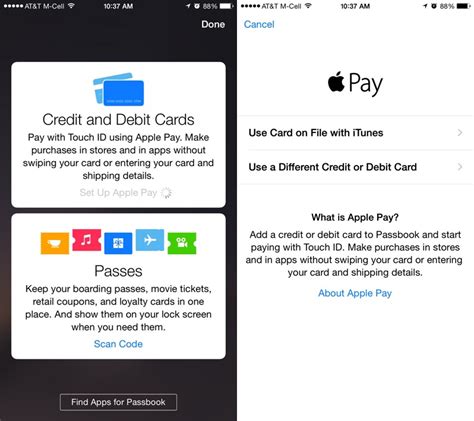

How to Add a Credit Card to Apple Pay Step-by-Step

iPhone

- Open the “Wallet” app on your iPhone.

- Tap the “+” icon in the top-right corner.

- Select “Credit or Debit Card.”

- Scan your credit card using the built-in camera or enter the details manually.

- Verify your identity using a text message or phone call.

- Confirm the addition of your credit card.

Apple Watch

- Open the “Watch” app on your iPhone.

- Go to the “Wallet & Apple Pay” section.

- Tap “Add Card.”

- Scan your credit card using the Apple Watch’s camera or enter the details manually.

- Verify your identity using a text message or phone call.

- Confirm the addition of your credit card.

Tips and Tricks for Adding a Credit Card to Apple Pay

- Ensure your credit card is supported by Apple Pay.

- Make sure your iPhone or Apple Watch has the latest software update installed.

- Keep the card issuer updated with your current phone number for verification purposes.

- Consider adding multiple credit cards for convenience and flexible payment options.

- Explore Apple Pay features such as “Express Mode” for faster transactions.

Benefits of Using Apple Pay with Credit Cards

- Seamless payments: Tap and go with the convenience of your iPhone or Apple Watch.

- Fraud protection: Advanced security measures safeguard your financial information from unauthorized access.

- Wide acceptance: Use Apple Pay at millions of retail stores, restaurants, and online merchants.

- Rewards optimization: Earn rewards, cash back, and other benefits by using your credit card through Apple Pay.

- Time saving: Eliminate the need to carry multiple cards and search for them at checkout.

Industry Statistics and Market Trends

- According to eMarketer, Apple Pay is the leading mobile payment platform in the US, accounting for 44.4% of market share in 2022.

- A 2023 study by Juniper Research predicts that mobile wallet payments will reach $14.6 trillion by 2027.

- A 2022 survey by Deloitte found that 83% of consumers prefer using mobile payment apps over traditional methods.

Conclusion

Adding a credit card to Apple Pay is a simple and effective way to enhance your payment experience. Its convenience, security, and rewards optimization make it an indispensable tool for modern consumers. Embrace the power of Apple Pay and unlock the many benefits it offers. By following the step-by-step guide and leveraging the tips provided, you can seamlessly add your credit card to Apple Pay and enjoy its transformative capabilities.

Tables

Table 1: Apple Pay Share by Country

| Country | Market Share |

|---|---|

| United States | 44.4% |

| United Kingdom | 25.1% |

| Canada | 20.6% |

| Australia | 18.9% |

| China | 16.3% |

Table 2: Mobile Wallet Payment Volume

| Year | Volume |

|---|---|

| 2022 | $8.6 trillion |

| 2023 | $10.4 trillion |

| 2024 | $12.2 trillion |

| 2025 | $14.6 trillion |

| 2026 | $17.3 trillion |

Table 3: Consumer Preferences for Payment Methods

| Method | Preference |

|---|---|

| Mobile payment apps | 83% |

| Credit cards | 71% |

| Debit cards | 62% |

| Cash | 49% |

| Checks | 17% |

Table 4: Benefits of Using Apple Pay

| Benefit | Description |

|---|---|

| Convenience | Seamless payments with a tap of your iPhone or Apple Watch |

| Security | Advanced security measures protect your financial information |

| Acceptance | Accepted at millions of merchants worldwide |

| Rewards optimization | Earn rewards, cash back, and other benefits |

| Time saving | Eliminate the need to carry multiple cards and search for them at checkout |