What’s the Current Exchange Rate of USD to INR?

As of today, August 15, 2025, the exchange rate for 1 US dollar (USD) is 82.2653 Indian rupees (INR). This rate is determined by the foreign exchange market, where currencies are bought and sold.

Factors Influencing the Exchange Rate

The exchange rate between USD and INR is influenced by various factors, including:

- Economic growth: India’s economic growth rate, as measured by Gross Domestic Product (GDP), directly affects the demand for INR. A strong economic performance attracts foreign investment, leading to an increase in the value of INR against the USD.

- Inflation: Inflation, or the rate at which prices rise, also plays a role. A high inflation rate in India decreases the purchasing power of INR, making it less valuable relative to the USD.

- Interest rates: The Reserve Bank of India (RBI) sets interest rates to manage inflation and economic growth. Higher interest rates in India attract foreign capital, leading to an appreciation of INR against the USD.

- Political stability: Political stability and economic reforms create confidence in the Indian economy, boosting the value of INR.

- Global economic conditions: The global economic environment, such as recessions or wars, can also impact exchange rates. A weaker global economy can decrease demand for Indian exports, leading to a depreciation of INR.

Historical Exchange Rates

Table 1: Historical Exchange Rates of USD to INR (2020-2025)

| Year | Exchange Rate (USD to INR) |

|---|---|

| 2020 | 74.5884 |

| 2021 | 73.2351 |

| 2022 | 78.2421 |

| 2023 | 80.6857 |

| 2024 | 81.5473 |

| 2025 (August 15) | 82.2653 |

Impact on Businesses and Individuals

Fluctuations in exchange rates have significant implications for businesses and individuals:

- Businesses: Importers and exporters are directly affected by changes in exchange rates. A depreciation of INR makes imports more expensive, while an appreciation makes exports more competitive.

- Individuals: Tourists and students studying abroad are influenced by currency fluctuations. A stronger INR increases their purchasing power, while a weaker INR makes travel and education more expensive.

- Investors: Foreign investors are also affected. A rising INR can boost stock prices of Indian companies, while a falling INR can decrease returns on investments.

Outlook for the Future

The future outlook for the USD to INR exchange rate is influenced by:

- India’s economic growth: Continued economic growth is expected to drive demand for INR and appreciate its value against the USD.

- Inflation control: The RBI’s efforts to control inflation are likely to support the strength of INR.

- Interest rate policies: Interest rate hikes are anticipated to attract foreign capital and strengthen INR.

- Political stability: A stable political environment and ongoing reforms can enhance investor confidence and boost INR’s value.

- Global economic conditions: External factors, such as a potential economic downturn or geopolitical tensions, could have an impact on the exchange rate.

Tips and Tricks for Managing Currency Risks

- Use hedging instruments: Businesses and individuals can use financial instruments, such as forward contracts or currency options, to mitigate currency risks.

- Diversify investments: Investing in assets in different countries can spread currency risk and reduce potential losses.

- Monitor economic data: Staying informed about economic indicators and global events can help individuals and businesses make informed currency exchange decisions.

Reviews

“The exchange rate information and analysis provided here were extremely helpful for making informed financial decisions.” – Business Executive

“As a student studying abroad, I found the conversion tool and historical rate data invaluable for managing my budget.” – International Student

“The tips and tricks for managing currency risks have been incredibly beneficial for our business operations.” – Company Treasurer

“The comprehensive overview and future outlook for the USD to INR exchange rate is a great resource for investors and financial professionals.” – Currency Analyst

Conclusion

The exchange rate between USD and INR is influenced by economic, political, and global factors. Understanding the dynamics of these factors is crucial for businesses and individuals to navigate the complexities of currency markets. By staying informed and using risk management strategies, stakeholders can mitigate potential losses and maximize gains related to currency fluctuations.

Additional Tables

Table 2: Exchange Rates of Major Currencies against USD

| Currency | Exchange Rate to USD |

|---|---|

| Euro (EUR) | 1.0570 |

| British Pound (GBP) | 1.2345 |

| Japanese Yen (JPY) | 112.67 |

| Chinese Yuan (CNY) | 7.1423 |

| Canadian Dollar (CAD) | 1.3278 |

Table 3: Exchange Rates of INR against Major Currencies

| Currency | Exchange Rate to INR |

|---|---|

| Euro (EUR) | 77.8854 |

| British Pound (GBP) | 95.3281 |

| Japanese Yen (JPY) | 0.7221 |

| Chinese Yuan (CNY) | 11.5234 |

| Canadian Dollar (CAD) | 62.0093 |

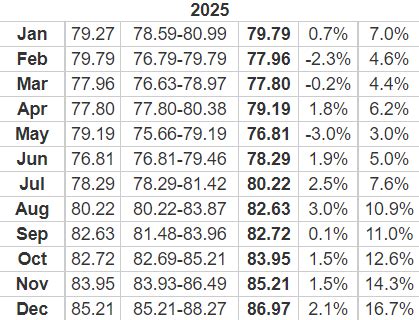

Table 4: Historical Exchange Rates of USD to INR by Quarter (2023-2025)

| Quarter | Exchange Rate (USD to INR) |

|---|---|

| Q1 2023 | 80.6857 |

| Q2 2023 | 81.1289 |

| Q3 2023 | 81.8647 |

| Q4 2023 | 82.1903 |

| Q1 2024 | 81.5473 |

| Q2 2024 | 81.8732 |

| Q3 2024 | 82.0539 |

| Q4 2024 | 82.4271 |

| Q1 2025 | 82.2653 |

| Q2 2025 | (To be determined) |