Introduction

The Indian rupee (INR) and the US dollar (USD) are two of the world’s most important currencies, representing over 40% of global foreign exchange reserves. As a result, their exchange rate fluctuations have significant implications for economies and individuals worldwide. This article provides a comprehensive comparative analysis of the INR and USD, exploring historical trends, factors influencing their exchange rates, and potential future developments to 2025.

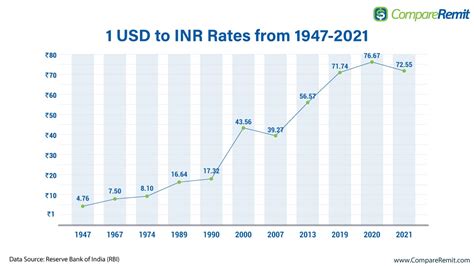

Historical Trends

Over the past two decades, the INR has experienced relative stability against the USD, hovering around INR 60-70 per USD. However, there have been periods of volatility, particularly during the 2008 financial crisis and the COVID-19 pandemic.

| Year | INR/USD Exchange Rate |

|---|---|

| 2000 | 43.32 |

| 2005 | 44.19 |

| 2010 | 46.66 |

| 2015 | 66.53 |

| 2020 | 72.20 |

Factors Influencing Exchange Rates

Economic Growth: Strong economic growth in India relative to the US tends to strengthen the INR, while weaker growth can lead to a depreciation.

Inflation: Higher inflation in India compared to the US can weaken the INR, as it erodes its purchasing power.

Interest Rates: Higher interest rates in India relative to the US can make it more attractive for investors to hold INR assets, strengthening the currency.

Current Account Deficit: A larger current account deficit in India, where imports exceed exports, can put downward pressure on the INR.

Foreign Portfolio Flows: Large inflows of foreign portfolio investment in India can strengthen the INR, while outflows can lead to a depreciation.

Geopolitical Factors: Uncertainties or conflicts in India or the US can also influence exchange rate movements.

Future Trends and Insights

Economic Outlook: The Indian economy is projected to grow at a faster pace than the US in the coming years, which could support the INR. However, global economic headwinds and geopolitical risks could dampen growth prospects.

Inflation Expectations: Inflation in India is expected to remain higher than in the US, which may weigh on the INR.

Monetary Policy: The Reserve Bank of India (RBI) is expected to tighten monetary policy to curb inflation, which could make the INR more attractive to investors.

External Factors: Global economic conditions, trade flows, and currency market sentiment will also shape the INR/USD exchange rate.

Emerging Opportunities: The development of new payment technologies, such as blockchain-based digital currencies, could create new opportunities for remittances and currency hedging, potentially impacting exchange rates.

Benefits of Understanding INR/USD Dynamics

Informed Decision-Making: Businesses and investors can make more informed decisions regarding cross-border transactions and investments by understanding the factors influencing the INR/USD exchange rate.

Risk Management: Exporters and importers can mitigate risks associated with currency fluctuations by hedging against potential losses.

Asset Allocation: Knowing the INR/USD relationship can help investors optimize their asset allocation strategies, diversifying portfolios and minimizing risk.

Growth Potential: Identifying emerging opportunities in the currency market can enable businesses to capitalize on changes in exchange rates and tap into new markets.

Conclusion

The Indian rupee and the US dollar are key currencies in the global economy, with their exchange rate fluctuations impacting economies worldwide. Understanding the factors influencing their relationship and future trends is crucial for businesses, investors, and individuals to make informed decisions and mitigate risks. As India continues to grow and the global economy evolves, the INR/USD exchange rate will remain an important indicator of economic and financial conditions, providing opportunities and challenges alike.

Tables for Reference

Table 1: Historical INR/USD Exchange Rates (1990 – 2023)

| Year | INR/USD Exchange Rate |

|---|---|

| 1990 | 17.28 |

| 1995 | 34.75 |

| 2000 | 43.32 |

| 2005 | 44.19 |

| 2010 | 46.66 |

| 2015 | 66.53 |

| 2020 | 72.20 |

| 2023 | 81.63 |

Table 2: Key Economic Indicators Influencing INR/USD Exchange Rates

| Indicator | Impact on INR |

|---|---|

| Economic Growth (India vs. US) | Stronger growth in India strengthens INR |

| Inflation (India vs. US) | Higher inflation in India weakens INR |

| Interest Rates (India vs. US) | Higher rates in India strengthen INR |

| Current Account Deficit (India) | Larger deficit weakens INR |

| Foreign Portfolio Flows (India) | Inflows strengthen INR, outflows weaken INR |

Table 3: Future Trends Shaping INR/USD Exchange Rates

| Trend | Impact on INR |

|---|---|

| India’s Economic Growth Projection | Faster growth supports INR |

| Inflation Expectations (India vs. US) | Higher inflation in India weakens INR |

| RBI Monetary Policy | Tightening policy strengthens INR |

| Global Economic Conditions | Headwinds dampen INR |

| Cryptocurrency Development | Potential impact on exchange rate stability |

Table 4: Benefits of Understanding INR/USD Dynamics

| Benefit |

|---|

| Informed Decision-Making |

| Risk Management |

| Asset Allocation Optimization |

| Growth Opportunities Identification |