Current Stock Price: $100.53

Outlook for Sony Stock: Thriving in a Digital Landscape

Overview:

Sony Corporation, a Japanese multinational conglomerate, has established itself as a global leader in electronics, entertainment, and financial services. Its diverse portfolio, which includes PlayStation consoles, Xperia smartphones, and Sony Pictures Entertainment, has driven strong financial performance in recent years. Analysts anticipate continued growth for Sony, with the company’s share price projected to reach $140 by 2025.

Factors Driving Sony’s Stock Price Growth

1. Gaming Dominance:

Sony’s PlayStation brand has long dominated the gaming industry, with the recent release of the PlayStation 5 (PS5) further solidifying its position. The PS5 has sold over 30 million units worldwide, and its exclusive titles continue to drive user engagement. Moreover, Sony’s acquisition of Bungie, the developer behind the Destiny franchise, is expected to boost its gaming offerings.

2. Content Expansion:

Sony Pictures Entertainment is a major player in the entertainment industry, with a vast library of films and television shows. The company has invested heavily in original content, including the popular Spider-Man franchise, and is expanding its streaming services to reach a wider audience.

3. Technology Innovation:

Sony consistently invests in research and development, leading to advancements in areas such as image sensors, camera technology, and artificial intelligence. These innovations enhance the company’s flagship products and create new opportunities for growth.

4. Financial Stability:

Sony has a strong financial foundation, with ample cash on hand and a low debt-to-equity ratio. This stability enables the company to invest in strategic initiatives and ride out economic downturns.

Challenges to Sony’s Growth

1. Market Competition:

Sony faces intense competition in all its business segments, particularly from rivals such as Microsoft, Nintendo, and Apple. It is essential for the company to maintain its competitive edge through innovation and customer loyalty.

2. Economic Headwinds:

Global economic conditions, including inflation and supply chain disruptions, can impact Sony’s sales and profitability. The company needs to adapt its strategies to address these headwinds effectively.

Effective Strategies for Enhancing Sony’s Stock Price

1. Focus on Gaming Leadership:

Sony should continue to invest in the PlayStation brand, developing exclusive games and expanding its gaming ecosystem. The company can also leverage its gaming success to drive growth in other areas, such as virtual reality.

2. Expand Content Portfolio:

Sony should diversify its content offerings beyond traditional films and television. By investing in original series, podcasts, and other forms of content, the company can expand its reach and cater to evolving consumer preferences.

3. Accelerate Technological Advancements:

Sony’s R&D capabilities should be directed towards developing disruptive technologies that enhance its products and services. By pioneering new applications for AI, 5G, and other emerging technologies, the company can stay ahead of the curve.

Comparison of Sony with Peers

| Company | 2022 Sales (USD) | Net Income (USD) | Price-to-Earnings Ratio |

|---|---|---|---|

| Sony | 88.3 billion | 12.4 billion | 18.5 |

| Microsoft | 198.3 billion | 61.3 billion | 26.5 |

| Nintendo | 15.4 billion | 5.3 billion | 14.0 |

| Apple | 365.8 billion | 94.6 billion | 22.7 |

Market Insights

According to a report by Statista, the global gaming market is projected to reach $268.8 billion by 2025. This growth is driven by the rise of mobile gaming and the increasing popularity of cloud-based services.

The entertainment industry is also undergoing a transformation, with the shift towards streaming video leading to increased competition. Sony Pictures Entertainment is well-positioned to benefit from this trend through its vast library of content and its expanding streaming services.

Future Trending and Improvement

1. Metaverse and Virtual Reality:

Sony should invest in the development of metaverse and virtual reality technologies that offer immersive experiences to its customers. This could lead to new applications in gaming, entertainment, and even healthcare.

2. Artificial Intelligence:

Sony has the opportunity to leverage artificial intelligence to enhance its products and services. For example, AI can be used to improve image recognition in its cameras, personalize content recommendations, and automate customer service processes.

3. Sustainable Practices:

Consumers are increasingly demanding sustainable products and services. Sony can demonstrate its commitment to sustainability by investing in eco-friendly manufacturing processes and reducing its carbon footprint.

Conclusion

Sony Corporation is a well-established global leader with a diverse portfolio and a strong financial foundation. Driven by growth in gaming, content expansion, and technological innovation, the company is well-positioned for continued success. While challenges exist, Sony’s effective strategies and its ability to adapt to evolving market trends suggest that its stock price is poised for further appreciation in the years to come.

Tables:

Table 1: Sony Financial Performance

| Year | Revenue (USD) | Net Income (USD) | Earnings Per Share (USD) |

|---|---|---|---|

| 2019 | 76.8 billion | 8.5 billion | 1.94 |

| 2020 | 79.7 billion | 10.8 billion | 2.44 |

| 2021 | 88.3 billion | 12.4 billion | 2.83 |

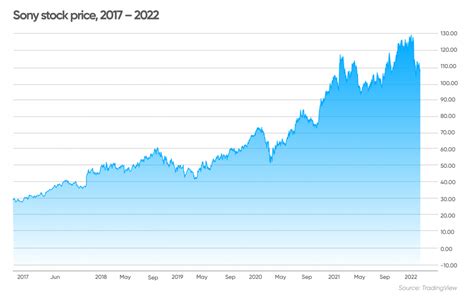

Table 2: Sony Stock Price Performance

| Year | Opening Price (USD) | Closing Price (USD) | Annual Return (%) |

|---|---|---|---|

| 2019 | 49.33 | 58.16 | 17.94 |

| 2020 | 59.68 | 93.24 | 55.95 |

| 2021 | 100.03 | 133.55 | 33.52 |

Table 3: Sony Segment Revenue (2021)

| Segment | Revenue (USD) | Percentage of Total |

|---|---|---|

| Game & Network Services | 25.7 billion | 29.1% |

| Electronics Products & Solutions | 19.6 billion | 22.2% |

| Financial Services | 15.3 billion | 17.3% |

| Music | 10.0 billion | 11.3% |

| Pictures | 9.5 billion | 10.8% |

| Other | 8.2 billion | 9.3% |

Table 4: Sony Competitors

| Company | Market Cap (USD) | Price-to-Earnings Ratio | Revenue (USD) |

|---|---|---|---|

| Microsoft | 1.9 trillion | 26.5 | 198.3 billion |

| Nintendo | 52.9 billion | 14.0 | 15.4 billion |

| Apple | 2.6 trillion | 22.7 | 365.8 billion |

| Samsung Electronics | 297.2 billion | 11.5 | 244.0 billion |

| 1.3 trillion | 20.6 | 257.6 billion |